Pizza Hut 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

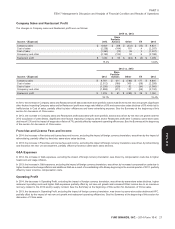

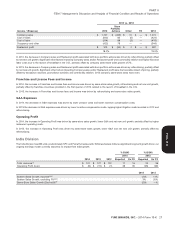

During the year ended December 27, 2014 we repurchased shares for rate for borrowings under the Credit Facility ranges from 1.0% to

$820 million. On November 22, 2013, our Board of Directors 1.75% over the ‘‘London Interbank Offered Rate’’ (‘‘LIBOR’’). The

authorized share repurchases through May 2015 of up to $750 million exact spread over LIBOR under the Credit Facility depends upon our

(excluding applicable transaction fees) of our outstanding Common performance against specified financial criteria. Interest on any

Stock. On November 20, 2014, our Board of Directors authorized outstanding borrowings under the Credit Facility is payable at least

additional share repurchases through May 31, 2016 of up to $1 billion quarterly.

(excluding applicable transaction fees) of our outstanding Common The Credit Facility is unconditionally guaranteed by our principal

Stock. At December 27, 2014, we had remaining capacity to domestic subsidiaries and contains financial covenants relating to

repurchase up to $1.1 billion of outstanding Common Stock (excluding maintenance of leverage and fixed-charge coverage ratios and also

applicable transaction fees) under these authorizations. Shares are contains affirmative and negative covenants including, among other

repurchased opportunistically as part of our regular capital structure things, limitations on certain additional indebtedness and liens, and

decisions. certain other transactions specified in the agreement. Given the

During the year ended December 27, 2014, we paid cash dividends of Company’s strong balance sheet and cash flows we were able to

$669 million. Additionally, on November 20, 2014 our Board of comply with all debt covenant requirements at December 27, 2014

Directors approved cash dividends of $0.41 per share of Common with a considerable amount of cushion. Additionally, the Credit Facility

Stock that were distributed on February 6, 2015 to shareholders of contains cross-default provisions whereby our failure to make any

record at the close of business on January 16, 2015. The Company payment on our indebtedness in a principal amount in excess of

targets an ongoing annual dividend payout ratio of 40% to 45% of net $125 million, or the acceleration of the maturity of any such

income. indebtedness, will constitute a default under such agreement.

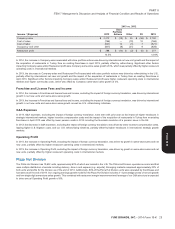

The majority of our remaining long-term debt primarily comprises

Senior Unsecured Notes with varying maturity dates from 2015

Borrowing Capacity through 2043 and stated interest rates ranging from 3.75% to 6.88%.

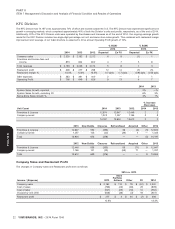

Our primary bank credit agreement comprises a $1.3 billion The notes represent senior, unsecured obligations and rank equally in

syndicated senior unsecured revolving credit facility (the ‘‘Credit right of payment with all of our existing and future unsecured

Facility’’) which matures in March 2017 and includes 24 participating unsubordinated indebtedness. Amounts outstanding under Senior

banks with commitments ranging from $23 million to $115 million. We Unsecured Notes were $2.8 billion at December 27, 2014. Our Senior

believe the syndication reduces our dependency on any one bank. Unsecured Notes provide that the acceleration of the maturity of any

of our indebtedness in a principal amount in excess of $50 million will

Under the terms of the Credit Facility, we may borrow up to the constitute a default under the Senior Unsecured Notes unless such

maximum borrowing limit, less outstanding letters of credit or banker’s indebtedness is discharged, or the acceleration of the maturity of that

acceptances, where applicable. At December 27, 2014, our unused indebtedness is annulled, within 30 days after notice.

Credit Facility totaled $824 million net of outstanding letters of credit of

$60 million and outstanding borrowings of $416 million. The interest

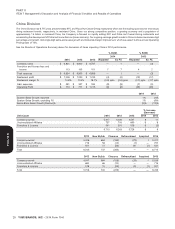

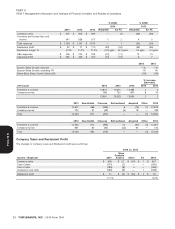

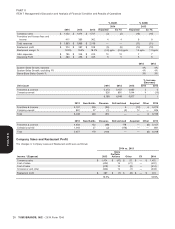

Contractual Obligations

Our significant contractual obligations and payments as of December 27, 2014 included:

More than 5

Total Less than 1 Year 1-3 Years 3-5 Years Years

Long-term debt obligations(a) $ 4,561 $ 395 $ 953 $ 754 $ 2,459

Capital leases(b) 282 20 41 40 181

Operating leases(b) 5,479 709 1,270 1,056 2,444

Purchase obligations(c) 781 587 103 69 22

Benefit plans(d) 179 38 38 34 69

Total contractual obligations $ 11,282 $ 1,749 $ 2,405 $ 1,953 $ 5,175

(a) Debt amounts include principal maturities and expected interest payments on a nominal basis. Debt amounts exclude a fair value adjustment of $7 million related

to interest rate swaps that hedge the fair value of a portion of our debt. See Note 10.

(b) These obligations, which are shown on a nominal basis, relate primarily to approximately 7,775 company-owned restaurants. See Note 11.

(c) Purchase obligations include agreements to purchase goods or services that are enforceable and legally binding on us and that specify all significant terms,

including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the transaction. We have

excluded agreements that are cancelable without penalty. Purchase obligations relate primarily to supply agreements, marketing, information technology,

purchases of property, plant and equipment (‘‘PP&E’’) as well as consulting, maintenance and other agreements.

(d) Includes actuarially determined timing of payments from our most significant unfunded pension plan as well as scheduled payments from our deferred

compensation plan. This table excludes $129 million of future benefit payments for deferred compensation and other unfunded benefit plans to be paid upon

separation of employee’s service or retirement from the company, as we cannot reasonably estimate the dates of these future cash payments.

We sponsor noncontributory defined benefit pension plans covering required to comply with the Pension Protection Act of 2006. However,

certain salaried and hourly employees, the most significant of which additional voluntary contributions are made from time to time to

are in the U.S. and UK. The most significant of the U.S. plans, the improve the Plan’s funded status. At December 27, 2014 the Plan was

YUM Retirement Plan (the ‘‘Plan’’), is funded while benefits from our in a net underfunded position of $191 million. The UK pension plans

other significant U.S. plan are paid by the Company as incurred (see were in a net overfunded position of $57 million at our 2014

footnote (d) above). Our funding policy for the Plan is to contribute measurement date.

annually amounts that will at least equal the minimum amounts

30 YUM! BRANDS, INC. - 2014 Form 10-K

Form 10-K