Shaw 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

Company has provided indemnifications in various commercial agreements, customary for the

t

elecommunications industr

y

, which ma

y

re

q

uire

p

a

y

ment b

y

the Com

p

an

y

for breach o

f

contractual terms o

f

the a

g

reement.

C

ounter

p

art

i

es to these a

g

reements

p

rov

i

de the

C

om

p

an

y

with comparable indemnifications. The indemnification period generally covers, at maximum

,

t

he

p

eriod of the a

pp

licable a

g

reement

p

lus the a

pp

licable limitations

p

eriod under law.

The maximum

p

otential amount of future

p

a

y

ments that the Com

p

an

y

would be re

q

uired t

o

m

ake under these

i

ndemn

ifi

cat

i

on a

g

reements

i

s not reasonabl

yq

uant

ifi

able as certa

in

indemnifications are not subject to limitation. However, the Company enters int

o

indemnification a

g

reements onl

y

when an assessment of the business circumstances would

i

nd

i

cate that the r

i

sk o

f

loss

i

s remote. At Au

g

ust

31

,

2013

, mana

g

ement bel

i

eves

i

t

i

s remote

t

hat the indemnification provisions would require any material cash payment.

The Company indemnifies its directors and officers against any and all claims or losses

reasonabl

y

incurred in the

p

erformance of their service to the Com

p

an

y

to the extent

p

ermitte

d

by l

aw.

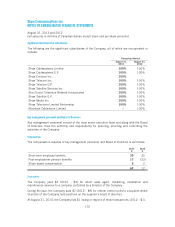

Irrevocable standby letters of credit and commercial surety bonds

The Com

p

an

y

and certain of its subsidiaries have

g

ranted irrevocable standb

y

letters of credi

t

and commerc

i

al suret

y

bonds,

i

ssued b

y

h

ig

h rated

fi

nanc

i

al

i

nst

i

tut

i

ons, to th

i

rd

p

art

i

es t

o

indemnify them in the event the Company does not perform its contractual obligations. As o

f

Au

g

ust 31, 2013, the

g

uarantee instruments amounted to

$

4. The Com

p

an

y

has not recorded

an

y

add

i

t

i

onal l

i

ab

i

l

i

t

y

w

i

th res

p

ect to these

g

uarantees, as the

C

om

p

an

y

does not ex

p

ect t

o

m

ake any payments in excess of what is recorded on the Company’s consolidated financia

l

statements. The

g

uarantee instruments mature at various dates durin

g

fiscal 2014.

26

. EMPL

O

YEE BENEFIT PLAN

S

Defined contribution pension plans

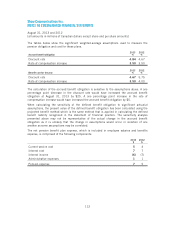

The Company has defined contribution pension plans for its non-union employees and, for the

m

a

j

or

i

t

y

o

f

these em

p

lo

y

ees, contr

i

butes 5

%

o

f

el

igi

ble earn

i

n

g

s to the max

i

mum amount

d

eductible under the Income Tax Act. For union employees, the Company contributes amounts

u

p to 9.8% of earnings to the individuals’ registered retirement savings plans. Total pension

costs in res

p

ect of these

p

lans for the

y

ear were $35 (2012 – $32) of which $23 (2012 – $20)

was expensed and the remainder capitalized.

108