Pizza Hut 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15MAR201511093851

Potential Payments Upon Termination or Change in

Control

The information below describes and quantifies certain executive and appreciation on these deferred amounts (see

compensation that would become payable under existing page 55 for discussion of investment alternatives available

plans and arrangements if the NEO’s employment had under the EID). In Mr. Novak’s case, over 80% of his

terminated on December 31, 2014, given the NEO’s balance is invested in Company RSUs, which he will receive

compensation and service levels as of such date and, if in the form of Company stock following his retirement. The

applicable, based on the Company’s closing stock price on other NEOs’ EID balances are invested primarily in RSUs.

that date. These benefits are in addition to benefits available Thus, Mr. Novak and the other NEOs’ EID account balances

generally to salaried employees, such as distributions under represent deferred bonuses (earned in prior years) and

the Company’s 401(k) Plan, retiree medical benefits, appreciation of their accounts based primarily on the

disability benefits and accrued vacation pay. performance of the Company’s stock.

Due to the number of factors that affect the nature and Leadership Retirement Plan. Under the LRP, participants

amount of any benefits provided upon the events discussed age 55 are entitled to a lump sum distribution of their

below, any actual amounts paid or distributed may be account balance following their termination of employment.

different. Factors that could affect these amounts include Participants under age 55 who terminate with more than five

the timing during the year of any such event, the Company’s years of service will receive their account balance at their

stock price and the executive’s age. 55th birthday. In case of termination of employment as of

December 31, 2014, Mr. Novak would have received

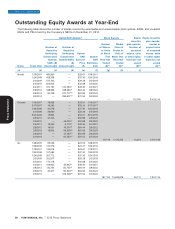

Stock Options and SAR Awards. If one or more NEOs $30,344,910. Mr. Grismer would receive $687,778 when he

terminated employment for any reason other than attains age 55 and Mr. Bergren would have received

retirement, death, disability or following a change in control $3,826,087.

as of December 31, 2014, they could exercise the stock

options and SARs that were exercisable on that date as Third Country National Plan. Under the TCN, participants

shown at the Outstanding Equity Awards at Year-End table age 55 or older are entitled to a lump sum distribution of

on page 50, otherwise all options and SARs, pursuant to their account balance in the quarter following their

their terms, would have been forfeited and cancelled after termination of employment. Participants under age 55 who

that date. If the NEO had retired, died or become disabled terminate will receive interest annually and their account

as of December 31, 2014, exercisable stock options and balance will be distributed in the quarter following their

SARs would remain exercisable through the term of the 55th birthday. In case of termination of employment as of

award. Except in the case of a change in control, no stock December 31, 2014, Mr. Creed would have received

options or SARs become exercisable on an accelerated $1,235,066.

basis. Benefits a NEO may receive on a change of control Performance Share Unit Awards. If one or more NEOs

are discussed below. terminated employment for any reason other than

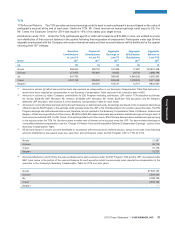

Executive Income Deferral Program. As described in retirement or death or following a change in control and prior

more detail beginning at page 55, the NEOs participate in to achievement of the performance criteria and vesting

the EID Program, which permits the deferral of salary and period, then the award would be cancelled and forfeited. If

annual incentive compensation. The last column of the the NEO had retired, or died as of December 31, 2014, the

Nonqualified Deferred Compensation Table on page 57 PSU award would be paid out based on actual performance

includes each NEO’s aggregate balance at December 31, for the performance period, subject to a pro rata reduction

2014. The NEOs are entitled to receive their vested amount reflecting the portion of the performance period not worked

under the EID Program in case of voluntary termination of by the NEO. If any of these terminations had occurred on

employment. In the case of involuntary termination of December 31, 2014, Messrs. Novak, Grismer, Su, Creed

employment, they are entitled to receive their vested benefit and Bergren would have been entitled to $2,212,622,

and the amount of the unvested benefit that corresponds to $234,374, $493,299, $313,610 and $260,138, respectively,

their deferral. In the case of death, disability or retirement assuming target performance.

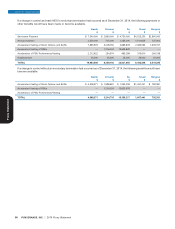

after age 65, they or their beneficiaries are entitled to their Pension Benefits. The Pension Benefits Table on page 53

entire account balance as shown in the last column of the describes the general terms of each pension plan in which

Nonqualified Deferred Compensation table on page 57. the NEOs participate, the years of credited service and the

In the case of an involuntary termination of employment as present value of the annuity payable to each NEO assuming

of December 31, 2014, each NEO would receive the termination of employment as of December 31, 2014. The

following: Mr. Novak $202,267,298; Mr. Grismer table on page 54 provides the present value of the lump sum

$2,201,021; Mr. Su $4,350,845; Mr. Creed $8,036,363; and benefit payable to each NEO when they attain eligibility for

Mr. Bergren $5,996,863. As discussed at page 57, these Early Retirement (i.e., age 55 with 10 years of service)

amounts reflect bonuses previously deferred by the under the plans.

58 YUM! BRANDS, INC. 2015 Proxy Statement

EXECUTIVE COMPENSATION

Proxy Statement