Pizza Hut 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

PART II

ITEM 8 Financial Statements and Supplementary Data

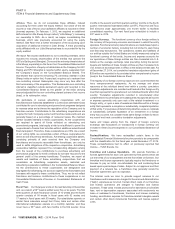

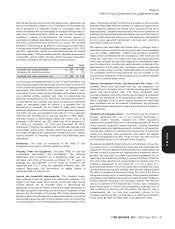

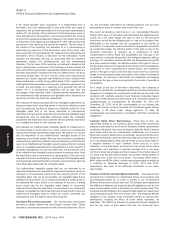

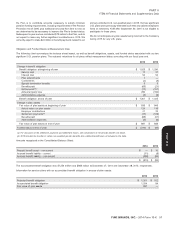

Franchise and License Fees and Income

2014 2013 2012

Initial fees, including renewal fees $ 83 $ 90 $ 92

Initial franchise fees included in Refranchising (gain) loss (5) (13) (24)

78 77 68

Continuing fees and rental income 1,877 1,823 1,732

Franchise and license fees and income $ 1,955 $ 1,900 $ 1,800

Other (Income) Expense

2014 2013 2012

Equity (income) loss from investments in unconsolidated affiliates $ (30) $ (26) $ (47)

Gain upon acquisition of Little Sheep(a) — — (74)

China poultry supply insurance recovery(b) (25) — —

Foreign exchange net (gain) loss and other 14 10 6

Other (income) expense $ (41) $ (16) $ (115)

(a) See Note 4.

(b) Recovery related to lost profits associated with a 2012 poultry supply incident.

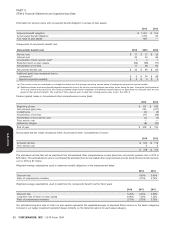

Supplemental Balance Sheet Information

Prepaid Expenses and Other Current Assets 2014 2013

Income tax receivable $55 $89

Assets held for sale(a) 14 16

Other prepaid expenses and current assets 185 181

Prepaid expenses and other current assets $ 254 $ 286

(a) Reflects restaurants we have offered for sale to franchisees and excess properties that we do not intend to use for restaurant operations in the future.

Property, Plant and Equipment 2014 2013

Land $ 506 $ 508

Buildings and improvements 4,549 4,393

Capital leases, primarily buildings 210 199

Machinery and equipment 2,817 2,750

Property, plant and equipment, gross 8,082 7,850

Accumulated depreciation and amortization (3,584) (3,391)

Property, plant and equipment, net $ 4,498 $ 4,459

Depreciation and amortization expense related to property, plant and equipment was $702 million, $686 million and $629 million in 2014, 2013

and 2012, respectively.

Accounts Payable and Other Current Liabilities 2014 2013

Accounts payable $ 694 $ 692

Accrued capital expenditures 250 235

Accrued compensation and benefits 419 442

Dividends payable 178 164

Accrued taxes, other than income taxes 100 93

Other current liabilities 331 303

Accounts payable and other current liabilities $ 1,972 $ 1,929

52 YUM! BRANDS, INC. - 2014 Form 10-K

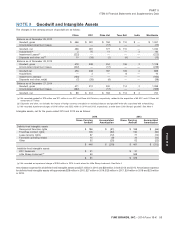

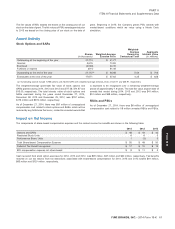

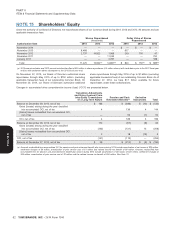

NOTE 6

NOTE 7

NOTE 8

Form 10-K