Samsung 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

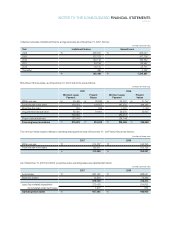

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

continued

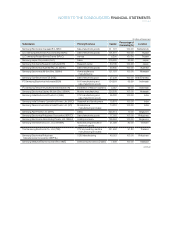

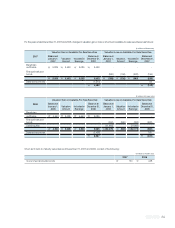

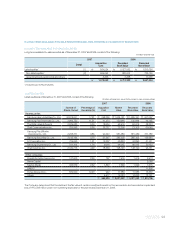

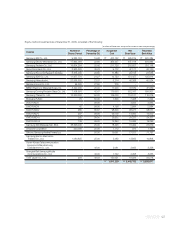

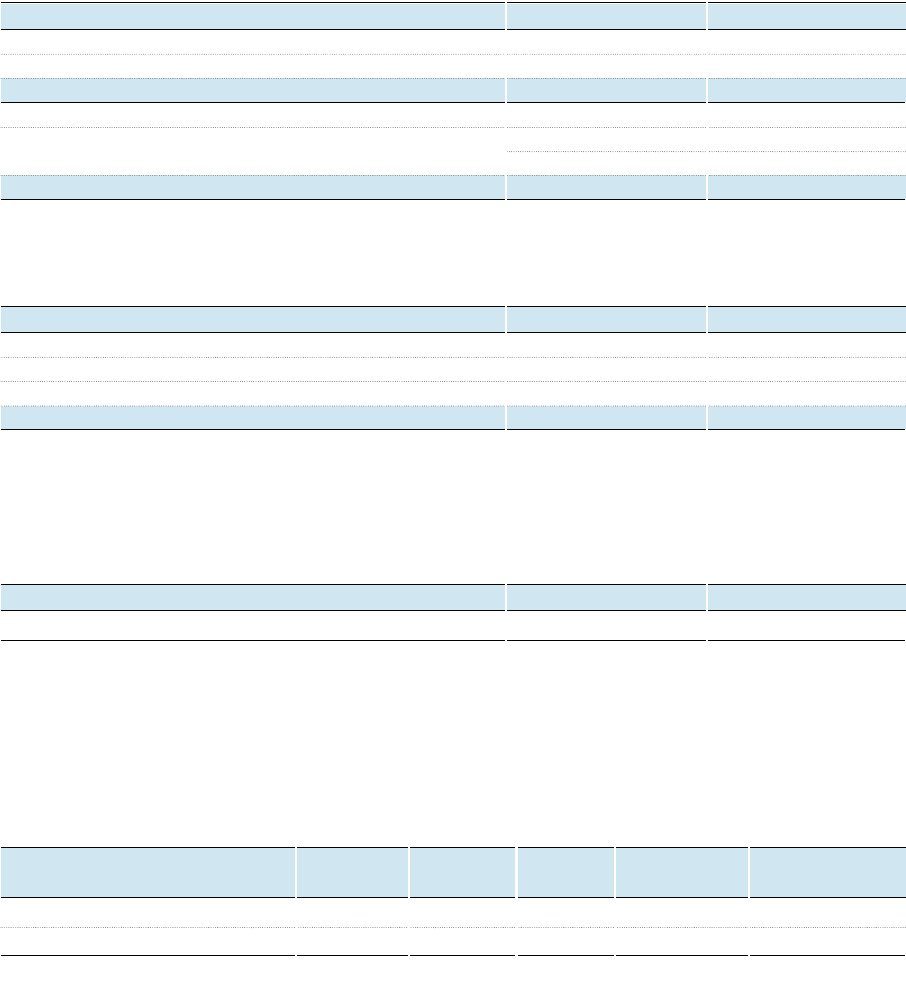

6. ACCOUNTS AND NOTES RECEIVABLE

Accounts and notes receivable, and their allowance for doubtful accounts as of December 31, 2007 and 2006, are as follows:

