Samsung 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

continued

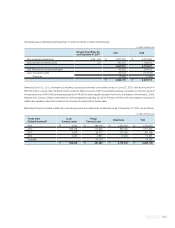

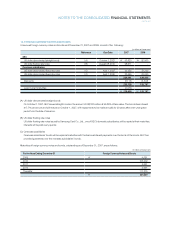

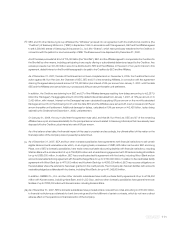

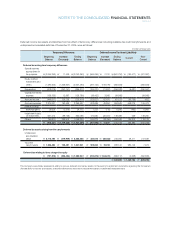

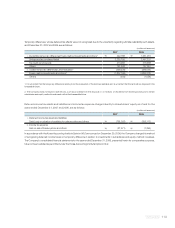

A domestic subsidiary of the Company, Samsung Card Co., Ltd. transferred certain eligible financial assets in accordance with the

Act on Asset Backed Securitization of the Republic of Korea to several financial institutions (“FIs”). The transfer is with recourse and

was completed through a Special Purpose Entity (“SPE”) issued securities. In the event of non-performance of those transferred

financial assets within certain measurement criteria noted in the transfer agreement, the Samsung Card is obliged to redeem the

issued securities.

The transfer of the financial assets has been recognized as a sale and accordingly, have been derecognized from the financial

statements. Total financial assets transferred amounted to ₩852,750 million for the year ended December 31, 2007 (2006:

₩1,448,439 million). As of December 31, 2007, ₩4,037,885 million (2006: ₩4,002,923 million) remain uncollected and

outstanding with the financial institutions.

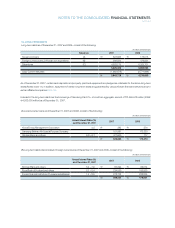

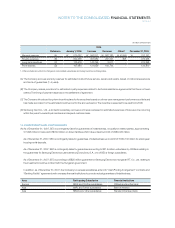

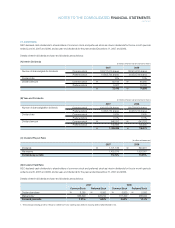

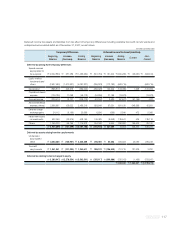

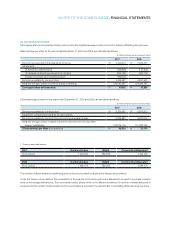

19. CAPITAL STOCK

Under its Articles of Incorporation, SEC is authorized to issue 500 million shares of capital stock with a par value of ₩5,000 per share,

of which 100 million shares are cumulative, participating preferred stock that are non-voting and entitled to a minimum cash dividend

at 9% of par value. In addition, SEC is authorized to issue to investors, other than current shareholders, convertible debentures and

debentures with warrants with face values up to ₩4,000 billion and ₩2,000 billion, respectively. The convertible debentures amounting

to ₩3,000 billion and ₩1,000 billion are assigned to common stock and preferred stock, respectively. While the debentures with

warrants amounting to ₩1,500 billion and ₩500 billion are assigned to common stock and preferred stock, respectively.

SEC is also authorized, subject to the Board of Directors’ approval, to issue shares of common or preferred stock to investors other than

current shareholders for issuance of depository receipts, general public subscription, urgent financing with financial institutions, and

strategic alliance.

SEC is authorized, subject to the Board of Directors’ approval, to retire treasury stock in accordance with applicable laws up to the

maximum amount of certain undistributed earnings. As of December 31, 2007, the 8,310,000 shares of common stock and 1,060,000

shares of non-voting preferred stock had been retired over three trenches, with the Board of Directors’ approval.

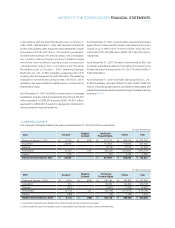

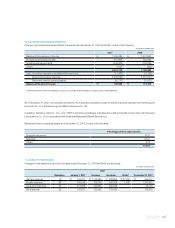

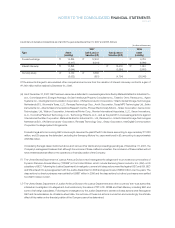

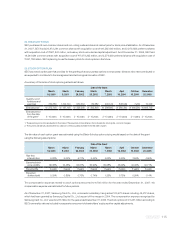

SEC has issued global depositary receipts (“GDR”), representing certain shares of non-voting preferred stock and common stock, at

overseas stock markets, are as follows:

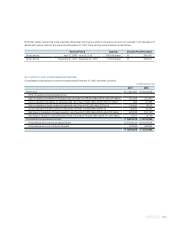

In addition to the above issuances, there have been several conversions of foreign currency convertible bonds into GDRs and

conversions of the issued GDRs into original shares of common stock or non-voting preferred stock.

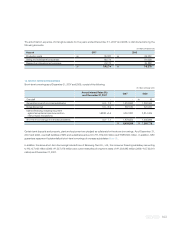

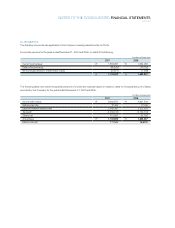

As of December 31, 2007, SEC’s outstanding global depositary receipts, as follows:

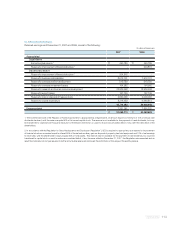

As of December 31, 2007, exclusive of retired stocks, 147,299,337 shares of common stock and 22,833,427 shares of preferred stock

have been issued. The preferred shares, which are non-cumulative and non-voting, were all issued on or before February 28, 1997, and

are entitled to an additional cash dividend of 1% of par value over common stock.

The par value of capital stock differs from paid-in capital as the retirement of capital stock was recorded as a deduction from retained

earnings.

Non-voting preferred stock 7,695,272 15,390,544

Common stock 4,251,339 8,502,678

Number of Shares of Stock Number of Shares of GDR

(N)

Non-voting preferred stock 3,459,872 6,919,744

Common stock 10,629,358 21,258,716

Number of Shares of Stock Number of Shares of GDR