Samsung 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

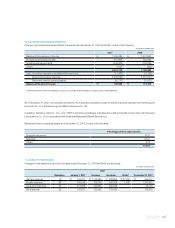

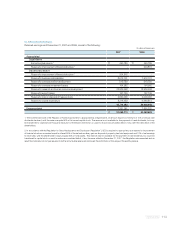

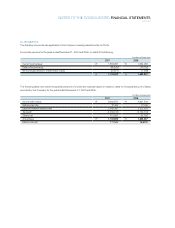

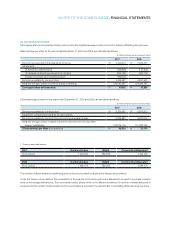

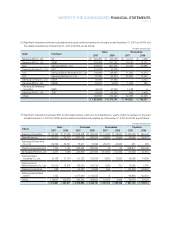

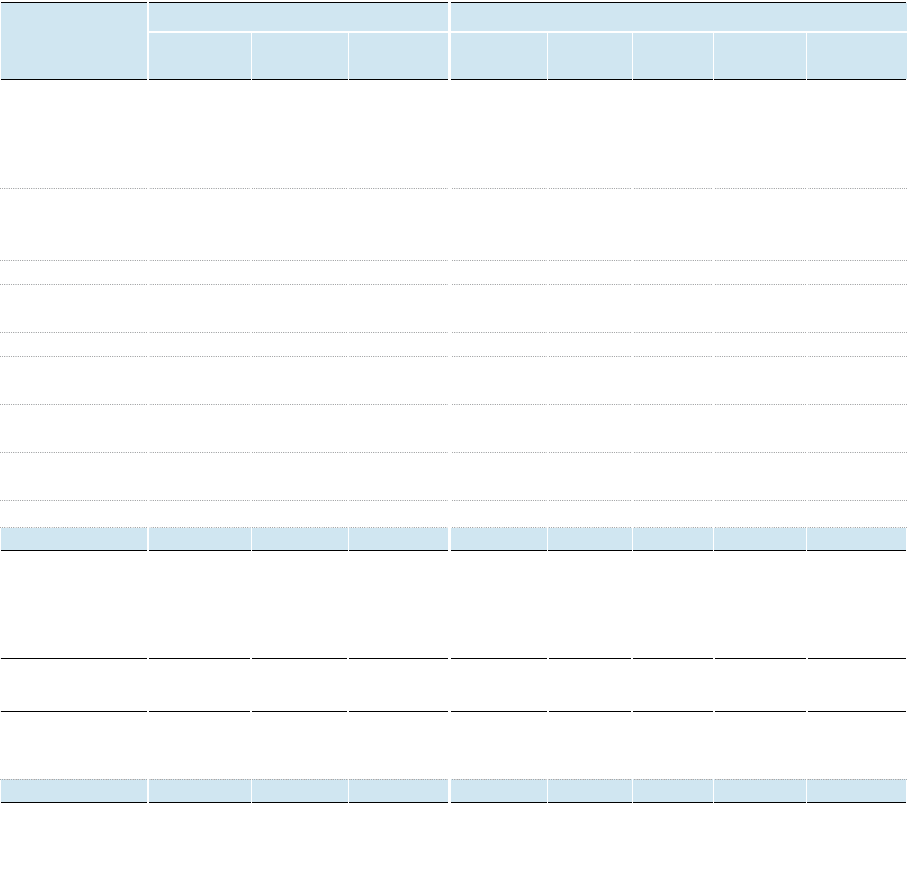

Deferred income tax assets and liabilites from tax effect of temporary differences including available tax credit carryforwards and

undisposed accumulated deficit as of December 31, 2007, are as follows:

Temporary Differences Deferred Income Tax Asset (Liabilities)

Beginning Increase Ending Beginning Increase Ending Non-

Balance (Decrease) Balance Balance (Decrease) Balance Current Current

(In millions of Korean won)

Deferred tax arising from temporary differences

Special reserves

appropriated for

tax purposes

₩

(2,042,850)

₩

587,286

₩

(1,455,564)

₩

(561,784)

₩

161,504

₩

(400,280)

₩

(36,667)

₩

(363,613)

Equity-method

investments and

others (2,627,490) (1,470,337) (4,097,827) (395,923) (112,792) (508,715) - (508,715)

Depreciation (865,817) 496,575 (369,242) (256,028) 132,543 (123,485) 1,598 (125,083)

Capitalized interest

expense (126,786) 77,068 (49,718) (34,866) 21,193 (13,673) - (13,673)

Accrued income (223,414) 13,701 (209,713) (61,157) 3,580 (57,577) (57,155) (422)

Allownce(technical

expense, others) 2,356,597 128,622 2,485,219 653,549 37,601 691,150 648,569 42,581

Deferred foreign

exchange gains 24,112 (3,153) 20,959 6,506 (666) 5,840 472 5,368

Impairment losses

on investments 532,066 (23,916) 508,150 149,489 (9,948) 139,541 425 139,116

Others 1,049,223 66,755 1,115,978 254,048 4,644 258,692 169,502 89,190

₩

(1,924,359)

₩

(127,399)

₩

(2,051,758)

₩

(246,166)

₩

237,659 (8,507) 726,744 (735,251)

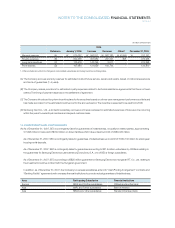

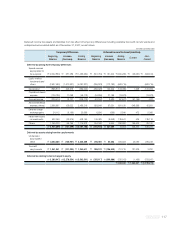

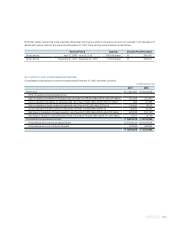

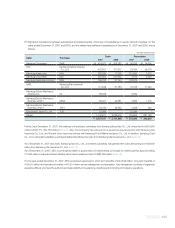

Deferred tax assets arising from the carryforwards

Undisposed

accumulated

deficit

₩

3,353,235

₩

(126,967)

₩

3,226,268

₩

246,060

₩

60,263 306,323 20,090 286,233

Tax credit

carryforwards

₩

1,341,941

₩

(101,330)

₩

1,240,611

₩

988,122

₩

(196,903) 791,219 787,929 3,290

Deferred tax relating to items charged to equity

₩

(1,283,947)

₩

(2,278,554)

₩

(3,562,501)

₩

(355,117)

₩

(399,886) (755,003) (1,456) (753,547)

₩

334,032

₩

1,533,307

₩

(1,199,275)