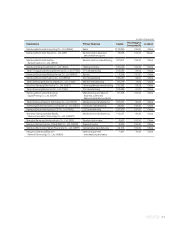

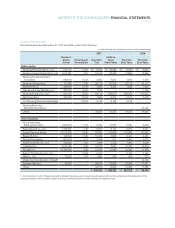

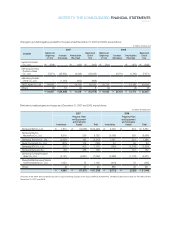

The outstanding balance of trade accounts and notes receivable sold to financial institutions as of December 31, 2007 and 2006, are as

follows:

As a consolidation entry to account for the sale of subsidiaries’ receivables, the Company has recognized borrowings of ₩4,384,783

million and ₩3,808,404 million as of December 31, 2007 and 2006, respectively.

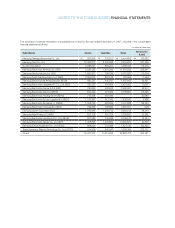

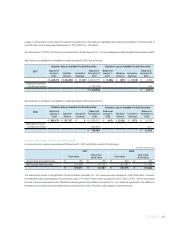

The outstanding balances of financing receivables sold to financial institutions as of December 31, 2007 and 2006, are as follows:

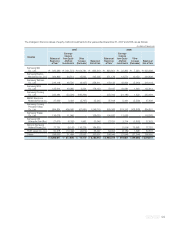

From 2003 to 2005, Samsung Card Co., Ltd. transferred credit card receivables and financial assets to SangRokSoo 1st Securitization

Specialty Co., Ltd., Badbank Harmony Co., Ltd. and Badbank Heemangmoah Securitization Specialty Co., Ltd. in accordance with the

“personal credit rehabilitation” program in exchange for cash, preferred stock and subordinated bonds. The preferred stock is recorded

as available-for-sale securities, while the subordinated bonds are recorded as held-to-maturity securities.

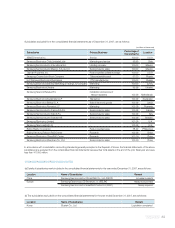

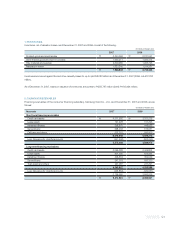

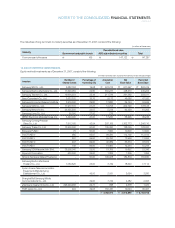

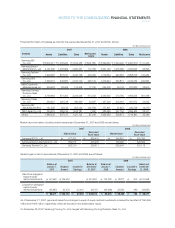

Accounts that are valued at present value under long-term installment transactions, including current portions, are as follows:

2007 2006

Asset-backed securities with limited recourse

₩

4,037,885

₩

4,002,923

(In millions of Korean won)

2007 2006

Trade accounts and notes receivable

₩

11,180,598

₩

9,133,647

Less: Allowance for doubtful accounts (55,466) (44,195)

₩

11,125,132

₩

9,089,452

Other accounts and notes receivable

₩

1,010,801

₩

987,634

Less: Allowance for doubtful accounts (21,600) (15,156)

Discounts on present value (58) (52)

₩

989,143

₩

972,426

(In millions of Korean won)

Accounts

Face Present Weighted-Average

Value Discount Value Period Interest Rate (%)

Long-term loans and other receivables

₩

220,439

₩

22,858

₩

197,581 2004. 5 ~ 2013. 1 3.1~8.0

Long-term payables and other payables 745,634 92,970 652,664 2002. 3 ~ 2015. 12 7.7~8.0

(In millions of Korean won)

2007 2006

Asset-backed securities with recourse

₩

1,396,041

₩

1,254,030

Trade accounts receivable with recourse 446,770 556,432

Trade accounts receivable without recourse 1,206,320 905,375

₩

3,049,131

₩

2,715,837

(In millions of Korean won)