Samsung 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

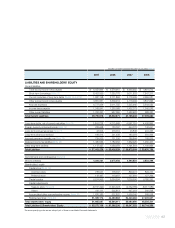

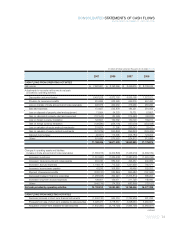

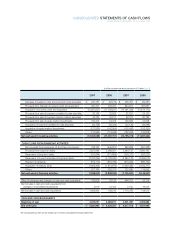

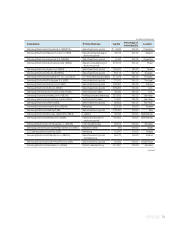

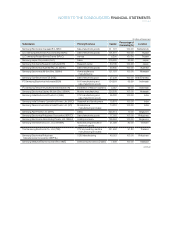

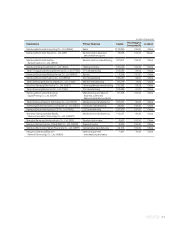

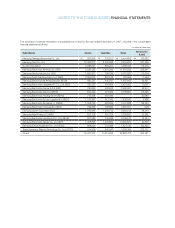

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2007 AND 2006

(In millions of Korean won and in thousands of U.S. dollars (Note 3))

continued

CASH FLOWS FROM OPERATING ACTIVITIES

Net income

₩

7,922,981

₩

8,193,659 $ 8,446,675 $ 8,735,244

Adjustments to reconcile net income to net cash

provided by operating activities

Depreciation and amortization 8,497,528 6,872,793 9,059,198 7,327,071

Provision for severance benefits 615,586 522,926 656,275 557,490

Loss on transfer of trade accounts and notes receivable 296,375 269,450 315,965 287,260

Bad debt expenses 172,827 545,878 184,251 581,959

Loss on disposal of property, plant and equipment 71,964 54,270 76,721 57,857

Gain on disposal of property, plant and equipment (107,542) (84,629) (114,650) (90,223)

Loss on foreign currency translation 122,597 159,382 130,700 169,917

Gain on foreign currency translation (128,580) (238,194) (137,079) (253,938)

Loss on valuation of equity-method investments 274,874 31,396 293,043 33,471

Gain on valuation of equity-method investments (372,239) (340,893) (396,843) (363,425)

Deferred income taxes (99,601) 115,565 (106,184) 123,204

Others 501,656 575,920 534,813 613,988

17,768,426 16,677,523 18,942,885 17,779,875

Changes in operating assets and liabilities

Increase in trade accounts and notes receivables (1,355,615) (2,409,893) (1,445,219) (2,569,182)

Increase in inventories (1,301,580) (1,336,430) (1,387,612) (1,424,765)

Increase in trade accounts and notes payable 464,720 882,643 495,437 940,984

Increase in accrued expenses 1,146,178 713,322 1,221,938 760,471

Increase in income taxes payable 43,576 308,838 46,456 329,252

Payment of severance benefits (338,137) (184,845) (360,487) (197,063)

Decrease(increase) in financing receivables (1,288,638) 364,223 (1,373,814) 388,297

Increase in long-term accrued expenses 198,601 139,471 211,728 148,690

Others (546,719) (74,253) (582,856) (79,161)

Net cash provided by operating activities 14,790,812 15,080,599 15,768,456 16,077,398

CASH FLOWS FROM INVESTING ACTIVITIES

Decrease (increase) in short-term financial instruments (1,646,130) 564,016 (1,754,936) 601,296

Proceeds from sale of short-term available-for-sale securities 3,028,477 3,718,317 3,228,654 3,964,091

Acquisition of short-term available-for-sale securities (1,842,360) (3,718,158) (1,964,136) (3,963,921)

2007 2006 2007 2006