Shaw 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

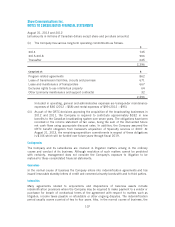

(ii) Investments and other assets and Other long-term asset

s

Investments

i

n

p

r

i

vate ent

i

t

i

es wh

i

ch do not have

q

uoted market

p

r

i

ces

i

n an act

i

v

e

market and whose

f

a

i

r value cannot be read

i

ly measured are carr

i

ed at cost. The

f

a

ir

v

alue of long-term receivables approximates their carrying value as they are recorded at

the net

p

resent values o

f

the

i

r

f

uture cash

f

lows, us

i

n

g

an a

pp

ro

p

r

i

ate d

i

scount rate.

(iii)

Long-term deb

t

The carr

y

in

g

value of lon

g

-term debt is at amortized cost based on the initial fair value as

determ

i

ned at the t

i

me o

fi

ssuance. The

f

a

i

r value o

fp

ubl

i

cl

y

traded notes

i

s based u

p

on

current trading values. Other notes and debentures are valued based upon curren

t

tradin

g

values for similar instruments.

(i

v

)O

ther long-term l

i

ab

i

l

i

t

i

e

s

The fair value of program rights payable, estimated by discounting future cash flows,

app

rox

i

mates the

i

r carr

yi

n

g

value

.

(v) Derivative financial instrument

s

The

f

a

i

r value o

f

U

S

currenc

yf

orward

p

urchase contracts

i

s determ

i

ned us

i

n

g

an

est

i

mated cred

i

t-ad

j

usted mark-to-market valuat

i

on

.

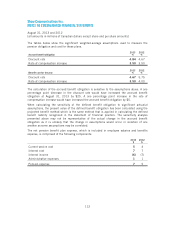

The carr

y

in

g

values and estimated fair values of lon

g

-term debt and derivative financia

l

i

n

st

r

u

m

e

n

ts a

r

easfo

ll

o

w

s:

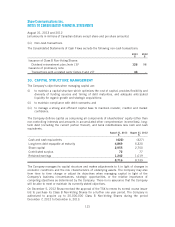

August 31, 2013 August 31, 201

2

C

arryin

g

v

a

l

ue

Estimate

d

fair value

C

arrying

v

a

l

ue

E

stimate

d

f

air valu

e

$$$$

Assets

Der

i

vat

i

ve

fi

nanc

i

al

i

nstrument

s

(1

)

33

–

–

L

iabilities

Long-term debt 4,

818

5,

2

75

5

,

263

5,75

3

Derivative financial instrument

s

(1

)

––

11

4

,

818 5

,

275

5

,264 5,75

4

(1)

Level

2f

a

i

r value – determ

i

ned b

y

valuat

i

on techn

iq

ues us

i

n

gi

n

p

uts based on observabl

e

m

arket data, e

i

ther d

i

rectly or

i

nd

i

rectly, other than quoted pr

i

ces.

D

erivative financial instruments held at Au

g

ust 31, 2013 have maturit

y

dates throu

g

hout fisca

l

201

4.

As at August 31, 2013 and 2012, US currency forward purchase contracts qualified as hedgin

g

instruments and were desi

g

nated as cash flow hed

g

es

.

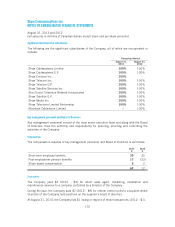

Ri

s

k

managemen

t

The Company is exposed to various market risks including currency risk and interest rate risk

,

as well as credit risk and li

q

uidit

y

risk associated with financial assets and liabilities. Th

e

C

om

p

an

y

has des

ig

ned and

i

m

p

lemented var

i

ous r

i

sk mana

g

ement strate

gi

es, d

i

scussed

f

urther

below, to ensure the exposure to these risks is consistent with its risk tolerance and busines

s

o

b

j

ectives

.

11

7