Samsung 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140

|

|

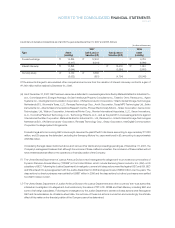

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

continued

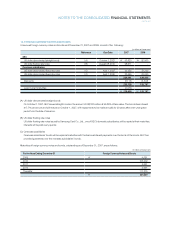

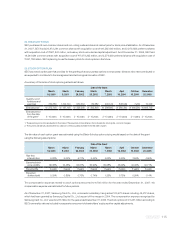

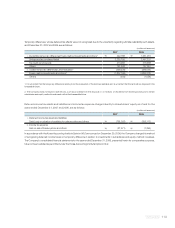

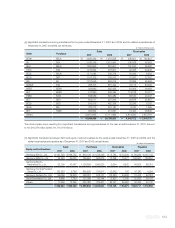

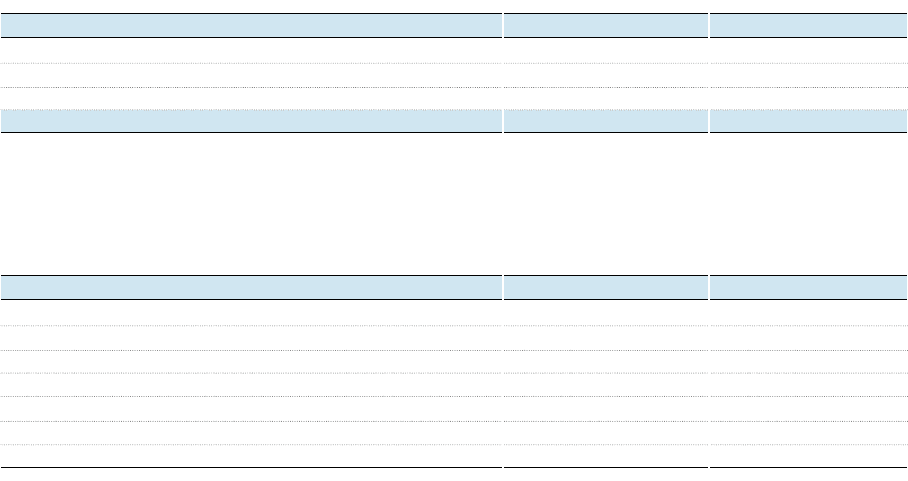

24. INCOME TAX

The statutory income tax rate applicable to the Company, including resident surtax, is 27.5%.

Income tax expense for the years ended December 31, 2007 and 2006, consists of the following:

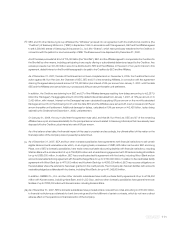

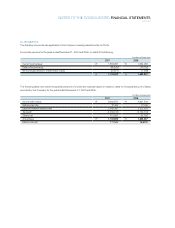

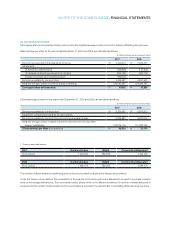

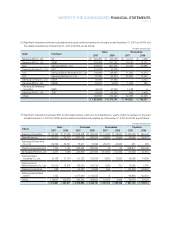

The following table reconciles the expected amount of income tax expense based on statutory rates to the actual amount of taxes

recorded by the Company for the years ended December 31, 2007 and 2006:

Current income taxes

₩

1,833,087

₩

1,652,083

Deferred income taxes (95,524) (10,702)

Items charged directly to shareholders’ equity (27,671) (7,394)

₩

1,709,892

₩

1,633,987

2007 2006

(In millions of Korean won)

Income before taxes

₩

9,632,873

₩

9,827,646

Statutory tax rate 27.5% 27.5%

Expected taxes at statutory rate 2,649,040 2,702,603

Tax credit (1,049,744) (1,120,772)

Others, net 110,596 52,156

Actual taxes

₩

1,709,892

₩

1,633,987

Effective tax rate 17.75% 16.63%

2007 2006

(In millions of Korean won)