Samsung 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INVESTOR INFORMATION

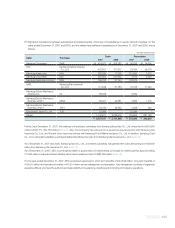

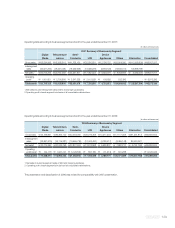

SHARES

Samsung Electronics shares are traded on the Korea Exchange

under code “005930” for common stock and “005935” for

preferred stock. As of December 31, 2007, there were

147,299,337 common and 22,833,427 preferred shares issued

and outstanding. All shares have a par value of KRW5,000.

Samsung global depository receipts are traded on the London

Stock Exchange under the “SMSN LI” ticker symbol for common

shares and “SMSD” symbol for preferred shares. Preferred GDRs

are also traded on the Luxemburg Stock Exchange under the

symbol “SAMDR.” A total of 24,284,064 GDRs are currently

outstanding, representing 12,142,032 common shares.

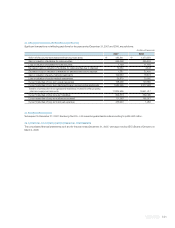

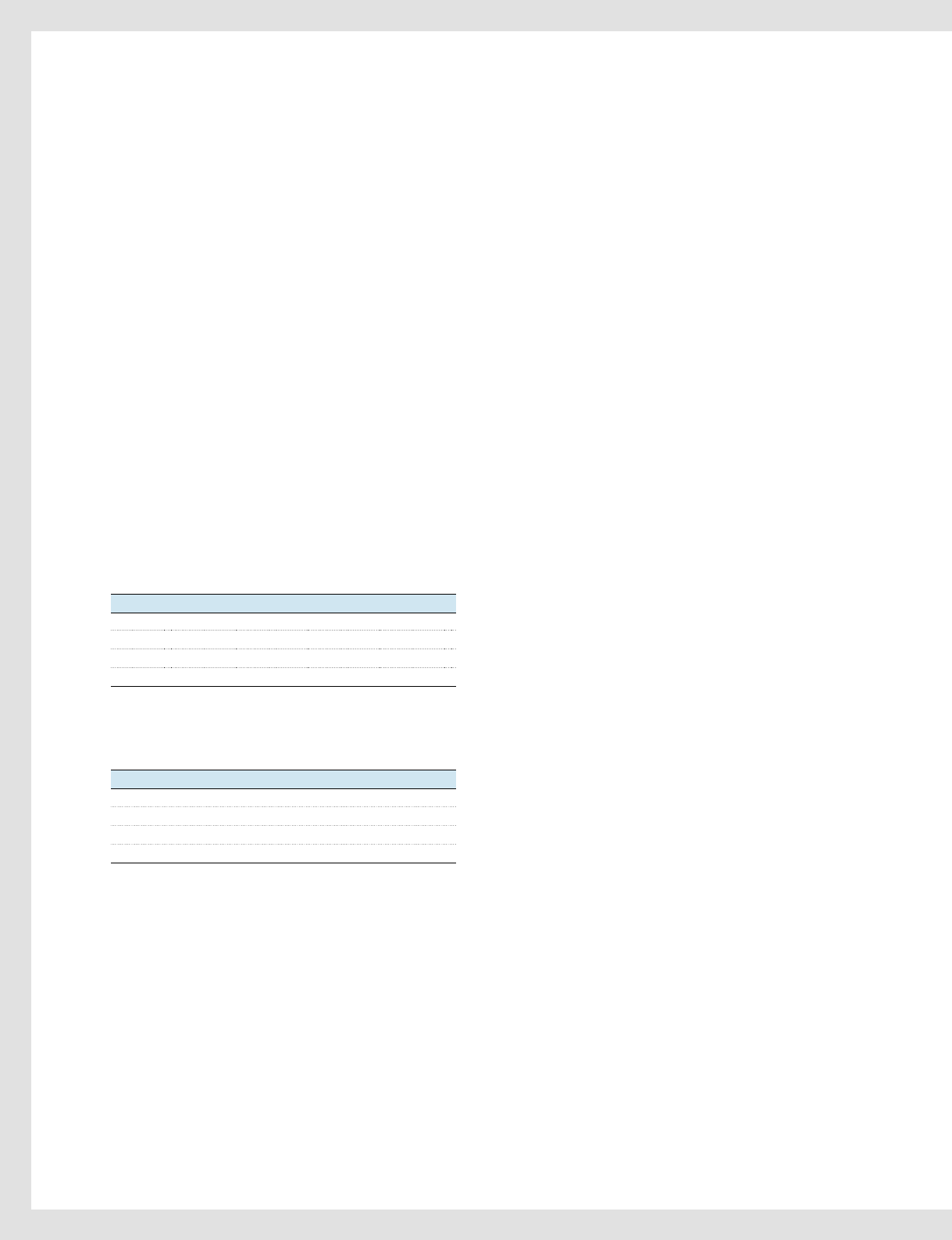

STOCK PERFORMANCE

Our fiscal year follows the calendar year, with quarters ending

March 31, June 30, September 30, and December 31.

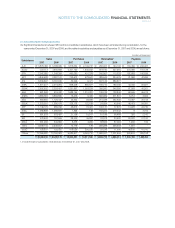

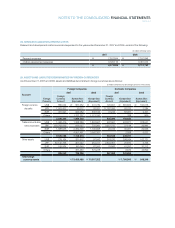

KOREA EXCHANGE

Share price in KRW

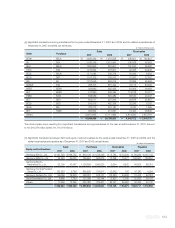

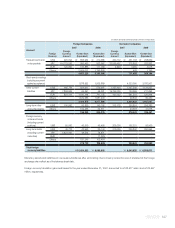

LONDON STOCK EXCHANGE

GDR price in USD

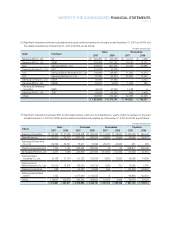

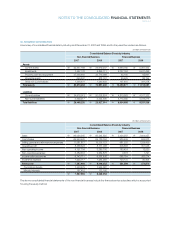

DIVIDENDS

In 2007, we declared a total dividend of KRW8,000 for each

common share and KRW8,050 for each preferred share, resulting

in a total payout of KRW1171.1 billion. We also invested

KRW1825.4 billion to repurchase 2,800,000 common shares and

400,000 preferred shares as part of our ongoing efforts to increase

shareholder value. The total payout ratio for the year was 40.4%.

