Samsung 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

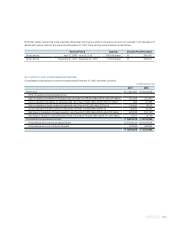

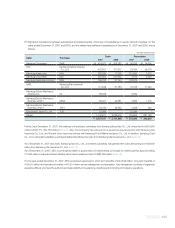

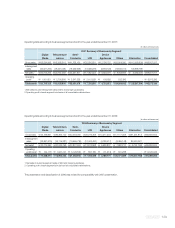

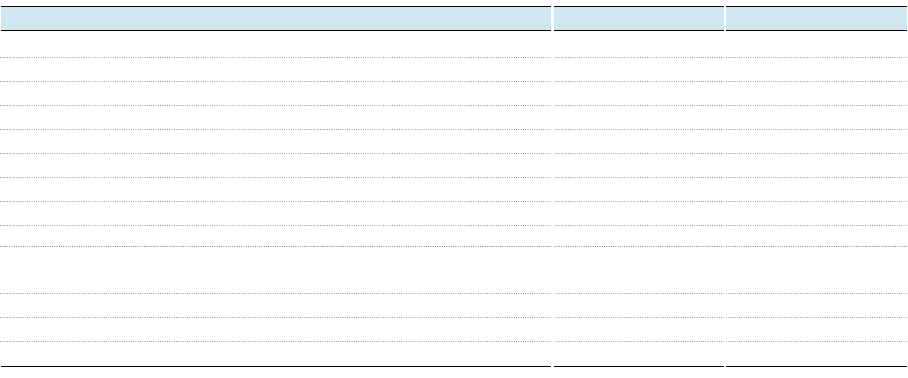

31. TRANSACTION NOT AFFECTING CASH FLOWS

Significant transactions not affecting cash flows for the years ended December 31, 2007 and 2006, are as follows:

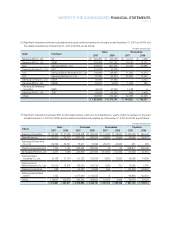

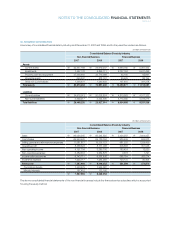

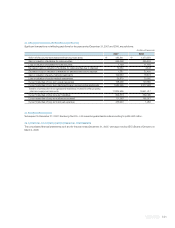

32. SUBSEQUENT EVENT

Subsequent to December 31, 2007, Samsung Card Co., Ltd. issued unguaranteed bonds amounting to ₩455,000 million.

33. APPROVAL OF CONSOLIDATED FINANCIAL STATEMENTS

The consolidated financial statements as of and for the year ended December 31, 2007, were approved by SEC’s Board of Directors on

March 4, 2008.

Write-off of accounts receivables and financing receivables

₩

483,841

₩

1,473,054

Gain on valuation of available-for-sale securities 956,298 225,203

Loss on valuation of available-for-sale securities 1,139 11,164

Decrease in gain on valuation of available-for-sale securities due to disposal 14,650 4,543

Decrease in loss on valuation of available-for-salesecurities due to disposal 1,387 32,450

Gain on valuation of equity-method investments 109,633 18,574

Loss on valuation of equity-method investments 35,870 20,082

Current maturities of long-term prepaid expenses 168,268 193,860

Current maturities of long-term debts and foreign currency notes and bonds 1,983,225 2,317,933

Transfer of construction-in-progress and machinery in transit to other property,

plant and equipment accounts 11,834,995 10,941,017

Current maturities of other long-term liabilities 304,374 332,435

Current maturities of long-term advances received 171,383 165,917

Current maturities of long-term accrued expenses 433,943 1,254

2007 2006

(In millions of Korean won)