Samsung 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

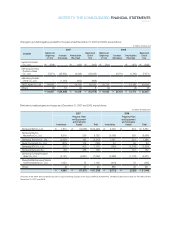

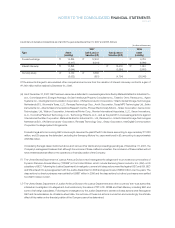

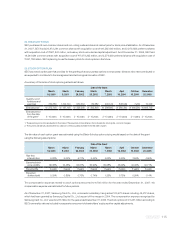

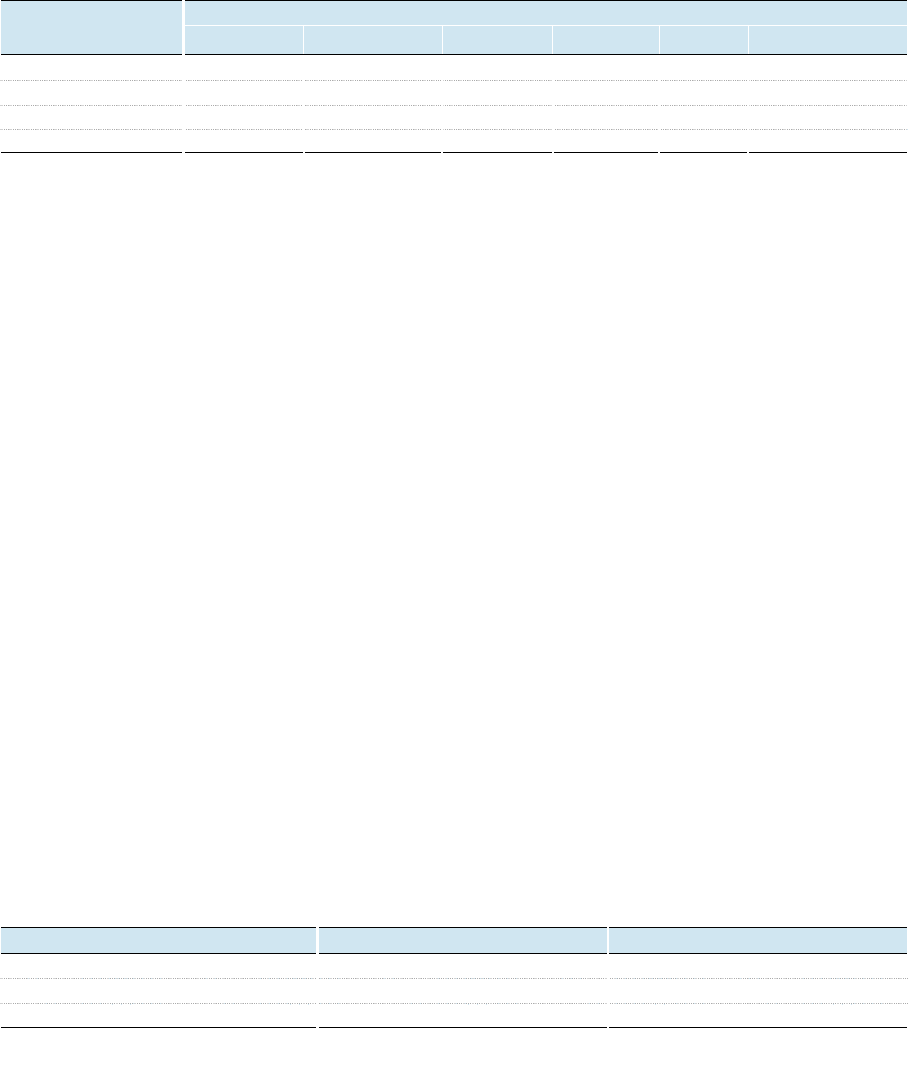

2006

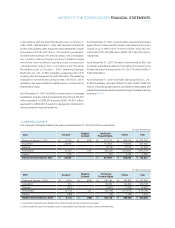

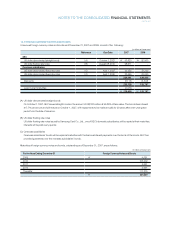

Reference January 1, 2006 Increase Decrease Others1 December 31, 2006

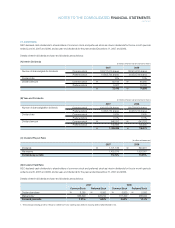

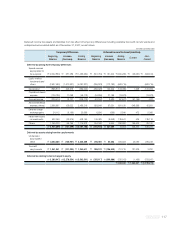

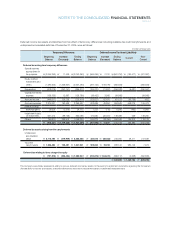

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

continued

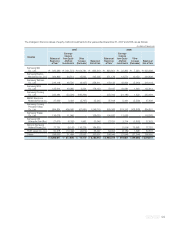

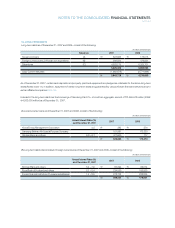

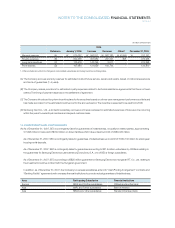

(A) The Company accrues warranty reserves for estimated costs of future service, repairs and recalls, based on historical experience

and terms of guarantees (1~4 years).

(B) The Company makes provisions for estimated royalty expenses related to technical assistance agreements that have not been

settled. The timing of payment depends on the settlement of agreement.

(C) The Company introduced long-term incentive plans for its executives based on a three-year management performance criteria and

has made a provision for the estimated incentive cost for the accrued period. The incentive is expected to be paid from 2008.

(D) Samsung Card Co., Ltd., a domestic subsidiary, accrues point reserves based on estimated expenses of future service occurring

within five years to reward loyal members and expand customer base.

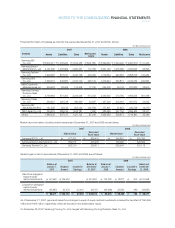

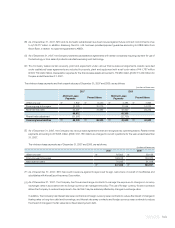

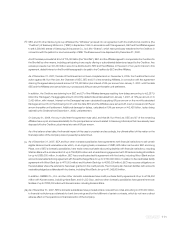

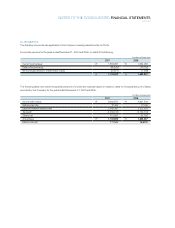

18. COMMITMENTS AND CONTINGENCIES

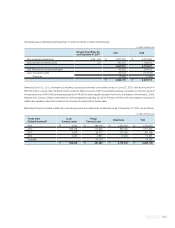

