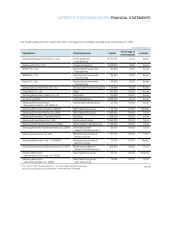

Samsung 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

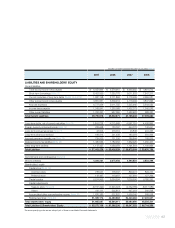

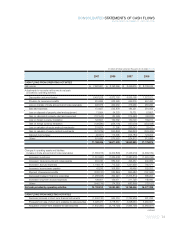

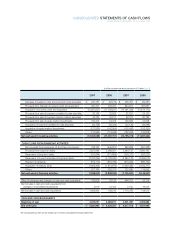

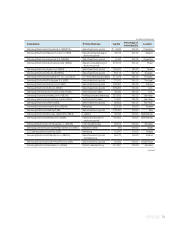

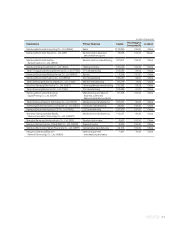

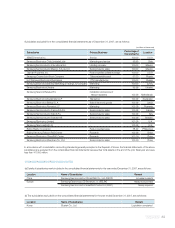

Cash Flow from Operating Activities 14,565 16,744 13,329 15,081 14,791

Net Income 5,962 10,790 7,640 7,926 7,421

Depreciation & Armortization 4,299 5,185 6,020 6,873 8,498

Cash Flow from Investing Activities (7,728) (8,183) (9,046) (11,098) (12,002)

Acquisition of PP&E (7,701) (10,497) (11,540) (11,738) (12,252)

Cash Flow from Financing Activities (5,178) (9,639) (3,266) (3,889) (1,600)

Dividend (910) (1,596) (849) (832) (819)

Rights Issuance / Stock repurchase (1,979) (3,841) (2,149) (1,813) (1825)

Consolidation adjustments 108 81 (63) 46 421

Increase in Cash & Cash Eq. * 1,767 (996) 953 139 1,610

2003 2004 2005 2006 2007

2003 2004 2005 2006 2007

(In billions of Korean won)

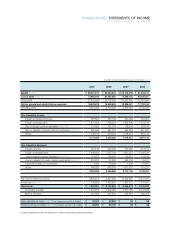

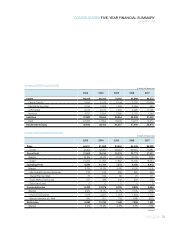

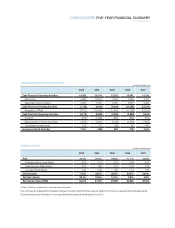

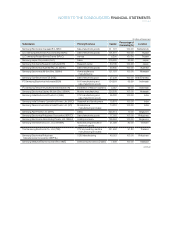

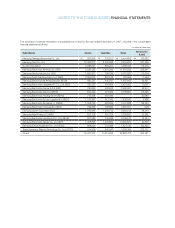

FINANCIAL RATIOS

ROE 21.4% 32.4% 19.6% 17.7 % 14.3%

Profitability (Net Income/Sales) 0.09 0.13 0.09 0.09 0.08

Asset Turnover (Sales/Asset) 0.97 1.20 1.12 1.10 1.13

Leverage (Asset/Equity) 2.39 2.06 1.84 1.74 1.68

Debt to Equity 77.8% 48.5% 39.5% 30.2% 25.9%

Net Debt / Equity 38.4% 18.8% 15.3% 9.8% 4.8%

Earnings per share (KRW) 36,376 67,916 49,969 52,880 49,502

* Cash & Cash Eq. includes short-term financial instruments

The numbers are adjusted for the latest change in Korean GAAP and thus may be different from those in audited financial statements.

Financial sectors are included in the consolidated base financial statements from 2000.

CONSOLIDATED CASH FLOW STATEMENT

(In billions of Korean won)

CONSOLIDATED FIVE-YEAR FINANCIAL SUMMARY

Consolidated base