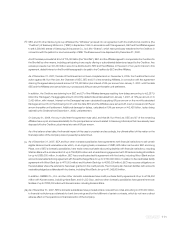

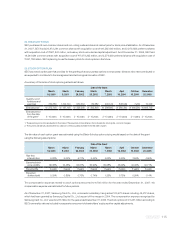

Samsung 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

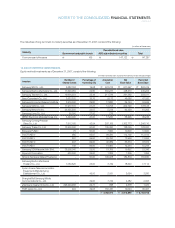

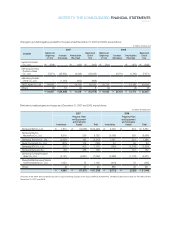

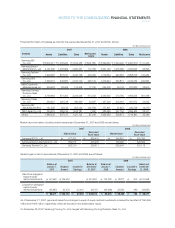

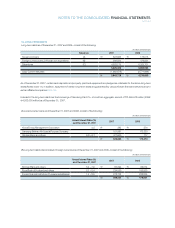

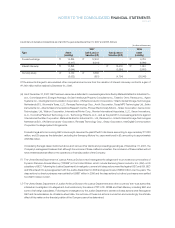

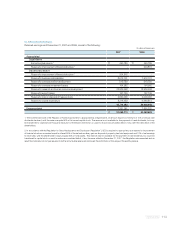

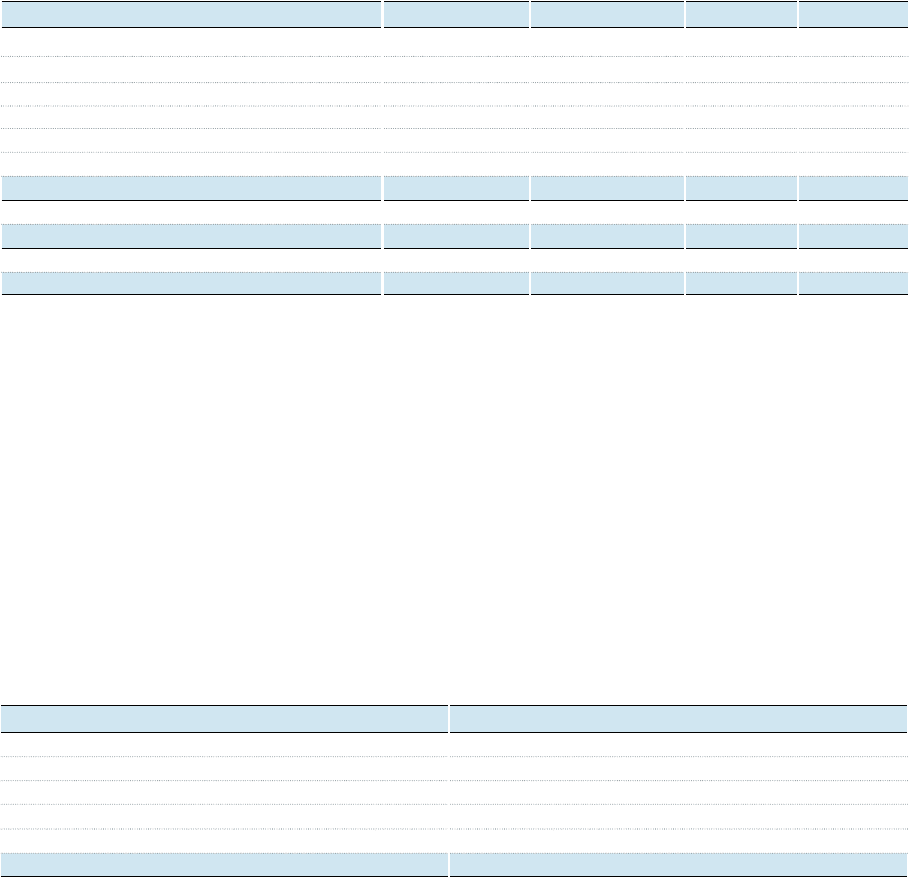

15. FOREIGN CURRENCY NOTES AND BONDS

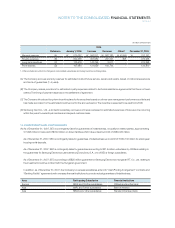

Unsecured foreign currency notes and bonds as of December 31, 2007 and 2006, consist of the following:

