Samsung 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.85

investees, are fully eliminated, and charged to the equity of the

controlling interests and minority interests, based on the percent-

age of ownership.

SEC and its consolidated subsidiaries follow the same fiscal year

end. Differences in accounting policies between the Company and

its consolidated subsidiaries are adjusted during consolidation.

MARKETABLE SECURITIES

Investments in equity securities or debt securities are classified

into trading securities, available-for-sale securities and held-to-

maturity securities, depending on the acquisition and holding

purpose. Trading securities are classified as current assets while

available-for-sale securities and held-to-maturity securities are

classified as long-term investments, except those securities that

mature or are certain to be disposed of within one year, which are

classified as current assets.

Cost is measured at the market value upon acquisition, including

incidental costs, and is determined using the average cost

method.

Available-for-sale securities are stated at fair value, while non-

marketable equity securities are stated at cost. Unrealized holding

gains and losses on available-for-sale securities are reported

in a separate component of shareholders’ equity under capital

adjustments, which are to be included in current operations

upon the disposal or impairment of the securities. In the case

of available-for-sale debt securities, the difference between the

acquisition cost after amortization, using the effective interest rate

method, and the fair value is reported as a capital adjustment.

Impairment resulting from the decline in realizable value below

the acquisition cost, net of amortization, are included in current

operations.

EQUITY-METHOD INVESTMENTS

Investments in business entities in which the Company has con-

trol or the ability to exercise significant influence over the operating

and financial policies are accounted for using the equity method of

accounting.

Under the equity method, the original investment is recorded at

cost and adjusted by the Company’s share in the net book value

of the investee with a corresponding charge to current opera-

tions, a separate component of shareholders’ equity, or retained

earnings, depending on the nature of the underlying change in

the net book value. All significant unrealized profits arising from

intercompany transactions between the Company and its equity-

method investee and subsidiaries are fully eliminated.

Differences between the investment amounts and correspond-

ing capital amounts of the investee at the date of acquisition

of the investment are recorded as part of investments and are

amortized over five years using the straight-line method. However,

differences which occur from additional investments made after

the Company obtains control and the investment becomes a

subsidiary are reported in a separate component of shareholders’

equity, and are not included in the determination of the results of

operations.

Assets and liabilities of the Company’s foreign investees are

translated at current exchange rates, while income and expense

are translated at average rates for the period. Adjustments

resulting from the translation process are reported in a separate

component of shareholders’ equity, and are not included in the

determination of the results of operations.

Certain equity-method investments are accounted for based on

unaudited or unreviewed financial statements as the audited or

reviewed financial statements of these entities are not available as

of the date of this audit report.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

The Company provides an allowance for doubtful accounts and

notes receivable based on the aggregate estimated collectibility of

the receivables.

INVENTORY VALUATION

Inventories are stated at the lower of cost or net realizable value.

Cost is determined using the average cost method, except for

materials-in-transit which are stated at actual cost as determined

using the specific identification method. Losses on valuation of

inventories and losses on inventory obsolescence are recorded as

part of cost of sales.

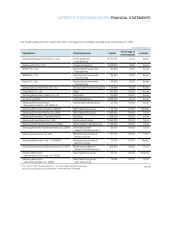

PROPERTY, PLANT AND EQUIPMENT AND

RELATED DEPRECIATION

Property, plant and equipment are stated at cost, except for

certain assets subject to upward revaluation in accordance with

the Asset Revaluation Law of Korea. The revaluation presents

production facilities and other buildings at their depreciated

replacement cost, and land at the prevailing market price, as of

the effective date of revaluation. The revaluation increment, net

of revaluation tax, is first applied to offset accumulated deficit

and deferred foreign exchange losses, if any. The remainder may

be credited to other capital surplus or transferred to common

stock. A new basis for calculating depreciation is established for

revalued assets.