Samsung 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

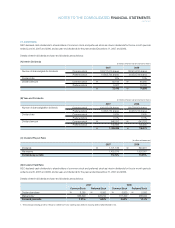

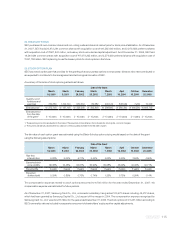

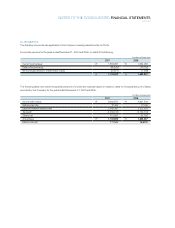

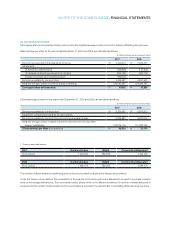

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

continued

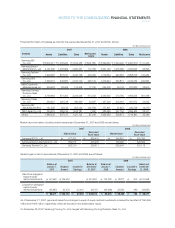

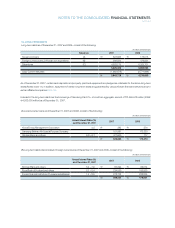

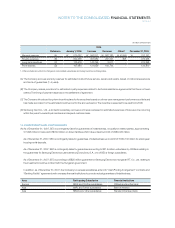

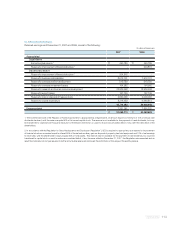

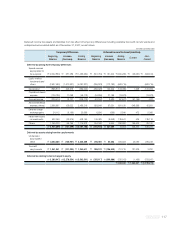

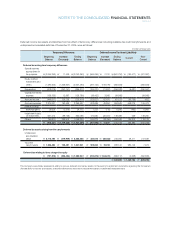

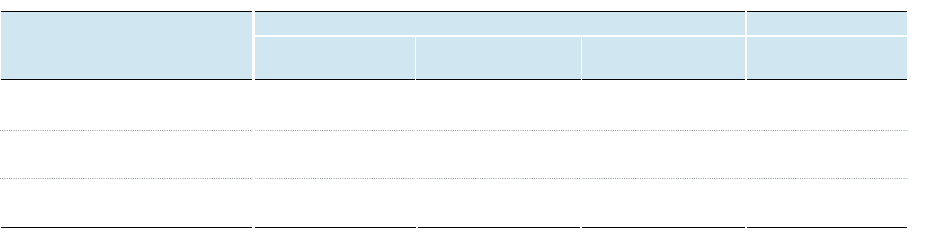

A summary of derivative transactions as of and for the year ended December 31, 2007 and 2006, follows:

(In millions of Korean won)

2007 2006

Asset Gain (Loss) on Gain (Loss) on Asset

(Liability) Valuation (I/S) Valuation (B/S) (Liability)

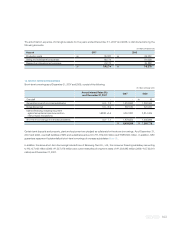

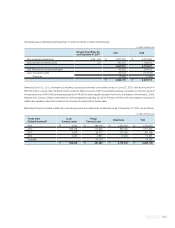

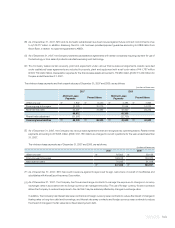

Of the amounts charged to accumulated other comprehensive income from the valuation of interest rate swap contracts, a gain of

₩1,861 million will be realized by December 31, 2008.

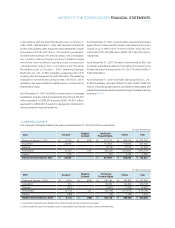

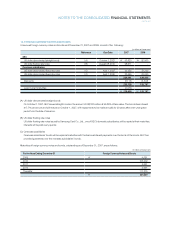

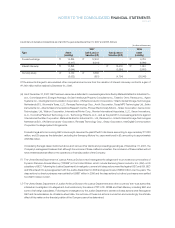

As of December 31, 2007, SEC has been named as a defendant in overseas legal actions filed by Matsushita Electric Industrial Co.,

Ltd., Commissariat A L’Energie Atomique, St.Clair Intellectual Property Consultants Inc., Tadahiro Ohmi, Rambus Inc., Agere

Systems Inc., InterDigital Communication Corporation, ON Semiconductor Corporation, Hitachi Global Storage Technologies

Netherlands B.V., Stormedia Texas, LLC., Renesas Technology Corp., Anvik Corporation, Texas MP3 Technologies Ltd., Seiko

Instruments Inc., Alberta Telecommunications Research Centre, Pioneer Electronics(USA) Inc., Sharp Corporation, Genoa Color

Technologies, Ltd., Wistron Corporation, International Printer Corp., Premier International Associates, LLC., Saxon Innovations,

LLC., Innovative Patented Technology, LLC., Technology Patents, LLC., and as the plaintiff in overseas legal actions against

International Rectifier Corporation, Matsushita Electric Industrial Co., Ltd, Rambus Inc., Hitachi Global Storage Technologies

Netherlands B.V., ON Semiconductor Corporation, Renesas Technology Corp., Sharp Corporation, InterDigital Communication

Corporation for alleged patent infringements.

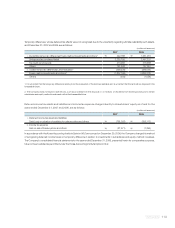

Domestic legal actions involving SEC include eight cases as the plaintiff with total claims amounting to approximately ₩7,823

million, and 29 cases as the defendant, excluding the Samsung Motors Inc. case mentioned in (K), amounting to approximately

₩58,862 million.

Considering the legal cases mentioned above and various other claims and proceedings pending as of December 31, 2007, the

Company’s management believes that, although the outcome of these matters is uncertain, the conclusion of these matters will not

have a material adverse effect on the operations or financial position of the Company.

The United States Department of Justice Antitrust Division had investigated the alleged anti-trust violations by the sellers of

Dynamic Random Access Memory (“DRAM”) in the United States, which include Samsung Semiconductor Inc. (SSI), a US

subsidiary of SEC. Following the Justice Department’s investigation, several civil class actions were filed against SEC and SSI. SEC

and SSI entered into a plea agreement with the Justice Department in 2005 and agreed to pay US$300 million over five years. The

class actions by direct purchasers were settled for US$67 million in 2006 and the class actions by indirect purchasers were settled

for US$113 million in 2007.

The United States Department of Justice Antitrust Division (the Justice Department) and other countries’ anti-trust authorities

initiated an investigation into alleged anti-trust violations by the sellers of TFT-LCD, SRAM and Flash Memory, including SEC and

some of its foreign subsidiaries. Following the investigation by the Justice Department, several civil class actions were filed against

SEC and its subsidiaries. As of balance sheet date, the outcome of these civil actions is uncertain and accordingly, the ultimate

effect of this matter on the financial position of the Company cannot be determined.

(H)

( I )

(J)

Forward exchange

₩

14,825

₩

12,534

-

₩

6,319

(9,417) (8,219) - (8,866)

Interest rate swap

₩

13,898

-

₩

13,418

₩

1,851

(3,044) - (2,564) (3,876)

Currency swap

₩

2,149

₩

6,366

-

-

(5,032) (651) (4,794) (28,948)

Type