Samsung 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

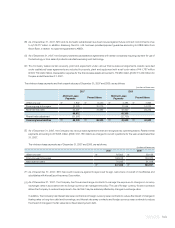

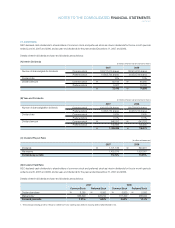

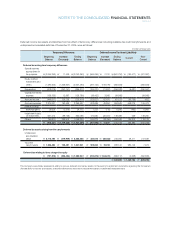

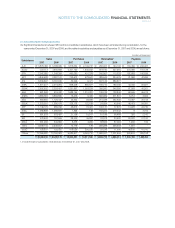

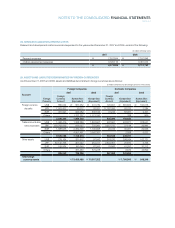

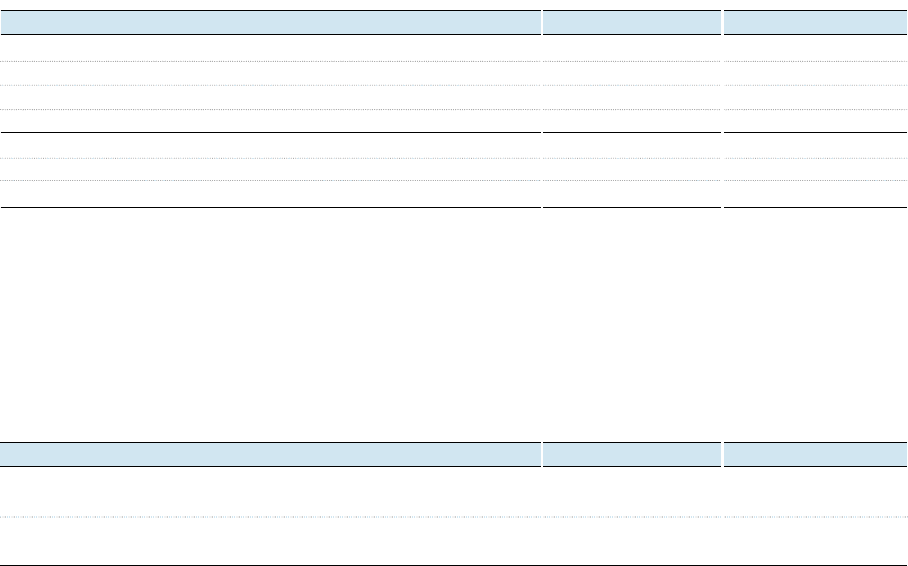

Temporary differences, whose deferred tax effects were not recognized due to the uncertainty regarding ultimate realizability such assets,

as of December 31, 2007 and 2006, are as follows:

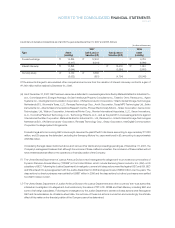

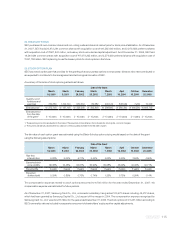

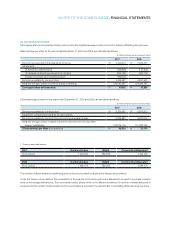

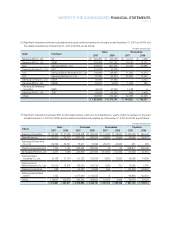

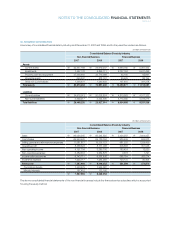

In accordance with the Korea Accounting Institute Opinion 06-2 announced on December 29, 2006, the Company changed its method

of recognizing deferred income taxes on temporary difference in relation to investments in subsidiaries and equity-method investees.

The Company’s consolidated financial statements for the year ended December 31, 2006, presented herein for comparative purposes,

have not been restated as permitted under the Korea Accounting Institute Opinion 06-2.

Ⅰ. Deductible temporary differences Equity-method investments and others 2

₩

422,188

₩

1,631,015

Undisposed accumulated deficit 2,235,756 2,457,237

Tax credit carryforwards 413,966 318,588

Others 161,308 137,061

Ⅱ. Taxable temporary differences Land revaluation1 (398,538) (399,034)

Equity-method investments and others 2 (1,807,196) (1,884,373)

Others (344) (1,026)

2007 2006

(In millions of Korean won)

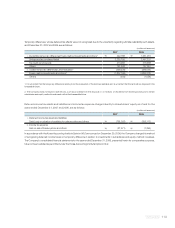

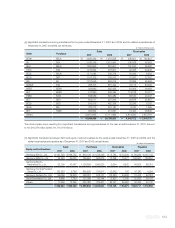

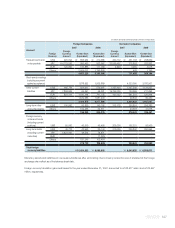

Deferred income tax assets and liabilities and income tax expense charged directly to shareholders’ equity as of and for the

years ended December 31, 2007 and 2006, are as follows:

Ⅰ. Deferred income tax assets and liabilities

Gain(Loss) on valuation of available-for-sale securities and others

₩

(755,003)

₩

(355,117)

Ⅱ. Income tax expense

Gain on sale of treasury stock and others

₩

(27,671)

₩

(7,394)

2007 2006

(In millions of Korean won)

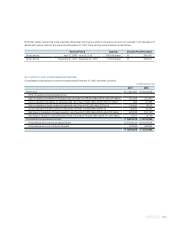

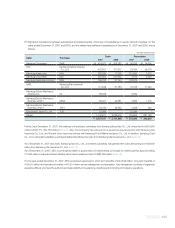

1. It is uncertain that the temporary differences arising from the revaluation of the land are realizable as it is uncertain that the land will be disposed in the

foreseeable future.

2. The Company does not expect cash inflows, such as proceeds from the disposal of, or receipts of dividends from earnings arising from certain

subsidiaries and equity method investments within the foreseeable future.