Samsung 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

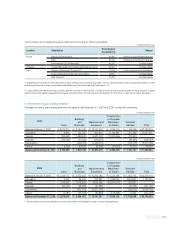

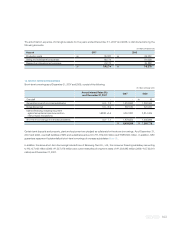

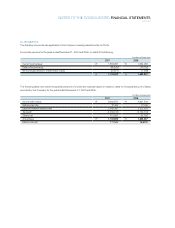

As of December 31, 2007, the Company has various lease agreements that are recognized as operating leases. Related rental

payments amounting to ₩73,508 million (2006: ₩61,188 million) are charged to current operations for the year ended December

31, 2007.

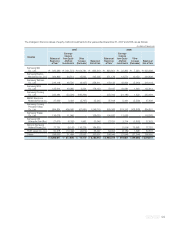

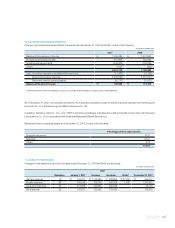

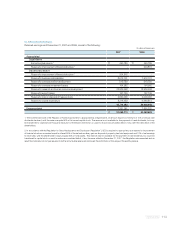

The minimum lease payments as of December 31, 2007 and 2006, are as follows:

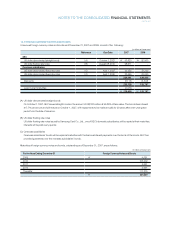

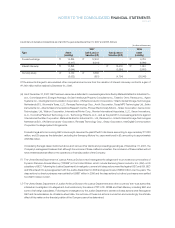

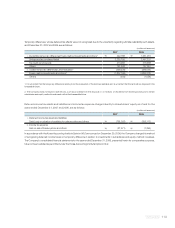

As of December 31, 2007, SEC has credit insurance against its approved foreign customers on behalf of its affiliates and

subsidiaries with Korea Export Insurance Corporation.

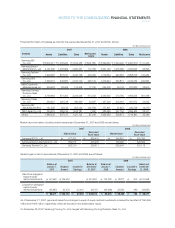

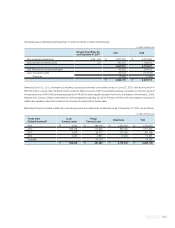

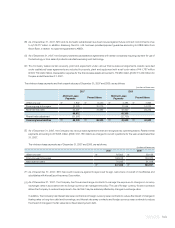

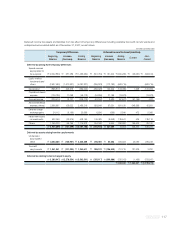

As of December 31, 2007, the Company has forward exchange contracts to manage the exposure to changes in currency

exchanges rates in accordance with its foreign currency risk management policy. The use of foreign currency forward contracts

allows the Company to reduce its exposure to the risk that it may be adversely affected by changes in exchange rates.

In addition, the Company has interest rate swap contracts and foreign currency swap contracts to reduce the impact of changes in

floating rates on long-term debt and borrowings, and interest rate swap contracts and foreign currency swap contracts to reduce

the impact of changes in the fair-value risk on fixed rate long-term debt.

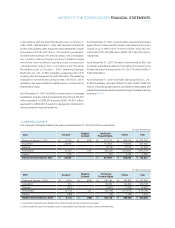

As of December 31, 2007, SEC and its domestic subsidiaries have been insured against future contract commitments of up

to ₩122,377 million. In addition, Samsung Card Co., Ltd. has been provided payment guarantee amounting to US$5 million from

Woori Bank, in relation to a payment guarantee to AMEX.

As of December 31, 2007, the Company has technical assistance agreements with certain companies requiring payment for use of

the technology or from sales of products manufactured using such technology.

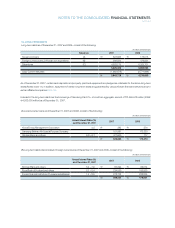

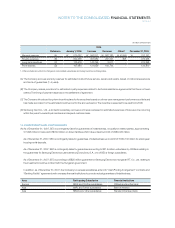

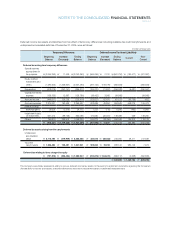

The Company leases certain property, plant and equipment under various finance lease arrangements. Assets recorded

under capitalized lease agreements are included in property, plant and equipment with a net book value of ₩41,787 million

(2006: ₩24,029 million). Depreciation expense for the finance lease assets amounted to ₩2,986 million (2006: ₩1,442 million) for

the year ended December 31, 2007.

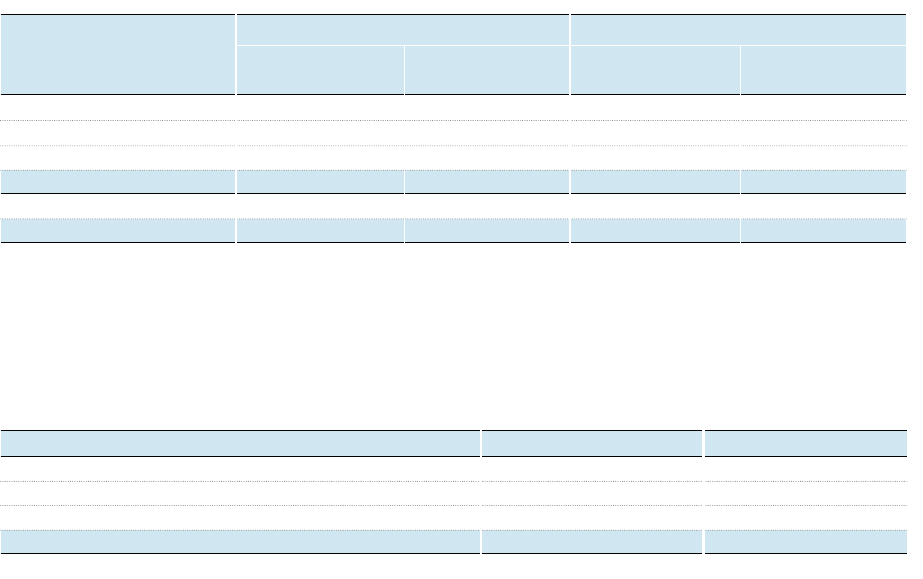

The minimum lease payments and their present value as of December 31, 2007 and 2006, are as follows:

(In millions of Korean won)

Within one year

₩

7,837

₩

6,240

₩

4,386

₩

3,833

From one year to five years 26,678 20,576 17,544 14,575

More than five years 55,297 31,489 43,420 24,212

89,812 65,350

Present value adjustment (31,507) (22,730)

Financing lease liabilities

₩

58,305

₩

58,305

₩

42,620

₩

42,620

Within one year

₩

83,903

₩

59,156

From one year to five years 192,918 133,373

More than five years 70,242 51,418

₩

347,063

₩

243,947

2007 2006

(In millions of Korean won)

(B)

(C)

(D)

(E)

(F)

(G)

Minimum Lease Present Values Minimum Lease Present Values

Payments Payments

2007 2006