Shaw 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

MANA

G

EMENT’

S

DI

SCUSS

I

O

N AND ANALY

S

I

S

August

31

,

2013

II.

S

UMMARY

O

F

Q

UARTERLY RE

S

ULT

S

Q

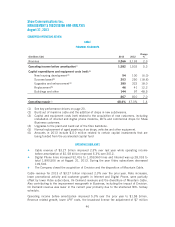

uarter Revenue

Operating

i

n

co

m

e

befo

r

e

a

m

o

r

ti

z

atio

n

(

1)

Net income

att

r

ibutab

l

e

to e

q

u

i

t

y

sha

r

eholde

r

s

Net

i

n

co

m

e

(

2

)

Basic

earn

i

n

gs

p

er s

h

ar

e

D

i

l

uted

earn

i

n

g

s

p

er s

h

ar

e

($

millions Cdn except per share amounts)

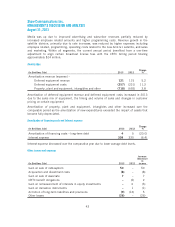

2013

Fourth

1

,

2

4

6

4

96 111 11

7

0

.

2

4

0

.

24

T

h

i

rd

1

,

326

5

8

5

239 2

5

00

.5

20

.5

2

S

econd 1

,

251 538 172 182 0.38 0.38

First 1

,

319 601 224 235 0.50 0.49

T

otal 5,142 2,220 746 784 1.64 1.6

3

2012

Fourth

1

,

210

5

01 129 133 0

.

28 0

.

28

T

hird 1,278 567 238 248 0.53 0.5

3

S

econd 1

,

231 493 169 178 0.38 0.38

First 1

,

279 566 192 202 0.43 0.4

3

T

otal 4,998 2,127 728 761 1.62 1.6

1

(1) See key performance drivers on page 20

.

(2) Net income attributable to both equity shareholders and non-controlling interests.

Q

uarterl

y

revenue and o

p

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on are

p

r

i

mar

i

l

yi

m

p

acted b

y

the

seasonality of the Media division and fluctuate throughout the year due to a number of factor

s

includin

g

seasonal advertisin

g

and viewin

gp

atterns. T

yp

icall

y

, the Media business has hi

g

he

r

revenue

i

n the

fi

rst

q

uarter dr

i

ven b

y

the

f

all launch o

f

season

p

rem

i

eres and h

ig

h demand an

d

t

he third quarter which is impacted by season finales and mid season launches. Advertising

revenue t

yp

icall

y

declines in the summer months of the fourth

q

uarter when viewershi

p

is

g

enerall

y

lower.

Op

erat

i

n

gi

ncome be

f

ore amort

i

zat

i

on

i

n

fi

scal

2012

was also

i

m

p

acted b

y

h

igher operating costs in the Cable division in the first and second quarters which include

d

h

i

g

her em

p

lo

y

ee related costs, mainl

y

related to brin

g

in

g

the new customer service centres on

l

i

ne, as well as h

ig

her market

i

n

g

, sales and

p

ro

g

ramm

i

n

g

costs. The th

i

rd and

f

ourth

q

uarters o

f

2012 benefited from improved operating income before amortization in the Cable business.

N

et

i

ncome has

f

luctuated

q

uarter-over-

q

uarter

p

r

i

mar

i

l

y

as a result o

f

the chan

g

es

i

no

p

erat

i

n

g

i

ncome be

f

ore amort

i

zat

i

on descr

i

bed above and the

i

mpact o

f

the net change

i

n non-operat

i

ng

items. In the fourth quarter of 2013, net income decreased

$

133 million due to lower

op

eratin

g

income before amortization of $89 million and reduction in net other revenue item

s

o

f $67 million partially offset by lower income taxes of $34 million. The reduction in net other

revenue items was mainly due to the gain on sale of Mountain Cable of

$

50 million recorded i

n

t

he third

q

uarter and write-down of a real estate

p

ro

p

ert

y

of $14 million in the fourth

q

uarter

.

I

n the third quarter of 2013, net income increased by $68 million due to increased operating

income before amortization of

$

47 million, the aforementioned gain on sale of Mountain Cable

and the

g

a

i

n on sale o

f

the s

p

ec

i

alt

y

channel AB

CSp

ark

p

art

i

all

y

o

ff

set b

y

h

ig

her

i

ncome taxes

o

f $30 million and acquisition and divestment costs in respect of the transactions with Roger

s

and the acquisition of Envision. In the second quarter of 2013, net income decreased

$

53 million

p

rimaril

y

due to lower o

p

eratin

g

income before amortization of $63 million

p

artiall

y

o

ffset by lower income taxes of $5 million. In the first quarter of 2013, net income increase

d

39