(A) As of December 31, 2007, SEC is contingently liable for guarantees of indebtedness, rincipally for related parties, approximating

₩7,693 million in loans and US$749 million on drawn facilities which have a maximum limit of US$3,020 million.

As of December 31, 2007, SEC is contingently liable for guarantees of indebtedness up to a limit of ₩250,132 million for employees’

housing rental deposits.

As of December 31, 2007, SEC is contingently liable for guarantees amounting to $21.6 million undertaken by Citi Bank relating to

the guarantees for Samsung Electronics Latinoamerica (Zona Libre), S.A., one of SEC’s foreign subsidiaries.

As of December 31, 2007, SEC is providing a US$25 million guarantee for Samsung Electronics Hungarian RT. Co., Ltd. relating to

the investment incentive contract with the Hungarian government.

In addition, as of December 31, 2007, the Company’s overseas subsidiaries enter into “Cash Pooling Arrangement” contracts and

“Banking Facility” agreements with overseas financial institutions to provide mutual guarantees of indebtedness.

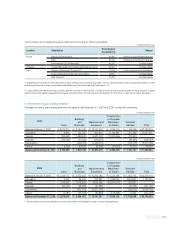

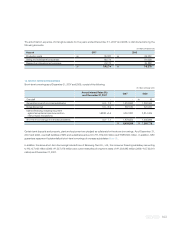

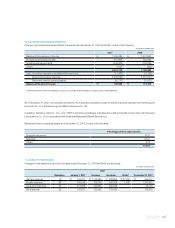

Europe SEUK and 18 other subsidiaries Citibank and another bank

Asia SAPL and 7 other subsidiaries Bank of America

Asia SEMA and 2 other subsidiaries Standard Chartered bank

Area Participating Subsidiaries Financial Institutions

(In millions of Korean won)

1. Others include amounts from changes in consolidated subsidiaries and foreign currency exchange rates.

Warranty reserves (A)

₩

579,362

₩

993,817

₩

862,783

₩

(6,599)

₩

703,797

Royalty expenses (B) 844,538 397,689 267,347 358 975,238

Long-term incentives (C) 133,579 143,796 3,017 - 274,358

Point reserves (D) 107,984 121,629 104,743 - 124,870