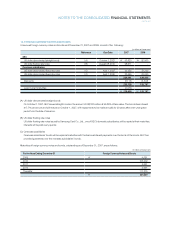

(A) US dollar denominated straight bonds

On October 2, 1997, SEC issued straight bonds in the amount of US$100 million at 99.85% of face value. The bonds bear interest

at 7.7% per annum and will mature on October 1, 2027, with repayments to be made annually for 20 years after a ten-year grace

period from the date of issuance.

(B) US dollar floating rate notes

US dollar floating rate notes issued by Samsung Card Co., Ltd., one of SEC’s domestic subsidiaries, will be repaid at their maturities.

Interests will be paid every quarter.

(C) Overseas subsidiaries

Overseas subsidiaries’ bonds will be repaid at maturities with the biannual interest payments over the terms of the bonds. SEC has

provided guarantees over the overseas subsidiaries’ bonds.

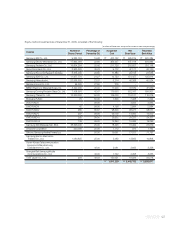

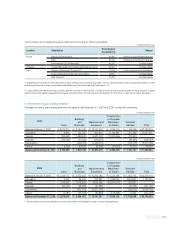

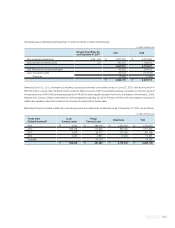

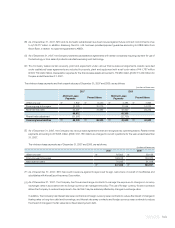

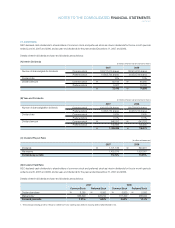

Maturities of foreign currency notes and bonds, outstanding as of December 31, 2007, are as follows:

(In millions of Korean won)

2009

₩

4,691

2010 103,202

2011 4,691

2012 4,691

Thereafter 117,275

₩

234,550

For the Years Ending December 31 Foreign Currency Notes and

Bonds

SEC

US dollar denominated straight bonds ( A ) October 1, 2027

₩

93,820

₩

92,960

US dollar floating rate notes ( B ) August 28, 2010 98,511 -

Overseas subsidiaries

US dollar denominated fixed rate notes ( C ) April 1, 2027 23,455 23,240

US dollar denominated fixed rate notes ( C ) April 1, 2030 23,455 23,240

239,241 139,440

Discounts (6,113) (5,643)

233,128 133,797

Less: Current maturities (4,470) -

₩

228,658

₩

133,797

Reference Due Date 2007 2006

(In millions of Korean won)

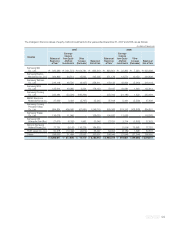

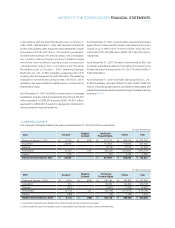

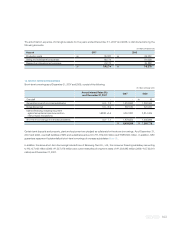

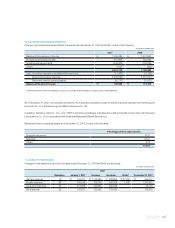

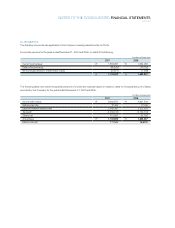

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

continued