Pizza Hut 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Long-Term Equity Performance-Based Incentives

.................................................................................................................................................................................................................................................................................................................................................................................

We provide performance-based long-term equity Performance Share Plan

compensation to our NEOs to encourage long-term Under the Company’s Performance Share Plan, the PSU

decision making that creates shareholder value. To that awards granted in 2014 are earned based on the Company’s

end, we use vehicles that motivate and balance the 3-year average total shareholder return (‘‘TSR’’) relative to the

tradeoffs between short-term and long-term performance. companies in the S&P 500. Incorporating TSR supports the

Performance-based long-term equity compensation also Company’s pay-for-performance philosophy while diversifying

serves as a retention tool. performance criteria and aligning our NEOs’ reward with the

Our NEOs are awarded long-term incentives annually creation of shareholder value. The threshold and maximum

based on the Committee’s subjective assessment of the are aggressively set, exceeding market best practice. The

following items for each NEO (without assigning weight to target, threshold and maximum shares that may be paid out

any particular item): under these awards for each NEO are described at page 48.

The target grant value for the CEO is 25% of his total long-term

Prior year individual and team performance incentive award value and for the other NEOs is 20% of their

Expected contribution in future years total long-term incentive award value.

Consideration of the market value of the executive’s role For the performance period covering 2014 – 2016 calendar

compared with similar roles in our Executive Peer Group years, each NEO will earn a percentage of his target PSU

award based on the achieved TSR percentile ranking as set

Achievement of stock ownership guidelines forth in the chart below:

Stock Appreciation Rights/Stock Options

TSR Percentile Ranking <40% 40% 50% 70% 90%

In general, our SARs/Options have ten-year terms and vest Payout as % of Target 0% 50% 100% 150% 200%

over at least four years. Each SAR/Option award was granted

with an exercise price based on the closing market price of the Dividend equivalents will accrue during the performance

underlying YUM common stock on the date of grant. period and will be distributed as incremental shares but only in

the same proportion and at the same time as the original

Each year, the Committee reviews the mix of long-term

awards are earned. If no awards are earned, no dividend

incentives to determine if it is appropriate to continue

equivalents will be paid. The awards are eligible for deferral

predominantly using SARs/Options as the long-term incentive

under the Company’s Executive Income Deferral Program. As

vehicle. The Committee continues to choose SARs/Options

discussed on page 30, PSU awards granted in 2011 did not

because they emphasize the Company’s focus on long-term

pay out since YUM did not attain the minimum performance

growth and they reward employees only if YUM’s stock price

threshold (these awards would have paid out during 2014 had

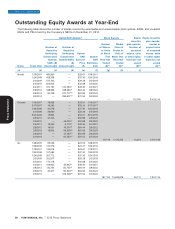

increases. For each NEO, the breakdown between SAR/

the Company’s average earnings per share during the

Option award values and PSU award values can be found

2011 – 2013 performance period reached the required

under the Summary Compensation Table, page 46 at

minimum average growth threshold of seven percent).

columns e and f.

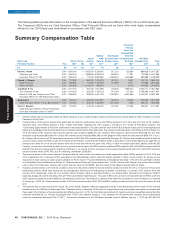

2014 Long-term Incentive Awards

Based on the Committee’s assessment as described above, the Committee set the following 2014 values for long-term incentive

awards, including SARs/Options and PSU awards, for each NEO:

Novak $7,150,000(1) Award brought his total direct compensation to our target philosophy

Grismer $1,825,000(1) Award brought his total direct compensation to our target philosophy

Su $2,350,000(1) Awarded at above target philosophy based on his sustained long-term results in role

Creed $1,675,000(1)(2) Awarded at above target philosophy based on his sustained long-term results in role

Bergren $1,450,000(1)(2) Awarded at above target philosophy based on his sustained long-term results in role

(1) 2014 grant values are rounded to the nearest $25,000 to reflect the Committee approved valuation figures.

(2) Mr. Creed and Mr. Bergren’s 2014 grant values exclude their 2014 Chairman’s Awards of $1,200,000 (rounded to the nearest $25,000 to

reflect the Committee-approved valuation figures). Mr. Creed received his award in February 2014 based on his superlative leadership in

helping Taco Bell achieve strong 2013 results and Mr. Bergren received his award in February 2014 in recognition of his multi-year

contributions to drive brand innovation across all divisions.

2015 Proxy Statement YUM! BRANDS, INC. 41

•

•

•

•

2014

NEO Grant Value Reason

EXECUTIVE COMPENSATION

Proxy Statement