Pizza Hut 2014 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

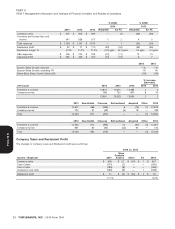

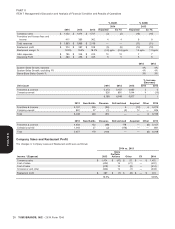

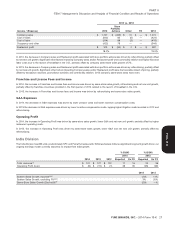

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

tax assets primarily relate to temporary differences in profitable U.S. is then measured at the largest amount of benefit that is greater than

federal, state and foreign jurisdictions, net operating losses in certain fifty percent likely of being realized upon settlement. At December 27,

foreign jurisdictions, the majority of which do not expire, and U.S. 2014 we had $115 million of unrecognized tax benefits, $17 million of

foreign tax credit carryovers that expire 10 years from inception and which, if recognized, would impact the effective tax rate. We evaluate

for which we anticipate having foreign earnings to utilize. In evaluating unrecognized tax benefits, including interest thereon, on a quarterly

our ability to recover our deferred tax assets, we consider future basis to ensure that they have been appropriately adjusted for events,

taxable income in the various jurisdictions as well as carryforward including audit settlements, which may impact our ultimate payment

periods and restrictions on usage. The estimation of future taxable for such exposures.

income in these jurisdictions and our resulting ability to utilize deferred Additionally, we have not provided deferred tax for investments in

tax assets can significantly change based on future events, including foreign subsidiaries where the carrying values for financial reporting

our determinations as to feasibility of certain tax planning strategies. exceed the tax basis, totaling approximately $2.0 billion at

Thus, recorded valuation allowances may be subject to material future December 27, 2014, as we believe the excess is essentially

changes. permanently invested. If our intentions regarding the duration of these

As a matter of course, we are regularly audited by federal, state and investments change, deferred tax may need to be provided on this

foreign tax authorities. We recognize the benefit of positions taken or excess that could materially impact the provision for income taxes.

expected to be taken in our tax returns in our Income Tax Provision See Note 16 for a further discussion of our income taxes.

when it is more likely than not that the position would be sustained

upon examination by these tax authorities. A recognized tax position

34 YUM! BRANDS, INC. - 2014 Form 10-K

Form 10-K