Samsung 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

125

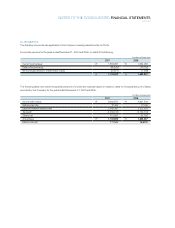

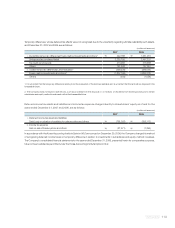

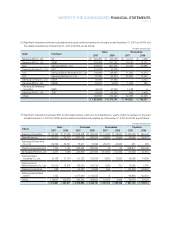

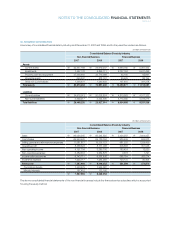

Further, as of December 31, 2007, the balances of beneficiary certificates from Samsung Securities Co., Ltd. amounted to ₩503,934

million (2006: ₩1,156,158 million) (Note 5). Also, the Company has entered into a severance insurance plan with Samsung Life

Insurance Co., Ltd., and fire and other insurance policies with Samsung Fire & Marine Insurance Co., Ltd. In addition, Samsung Card

Co., Ltd. a domestic subsidiary, purchased defined benefit pension plan from Samsung Life Insurance Co., Ltd. (Note 16).

As of December 31, 2007 and 2006, Samsung Card Co., Ltd., a domestic subsidiary, has general term loans amounting to ₩320,000

million from Samsung Life Insurance Co., Ltd. (Note 14).

As of December 31, 2007, SEC is contingently liable for guarantees of indebtedness, principally for related parties, approximating

₩7,693 million in loans and drawn facilities which have a maximum limit of US$3,020 million (Note 18).

For the year ended December 31, 2007, SEC recognized expenses for short-term benefits of ₩24,546 million, long-term benefits of

₩24,910 million and severance benefits of ₩7,514 million as key management compensation. Key management consists of registered

executive officers who have the authority and responsibility in the planning, directing and controlling of Company operations.

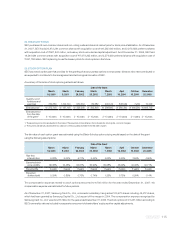

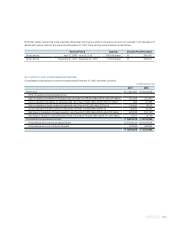

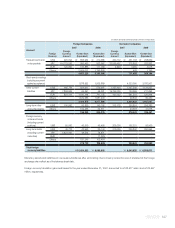

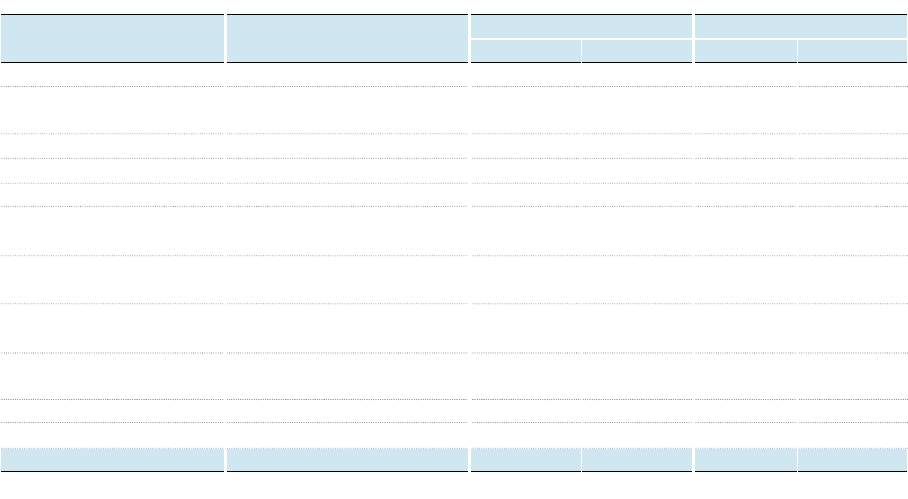

Samsung Corporation SAPL

₩

474,577

₩

308,782

₩

39,676

₩

14,605

SJC Samsung Heavy Industries

Co., Ltd. 407,551 377,517 23,484 24,018

Samsung America Inc. SAS 260,289 17,528 212,892 1,070

Samsung Corporation SJC 250,603 213,642 4,219 5,349

Samsung Deutschland GmbH SAS 155,310 21,744 120,276 -

SAPL Samsung Petrochemical

Co., Ltd. 113,548 61,783 15,158 11,320

Samsung Electro-Mechanics

America, Inc. SII 88,638 - 6,569 -

Samsung Electro-Mechanics

Germany, GmbH SESK 84,971 52,581 3,583 1,770

Samsung Electro-Mechanics

Germany, GmbH SEH 84,199 28,952 4,298 993

Scommtech Japan Co., Ltd. SJC 73,360 - 15,496 -

Others 1,144,271 2,029,319 124,644 281,190

₩

3,137,317

₩

3,111,848

₩

570,295

₩

340,315

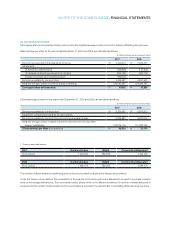

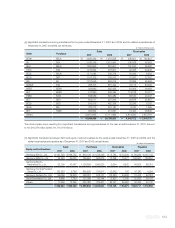

Sales Receivables

Seller Purchaser 2007 2006 2007 2006

(In millions of Korean won)

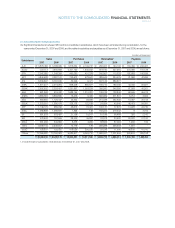

Significant transactions between subsidiaries and related parties, which are not subsidiaries or equity-method investees, for the

years ended December 31, 2007 and 2006, and the related receivables and payables as of December 31, 2007 and 2006, are as

follows:

(F)