Samsung 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.111

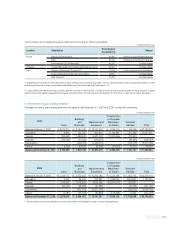

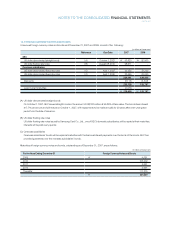

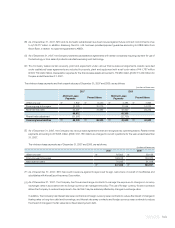

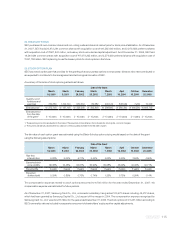

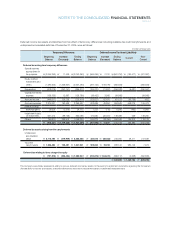

SEC and 30 other Samsung Group affiliates (the “Affiliates”) entered into an agreement with the institutional creditors (the

“Creditors”) of Samsung Motors Inc. (“SMI”) in September 1999. In accordance with this agreement, SEC and the Affiliates agreed

to sell 3,500,000 shares of Samsung Life Insurance Co., Ltd. (the “Shares”), which were previously transferred to the Creditors in

connection with the petition for court receivership of SMI. The Shares were to be disposed of by December 31, 2000.

And if the sales proceeds fell short of ₩2,450 billion (the “Shortfall”), SEC and the Affiliates agreed to compensate the Creditors for

the Shortfall by other means, including participating in any equity offering or subordinated debentures issued by the Creditors. Any

excess proceeds over ₩2,450 billion were to be distributed to SEC and the Affiliates. In the event of non-performance to this

agreement, default interest on the Shortfall was agreed to be paid to the Creditors by SEC and the Affiliates.

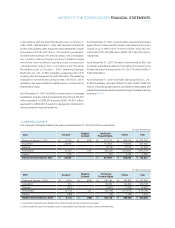

As of December 31, 2007, the sale of the Shares had not been completed and on December 9, 2005, the Creditors filed a civil

action against Mr. Kun-Hee Lee, the Chairman of SEC, SEC and 27 of the remaining Affiliates, in connection with this agreement

claiming the agreed sales proceeds amount of ₩2,450 billion plus interest of 6% per annum from January 1, 2001, until the date

SEC and the Affiliates were served with court process and 20% per annum thereafter until settlement.

In addition, the Creditors are claiming from SEC and 27 of the Affiliates damages resulting from delays amounting to ₩2,287.9

billion (the “Damages”), the aggregate amount of monthly default interest calculated from January 1, 2001, at 19% per annum on ₩

2,450 billion, with interest. Interest on the Damages has been calculated by applying 6% per annum on the monthly calculated

Damages amount from the following month until the date SEC and the Affiliates were served with court process and 20% per

annum thereafter until settlement. Additional damage for delays, calculated at 19% per annum on ₩2,450 billion, is also being

claimed by the Creditors from December 1, 2005, until settlement.

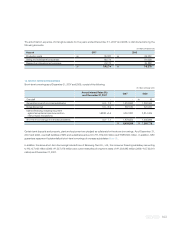

On January 31, 2008, the court ruled that the agreement was valid, and that Mr. Kun-Hee Lee, SEC and 27 of the remaining

Affiliates have a joint and severable liability for the principal less an amount related to Samsung Life shares that have already been

disposed of by the Creditors, plus interest at a rate of 6% per annum.

As of the balance sheet date, the financial impact of this case is uncertain and accordingly, the ultimate effect of this matter on the

financial position of the Company cannot presently be determined.

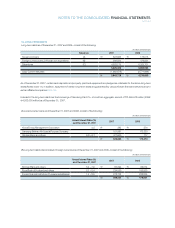

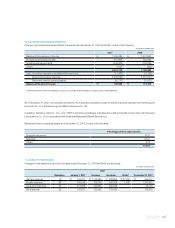

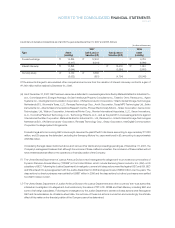

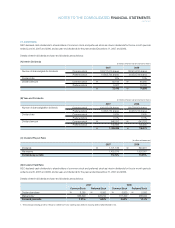

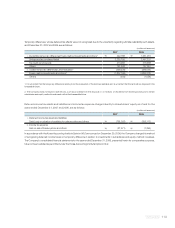

As of December 31, 2007, SEA and four other overseas subsidiaries have agreements with financial institutions to sell certain

eligible trade accounts receivable under which, on an ongoing basis, a maximum of US$1,622 million can be sold. SEC and Living

Plaza, one of SEC’s domestic subsidiaries, have trade notes receivable discounting facilities with financial institutions, including

Shinhan Bank with a combined limit of up to ₩498,800 million and a trade financing agreement with 23 banks including Woori Bank

for up to US$9,300 million. In addition, SEC has a credit sales facility agreement with five banks, including Woori Bank and an

accounts receivable factoring agreement with Korea Exchange Bank for up to ₩150,000 million. In relation to the credit sales facility

agreement with Woori Bank (up to ₩70,000 million) and Kookmin Bank (up to ₩200,000 million), SEC has recourse obligations on

the receivables where the extensions have been granted on the credit periods. The Company also has loan facilities with accounts

receivable pledged as collaterals with four banks, including Woori Bank, for up to ₩1,065,000 million.

In addition, SEMES Co., Ltd., and two other domestic subsidiaries have credit purchase facility agreements of up to ₩136,500

million with Korean banks, including Hana Bank, and S-LCD Corp. and two other domestic subsidiaries have general term loan

facilities of up to ₩282,000 million with Korean banks, including Kookmin Bank.

As of December 31, 2007, SEC’s domestic subsidiaries have provided a blank note and two notes amounting to ₩30,000 million,

to financial institutions as collaterals for bank borrowings and for the fulfillment of certain contracts, which do not have a direct

adverse effect on the operations or financial position of the Company.

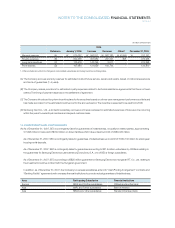

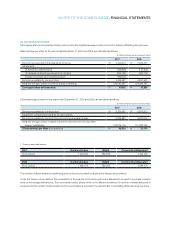

(K)

(L)

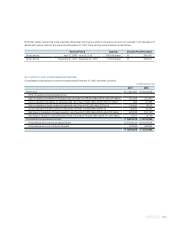

(M)