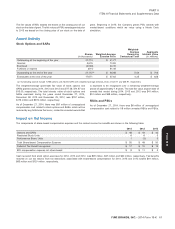

Pizza Hut 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

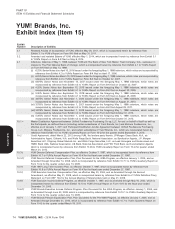

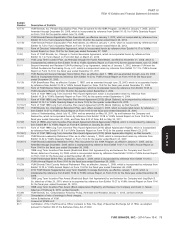

PART II

ITEM 8 Financial Statements and Supplementary Data

The Company believes it is reasonably possible its unrecognized tax The Company has settled audits with the IRS through fiscal year

benefits may decrease by approximately $5 million in the next 2008. Our operations in certain foreign jurisdictions remain subject to

12 months, including approximately $3 million which, if recognized examination for tax years as far back as 2004, some of which years

upon audit settlement or statute expiration, would affect the 2015 are currently under audit by local tax authorities. In addition, the

effective tax rate. Each of these positions is individually insignificant. Company is subject to various U.S. state income tax examinations, for

which, in the aggregate, we had significant unrecognized tax benefits

The Company’s income tax returns are subject to examination in the at December 27, 2014, each of which is individually insignificant.

U.S. federal jurisdiction and numerous foreign jurisdictions.

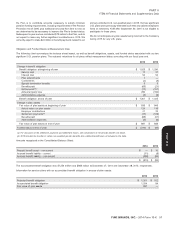

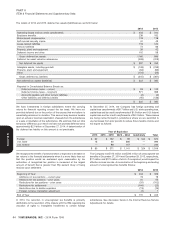

The accrued interest and penalties related to income taxes at December 27, 2014 and December 28, 2013 are set forth below:

2014 2013

Accrued interest and penalties $5 $64

During 2014, 2013 and 2012, a net expense of $11 million, net the Company received a RAR from the IRS for fiscal years 2007 and

expense of $18 million and net benefit of $3 million, respectively, for 2008 proposing a similar adjustment. The valuation issue impacted

interest and penalties was recognized in our Consolidated Statements tax returns for fiscal years 2004 through 2013.

of Income as components of its income tax provision. On July 31, 2014, the Company reached a final agreement with the

IRS Appeals Division regarding the valuation issue. As a result of this

agreement, we closed out our 2004 - 2006 and 2007 - 2008 audit

Internal Revenue Service Adjustments cycles and made cash payments to the IRS of $200 million, which

On June 23, 2010, the Company received a Revenue Agent Report were effectively fully reserved, to settle all issues for these audit

(‘‘RAR’’) from the Internal Revenue Service (the ‘‘IRS’’) relating to its cycles. The agreement also resolves the valuation issue for all later,

examination of our U.S. federal income tax returns for fiscal years impacted years. While additional cash payments related to the

2004 through 2006. The IRS proposed an adjustment to increase the valuation issue will be required upon the closure of the examinations

taxable value of rights to intangibles used outside the U.S. that YUM of fiscal years 2009 - 2013, the amounts will not be significant.

transferred to certain of its foreign subsidiaries. On January 9, 2013,

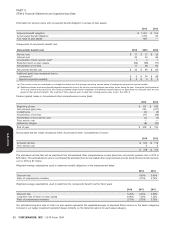

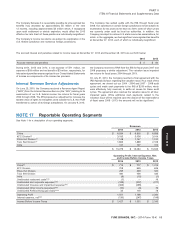

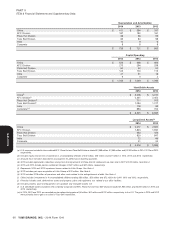

Reportable Operating Segments

See Note 1 for a description of our operating segments.

Revenues

2014 2013 2012

China $ 6,934 $ 6,905 $ 6,898

KFC Division(a) 3,193 3,036 3,014

Pizza Hut Division(a) 1,148 1,147 1,510

Taco Bell Division(a) 1,863 1,869 2,109

India 141 127 102

$ 13,279 $ 13,084 $ 13,633

Operating Profit; Interest Expense, Net;

and Income Before Income Taxes

2014 2013 2012

China(b) $ 713 $ 777 $ 1,015

KFC Division 708 649 626

Pizza Hut Division 295 339 320

Taco Bell Division 480 456 435

India (9) (15) (1)

Unallocated restaurant costs(c)(d) (1) — 16

Unallocated and corporate expenses(c)(e) (189) (207) (271)

Unallocated Closures and impairment expense(c)(f) (463) (295) —

Unallocated Other income (expense)(c)(g) (10) (6) 76

Unallocated Refranchising gain (loss)(c)(m) 33 100 78

Operating Profit 1,557 1,798 2,294

Interest expense, net(c)(h) (130) (247) (149)

Income Before Income Taxes $ 1,427 $ 1,551 $ 2,145

YUM! BRANDS, INC. - 2014 Form 10-K 65

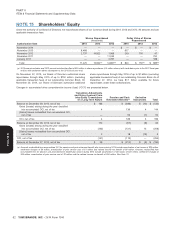

NOTE 17

13MAR201516053226

Form 10-K