GDR DEPOSITORY AGENT

For information regarding our global depository receipts, please

contact Citibank, N.A. DR Shareholder Services in the US at

877-248-4237, or e-mail your inquiry to citibank@shareholders-

online.com.

INDEPENDENT AUDITORS

Samil PricewaterhouseCoopers

Kukje Center Building, 21st Floor

191, Hangangno 2-ga, Yongsan-gu

Seoul 140-702, Korea

82-2-709-0800

IMPORTANT INVESTOR NOTE

This report may contain certain forward-looking statements that

reflect the current views and expectations of Samsung Electronics

with respect to its performance, businesses, and future events.

Please understand that these statements are subject to a number

of risks, uncertainties, and assumptions, any of which could

cause actual results to materially differ from the plans, objectives,

expectations, estimates, and intentions expressed in this annual

report. In no event will Samsung Electronics nor any of its

subsidiaries, affiliates, directors, officers, agents, or employees be

liable before any third party, including investors, for any investment

or business decision made or action taken based on information

and statements contained in this annual report or for any

consequential, special, or similar damages.

ADDITIONAL INFORMATION

The 2007 Samsung Electronics Annual Report and the latest

investor information are available online at www.samsung.com/ir.

You may also contact us at [email protected].

For information, please visit www.samsung.com.

Q1 625,000 562,000 563,000

Q2 604,000 532,000 566,000

Q3 687,000 534,000 575,000

Q4 614,000 507,000 556,000

Q1 336.75 292.25 304.25

Q2 320.50 284.50 309.50

Q3 372.00 288.50 313.75

Q4 334.00 272.50 292.75

2007 High Low Close

2007 High Low Close