Samsung 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

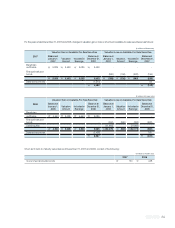

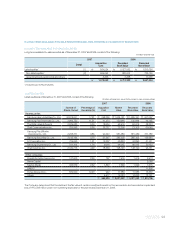

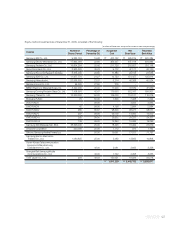

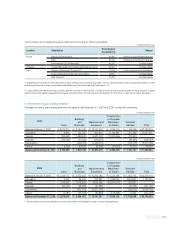

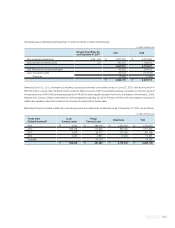

Gain and loss on evaluation of available-for-sale securities for 2007 are as follows:

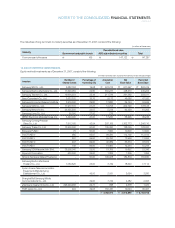

Losses on impairment of cost-method investments resulting from the decline in realizable value below the acquisition cost amounted to

₩6,234 million for the year ended December 31, 2007 (2006: ₩1,150 million).

As of December 31, 2007, the Company’s investments in Pusan Newport Co., Ltd. are pledged as collateral against the investee’s debt.

Valuation Gain on Available-For-Sale Securities

Valuation Gain on Available-For-Sale Securities

Valuation Loss on Available-For-Sale Securities

Valuation Loss on Available-For-Sale Securities

Balance at Balance at Balance at Balance at

January 1, Valuation Included in

December 31,

January 1, Valuation Included in

December 31,

2007 Amount Earnings 2007 2007 Amount Earnings 2007

Balance at Balance at Balance at Balance at

January 1, Valuation Included in

December 31,

January 1, Valuation Included in

December 31,

2006 Amount Earnings 2006 2006 Amount Earnings 2006

₩

1,286,374

₩

1,244,388

₩

11,581

₩

2,519,181

₩

(2,086)

₩

(897)

₩

(1,318)

₩

(1,665)

Deferred income tax

and Minority interest (1,092,358) 458

₩

1,426,823

₩

(1,207)

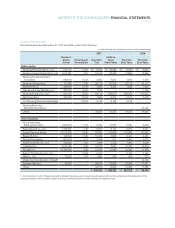

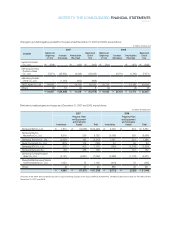

Gain and loss on evaluation of available-for-sale securities for 2006 are as follows:

₩

989,079

₩

297,297

₩

3

₩

1,286,373

₩

(402)

₩

(2,060)

₩

(375)

₩

(2,087)

Deferred income tax

and Minority interest (559,910) 574

₩

726,463

₩

(1,513)

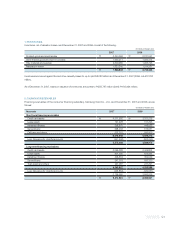

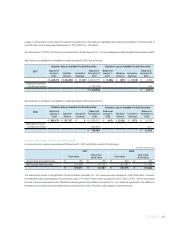

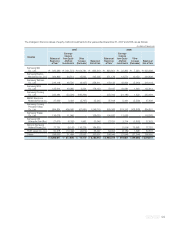

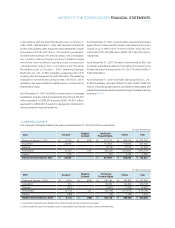

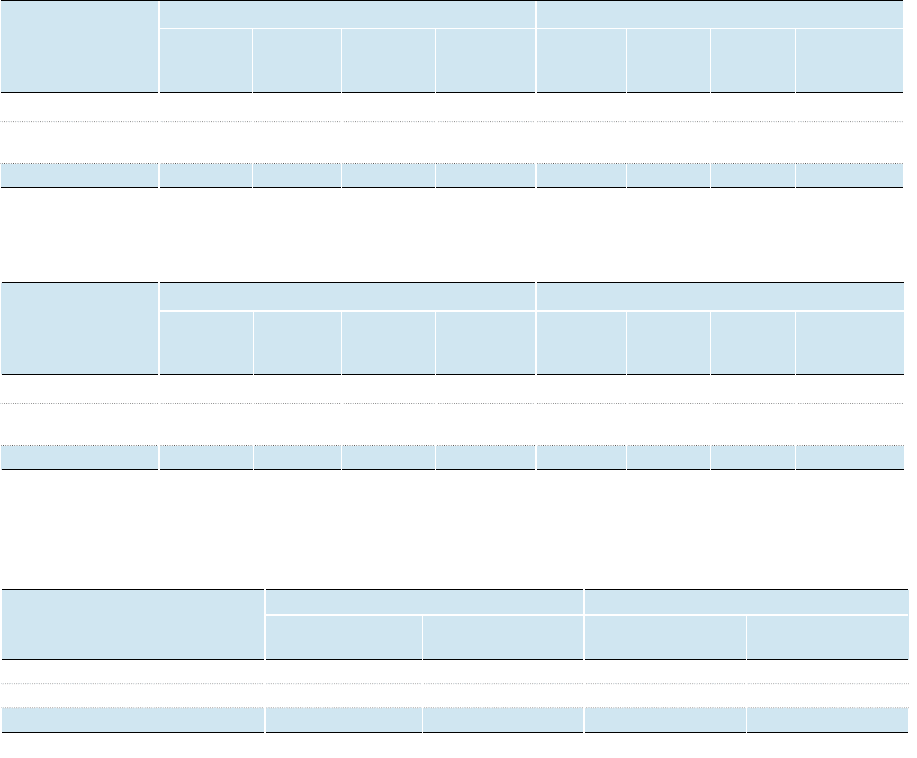

(2) LONG-TERM HELD-TO-MATURITY SECURITIES

Long-term held-to-maturity securities as of December 31, 2007 and 2006, consist of the following:

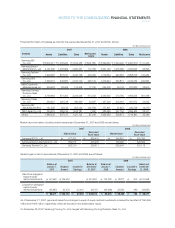

The subordinate bonds of SangRokSoo 1st Securitization Specialty Co., Ltd. were previously impaired by ₩423,895 million; however,

the realizable value subsequently recovered and a gain of ₩19,312 million was recognized in 2007. Also in 2007, as the recoverable

amount of the subordinate bonds of Badbank Heemangmoah Securitization Specialty Co., Ltd. declined significantly, the difference

between the book value and recoverable amount amounting to ₩20,700 million was charged to impairment loss.

Face Value Recorded Face Value Recorded

Book Value Book Value

(In millions of Korean won)

Government and public bonds

₩

165

₩

165

₩

294

₩

294

ABS subordinated securities 572,406 147,122 621,281 197,386

₩

572,571

₩

147,287

₩

621,575

₩

197,680

20062007

2007

2006