Shaw 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

haw

C

ommunications Inc

.

N

O

TE

S

T

OCO

N

SO

LIDATED FINAN

C

IAL

S

TATEMENT

S

August 31, 2013 and 201

2

[all amounts in millions of Canadian dollars exce

p

t share and

p

er share amounts

]

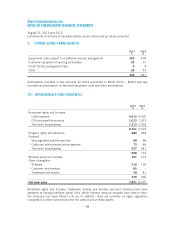

contribution will be used to create new programming. The obligation has been recorded in the

income statement at fair value, bein

g

the discounted future cash flows usin

g

a 4% discoun

t

r

ate.

A summar

y

o

f

net assets ac

q

u

i

red and allocat

i

on o

f

cons

i

derat

i

on

i

sas

f

ollows:

$

Net assets ac

q

u

i

red at ass

ig

ned

f

a

i

r value

s

C

ash

6

Accou

n

ts

r

ecei

v

ab

l

e4

O

ther current asset

s

(

1)

4

Intang

i

bles

(2)

[

note

10]

28

Goodwill

,

not deductible for ta

x

(

3

)

[

note 10

]

3

4

5

Cu

rr

e

n

t

l

iabi

l

ities

3

Deferred income taxes 2

4

0

(1) O

ther current assets

i

s com

p

r

i

sed o

fp

ro

g

ram r

ig

hts

.

(2)

Intan

gi

bles

i

nclude broadcast l

i

censes and

p

ro

g

ram r

ig

hts

.

(3) G

oodw

i

ll com

p

r

i

ses the value o

f

ex

p

ected e

ffi

c

i

enc

i

es and s

y

ner

gi

es

f

rom

i

nte

g

rat

i

n

g

the

o

perat

i

ons w

i

th the

C

ompany’s other wholly-owned spec

i

alty channels.

P

u

r

c

h

ase a

n

dsa

l

e of assets

T

ransactions with Ro

g

ers Communications Inc. (“Ro

g

ers”

)

D

ur

i

n

g

the current

y

ear, the

C

om

p

an

y

entered

i

nto a

g

reements w

i

th Ro

g

ers to sell to Ro

g

ers

i

t

s

shares in Mountain Cablevision Limited (“Mountain Cable”) and grant to Rogers an option t

o

ac

q

uire its wireless s

p

ectrum licenses as well as to

p

urchase from Ro

g

ers its 33.3% interest i

n

TVtro

p

ol

i

s

G

eneral Partnersh

ip (“

TVtro

p

ol

i

s”

)

. The sale o

f

Mounta

i

n

C

able closed on A

p

r

i

l

30,

2013 and the acquisition of the additional interest in TVtropolis closed on June 30, 2013. The

exercise of the o

p

tion and the sale of the wireless s

p

ectrum licenses is still sub

j

ect to variou

s

re

g

ulator

y

a

pp

rovals and

i

sex

p

ected to occur

i

n

201

5. The transact

i

ons are strate

gi

c

i

n natur

e

allowing the Company to use a portion of the net proceeds to accelerate various capital

investments to im

p

rove and stren

g

then its network advanta

g

e

.

The Com

p

an

y

incurred costs of

$

5 in res

p

ect of the transactions with Ro

g

ers. These costs have

been ex

p

ensed and are

i

ncluded

i

nac

q

u

i

s

i

t

i

on and d

i

vestment costs

i

n the statement o

f

income.

M

ountain

C

abl

e

M

ounta

i

n

C

able has a

pp

rox

i

matel

y

4

0

,

000

v

i

deo customers

i

n

i

ts o

p

erat

i

ons based

i

n Ham

i

lton

,

Ontario. It represented a disposal group within the cable operating segment and accordingly, i

s

n

ot presented as discontinued operations in the statement of income.

82