Samsung 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.87

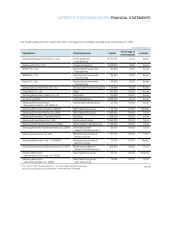

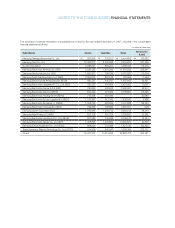

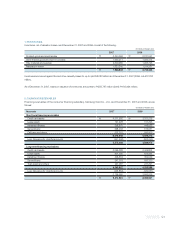

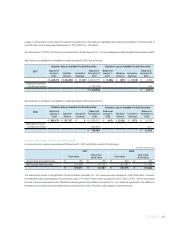

DEFERRED INCOME TAX ASSETS AND LIABILITIES

Deferred income tax assets and liabilities are recognized based on

estimated future tax consequences attributable to the differences

between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases, and operating

loss and tax credit carryforwards.

Deferred income tax assets and liabilities are computed on such

temporary differences by applying statutory tax rates applicable to

the years when such differences are expected to be reversed. Tax

assets related to tax credits and exemptions are recognized to the

extent of the Company’s certain taxable income.

The balance sheet distinguishes the current and non-current por-

tions of the deferred tax assets and liabilities, whose balances are

offset against each other.

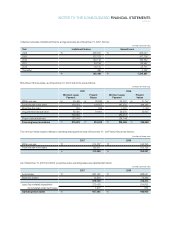

LONG-TERM RECEIVABLES AND PAYABLES

Long-term receivables and payables that have no stated interest

rate or whose interest rate are different from the market rate are

recorded at their present values using the market rate of discount.

The difference between the nominal value and present value of the

long-term receivables and payables are amortized using the effec-

tive interest rate method with interest income or expense adjusted

accordingly.

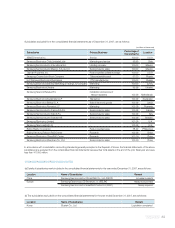

STOCK-BASED COMPENSATION

The Company uses the fair-value method in determining com-

pensation costs of stock options granted to its employees and

directors. The compensation cost is estimated using the Black-

Scholes option-pricing model and is accrued as a charge to

expense over the vesting period, recorded as a separate compo-

nent of shareholders’ equity under other capital adjustments.

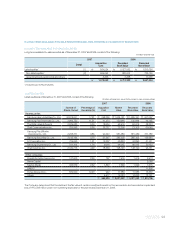

EARNINGS PER SHARE

Basic earnings per share is calculated by dividing net income

available to common shareholders by the weighted-average num-

ber of common shares outstanding during the year. Diluted earn-

ings per share is calculated using the weighted-average number

of common shares outstanding adjusted to include the potentially

dilutive effect of common equivalent shares outstanding.

PROVISIONS AND CONTINGENT LIABILITIES

When there is a probability that an outflow of economic benefits will

occur due to a present obligation resulting from a past event, and

whose amount is reasonably estimable, a corresponding amount

of provision is recognized in the financial statements. However,

when such outflow is dependent upon a future event, is not certain

to occur, or cannot be reliably estimated, a disclosure regarding the

contingent liability is made in the notes to the financial statements.

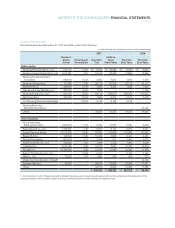

DERIVATIVE INSTRUMENTS

Derivative financial instruments for trading or hedging purpose

are valued at estimated market price with the resulting unrealized

gains or losses recognized in the current operations, except for

the effective portion of derivative transactions entered into for the

purpose of cash-flow hedges, which is recorded as an adjustment

to shareholders’ equity.

All derivative instruments are accounted for at fair value with the

resulting valuation gain or loss recorded as an asset or liability. If

the derivative instrument is not designated as a hedging instru-

ment, the gain or loss is recognized in earnings in the period of

change. Fair value hedge accounting is applied to a derivative in-

strument with the purpose of hedging the exposure to changes in

the fair value of an asset or a liability or a firm commitment (hedged

item) that is attributable to a particular risk.

The gain or loss, both on the hedging derivative instrument and

on the hedged item attributable to the hedged risk, is reflected

in current operations. Cash flow hedge accounting is applied to

a derivative instrument with the purpose of hedging the exposure

to variability in expected future cash flows of an asset or a liability

or a forecasted transaction that is attributable to a particular risk.

The effective portion of the gain or loss on a derivative instrument

designated as a cash flow hedge is recorded as a capital adjust-

ment and the ineffective portion is recorded in current operations.

The effective portion of the gain or loss recorded as a capital

adjustment is reclassified to current operations in the same period

during which the hedged forecasted transaction affects earnings.

If the hedged transaction results in the acquisition of an asset or

the incurrence of a liability, the gain or loss recognized as a capital

adjustment is added to or deducted from the asset or the liability.

ASSET IMPAIRMENT

When the book value of an asset is significantly greater than its

recoverable value due to obsolescence, physical damage or

the abrupt decline in the market value of the asset, the decline in

value is deducted from the book value and recognized as an asset

impairment loss in the current period.