Pizza Hut 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

PART II

ITEM 8 Financial Statements and Supplementary Data

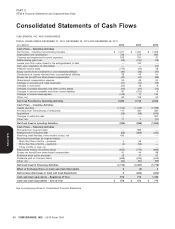

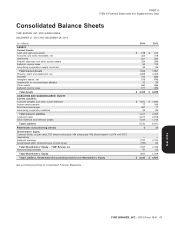

Consolidated Statements of Cash Flows

YUM! BRANDS, INC. AND SUBSIDIARIES

FISCAL YEARS ENDED DECEMBER 27, 2014, DECEMBER 28, 2013 AND DECEMBER 29, 2012

(in millions) 2014 2013 2012

Cash Flows – Operating Activities

Net Income – including noncontrolling interests $ 1,021 $ 1,064 $ 1,608

Depreciation and amortization 739 721 665

Closures and impairment (income) expenses 535 331 37

Refranchising (gain) loss (33) (100) (78)

Losses and other costs related to the extinguishment of debt — 120 —

Gain upon acquisition of Little Sheep — — (74)

Deferred income taxes (172) (24) 28

Equity income from investments in unconsolidated affiliates (30) (26) (47)

Distributions of income received from unconsolidated affiliates 28 43 41

Excess tax benefit from share-based compensation (42) (44) (98)

Share-based compensation expense 55 49 50

Changes in accounts and notes receivable (21) (12) (18)

Changes in inventories (22) 18 9

Changes in prepaid expenses and other current assets (10) (21) (14)

Changes in accounts payable and other current liabilities 60 (102) 9

Changes in income taxes payable (143) 14 126

Other, net 84 108 50

Net Cash Provided by Operating Activities 2,049 2,139 2,294

Cash Flows – Investing Activities

Capital spending (1,033) (1,049) (1,099)

Proceeds from refranchising of restaurants 114 260 364

Acquisitions (28) (99) (543)

Changes in restricted cash — — 300

Other, net 11 2 (27)

Net Cash Used in Investing Activities (936) (886) (1,005)

Cash Flows – Financing Activities

Proceeds from long-term debt — 599 —

Repayments of long-term debt (66) (666) (282)

Revolving credit facilities, three months or less, net 416 — —

Short-term borrowings, by original maturity

More than three months – proceeds 2 56 —

More than three months – payments (2) (56) —

Three months or less, net ———

Repurchase shares of Common Stock (820) (770) (965)

Excess tax benefit from share-based compensation 42 44 98

Employee stock option proceeds 29 37 62

Dividends paid on Common Stock (669) (615) (544)

Other, net (46) (80) (85)

Net Cash Used in Financing Activities (1,114) (1,451) (1,716)

Effect of Exchange Rates on Cash and Cash Equivalents 6 (5) 5

Net Increase (Decrease) in Cash and Cash Equivalents 5 (203) (422)

Cash and Cash equivalents – Beginning of Year 573 776 1,198

Cash and Cash Equivalents – End of Year $ 578 $ 573 $ 776

See accompanying Notes to Consolidated Financial Statements.

40 YUM! BRANDS, INC. - 2014 Form 10-K

Form 10-K