Shaw 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.S

haw

C

ommunications Inc

.

REP

O

RT T

OS

HAREH

O

LDER

S

August

31

,

2013

S

TRATE

G

I

C

TRAN

S

A

C

TI

O

N

S

D

uring the year we entered into a number of strategic transactions focused on optimizing our

p

ort

f

ol

i

oo

f

assets.

I

n January we announced a series of agreements with Rogers Communications Inc. (“Rogers”)

result

i

n

gi

n the sale o

f

Mounta

i

n

C

able, the

g

rant

i

n

g

o

f

an o

p

t

i

on to Ro

g

ers to ac

q

u

i

re ou

r

w

i

reless spectrum l

i

censes, and the acqu

i

s

i

t

i

on o

f

Rogers

i

nterest

i

n TVtropol

i

s. The Mounta

in

Cable and TVtropolis transactions closed in the year and the potential option exercise for the

sale o

f

the w

i

reless s

p

ectrum l

i

censes rema

i

ns sub

j

ect to re

g

ulator

y

a

pp

rovals and

i

sex

p

ecte

d

to c

l

ose i

n

fisca

l

2015

.

I

n March we announced a ser

i

es o

f

transact

i

ons w

i

th

C

orus Enterta

i

nment Inc.

(“C

orus”

)

resulting in the sale of our 49% interest in ABC Spark and 50% interest in two French language

n

etworks, Historia and Series+, and the ac

q

uisition of Corus’s interest in Food Network Canada

.

The AB

CSp

ark and Food Network

C

anada transact

i

ons closed

i

n the

y

ear, wh

i

le H

i

stor

i

aan

d

Series+ are expected to close in fiscal 2014

.

The ma

j

orit

y

of the ex

p

ected net

p

roceeds from these transactions, a

pp

roximatel

y

$800 million

o

nce all are closed, is planned for reinvestment back into the core business accelerating various

strate

g

ic ca

p

ital investments

.

Fi

nally,

i

n Apr

i

l we closed the acqu

i

s

i

t

i

on o

f

ENMAX Env

i

s

i

on Inc.

(“

Env

i

s

i

on”

)

, a company

providing leading telecommunication services to Calgary business customers. Shaw Business is

emer

gi

n

g

as a stron

g

com

p

et

i

tor

i

n

p

rov

i

d

i

n

g

enter

p

r

i

se-w

i

de solut

i

ons

f

or com

p

an

i

es o

f

all

s

i

zes

i

n

C

anada and we are

f

ocused on dr

i

v

i

ng cont

i

nued growth

i

nth

i

sd

i

v

i

s

i

on.

These strate

gi

c transact

i

ons create value and lon

g

-term

g

rowth

f

or our shareholders.

FINANCIAL PERFORMANC

E

O

ur d

i

sc

i

pl

i

ned

fi

nanc

i

al strategy enabled us to balance subscr

i

ber growth and pro

fi

tab

i

l

i

ty

i

n

a

h

ighly competitive market. We continue to focus on sustainable pricing strategies, customer

retent

i

on, and lon

g

term

g

rowth.

I

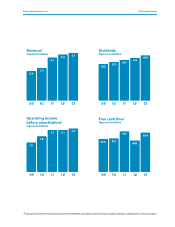

n fiscal 2013, we delivered 3% revenue growth and operating income before amortizatio

n

increased more than 4%. Free cash flow in fiscal 2013 was $604 million

,

a 25% increase over

t

he prev

i

ous year. Dur

i

ng the year we also

i

ncreased the d

i

v

i

dend by 5

%

, return

i

ng a total o

f

$

445 million to shareholders

.

O

ver the past

fi

ve years our d

i

v

i

dend has

i

ncreased over 4

0%

.

O

ur Board o

f

D

i

rectors

i

nd

i

cated

earlier this year that they plan to target dividend increases of 5% to 10% over each of the nex

t

t

wo

y

ears, assum

i

n

g

cont

i

nued

f

avorable market cond

i

t

i

ons

.

W

e have a solid balance sheet and healthy financial position providing the flexibility to invest i

n

o

ur bus

i

ness and take advanta

g

eo

f

strate

gi

co

pp

ortun

i

t

i

es wh

i

le su

pp

ort

i

n

g

the return o

f

ca

pi

tal

to sha

r

eholde

r

s

.

OUR COMMUNITIES

W

e believe being successful on the business front goes hand-in-hand with acting responsibly,

t

akin

g

action to reduce our environmental im

p

act, and

g

ivin

g

back to the communities where

we l

i

ve and work. We su

pp

ort a w

i

de var

i

et

y

o

fi

n

i

t

i

at

i

ves

i

nclud

i

n

g

those d

i

rected towards th

e

well-being of children and families, the environment, education, and the arts. During fisca

l

2013 we contributed almost $50 million throu

g

h cash and in kind contributions su

pp

ortin

g

an

arra

y

o

f

or

g

an

i

zat

i

ons and

i

n

i

t

i

at

i

ves

.

2