Pizza Hut 2014 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

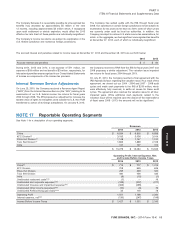

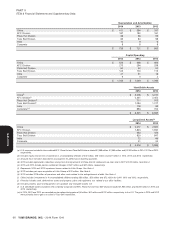

PART II

ITEM 8 Financial Statements and Supplementary Data

Expected benefits are estimated based on the same assumptions

Plan Assets used to measure our benefit obligation on the measurement date and

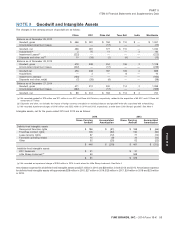

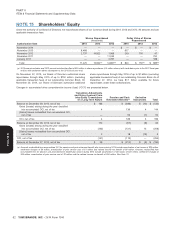

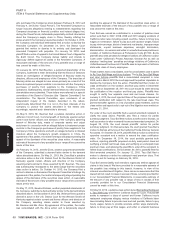

The fair values of our pension plan assets at December 27, 2014 and include benefits attributable to estimated future employee service.

December 28, 2013 by asset category and level within the fair value

hierarchy are as follows: International Pension Plans

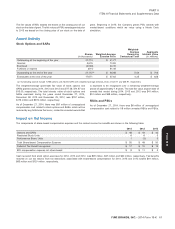

2014 2013 We also sponsor various defined benefit plans covering certain of our

Level 2: non-U.S. employees, the most significant of which are in the UK.

Cash Equivalents(a) $5$5 During 2013, one of our UK plans was frozen such that existing

Equity Securities – U.S. Large cap(b) 298 329 participants can no longer earn future service credits. Our other UK

Equity Securities – U.S. Mid cap(b) 50 55 plan was previously frozen to future service credits in 2011.

Equity Securities – U.S. Small cap(b) 50 53 At the end of 2014 and 2013, the projected benefit obligations of these

Equity Securities – Non-U.S.(b) 91 110 U.K. plans totaled $231 million and $226 million, respectively and plan

Fixed Income Securities – U.S. assets totaled $288 million and $259 million, respectively. These

Corporate(b) 305 234 plans were both in a net overfunded position at the end of 2014 and

Fixed Income Securities – U.S. 2013 and related expense amounts recorded in each of 2014, 2013

Government and Government and 2012 were not significant.

Agencies(c) 178 129

Fixed Income Securities – Other(d) 11 15 The funding rules for our pension plans outside of the U.S. vary from

country to country and depend on many factors including discount

Total fair value of plan assets(e) $ 988 $ 930

rates, performance of plan assets, local laws and regulations. We do

(a) Short-term investments in money market funds not plan to make significant contributions to either of our UK plans in

(b) Securities held in common trusts 2015.

(c) Investments held directly by the Plan

(d) Includes securities held in common trusts and investments held directly by Retiree Medical Benefits

the Plan

(e) 2014 and 2013 both exclude net unsettled trades receivable of $3 million Our post-retirement plan provides health care benefits, principally to

U.S. salaried retirees and their dependents, and includes retiree

Our primary objectives regarding the investment strategy for the cost-sharing provisions. This plan was previously amended such that

Plan’s assets are to reduce interest rate and market risk and to any salaried employee hired or rehired by YUM after September 30,

provide adequate liquidity to meet immediate and future payment 2001 is not eligible to participate in this plan. Employees hired prior to

requirements. To achieve these objectives, we are using a September 30, 2001 are eligible for benefits if they meet age and

combination of active and passive investment strategies. Our equity service requirements and qualify for retirement benefits. We fund our

securities, currently targeted to be 50% of our investment mix, consist post-retirement plan as benefits are paid.

primarily of low-cost index funds focused on achieving long-term

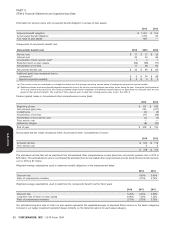

capital appreciation. We diversify our equity risk by investing in At the end of 2014 and 2013, the accumulated post-retirement benefit

several different U.S. and foreign market index funds. Investing in obligation was $69 million and $70 million, respectively. An actuarial

these index funds provides us with the adequate liquidity required to gain of $2 million was recognized in Accumulated other

fund benefit payments and plan expenses. The fixed income asset comprehensive (income) loss at the end of both 2014 and 2013. The

allocation, currently targeted to be 50% of our mix, is actively net periodic benefit cost recorded was $5 million in both 2014 and

managed and consists of long-duration fixed income securities that 2013 and $6 million in 2012, the majority of which is interest cost on

help to reduce exposure to interest rate variation and to better the accumulated post-retirement benefit obligation. The weighted-

correlate asset maturities with obligations. The fair values of all average assumptions used to determine benefit obligations and net

pension plan assets are determined based on closing market prices or periodic benefit cost for the post-retirement medical plan are identical

net asset values. to those as shown for the U.S. pension plans. Our assumed heath

care cost trend rates for the following year as of 2014 and 2013 are

A mutual fund held as an investment by the Plan includes shares of 7.1% and 7.2%, respectively, with expected ultimate trend rates of

YUM common stock valued at $0.5 million at December 27, 2014 and 4.5% reached in 2028.

$0.2 million at December 28, 2013 (less than 1% of total plan assets in

each instance). There is a cap on our medical liability for certain retirees. The cap for

Medicare-eligible retirees was reached in 2000 and the cap for

non-Medicare eligible retirees was reached in 2014; with the cap, our

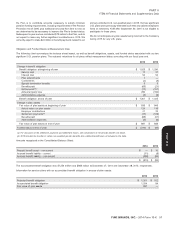

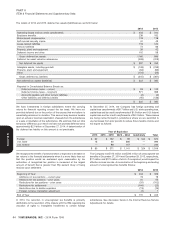

Benefit Payments

annual cost per retiree will not increase. A one-percentage-point

The benefits expected to be paid in each of the next five years and in increase or decrease in assumed health care cost trend rates would

the aggregate for the five years thereafter are set forth below: have less than a $1 million impact on total service and interest cost

and on the post-retirement benefit obligation. The benefits expected to

Year ended: be paid in each of the next five years are approximately $6 million and

in aggregate for the five years thereafter are $24 million.

2015 $ 72

2016 53

2017 51 Retiree Savings Plan

2018 55

2019 57 We sponsor a contributory plan to provide retirement benefits under

2020 – 2024 299 the provisions of Section 401(k) of the Internal Revenue Code (the

‘‘401(k) Plan’’) for eligible U.S. salaried and hourly employees.

Participants are able to elect to contribute up to 75% of eligible

YUM! BRANDS, INC. - 2014 Form 10-K 59

13MAR201516053226

Form 10-K