Pizza Hut 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

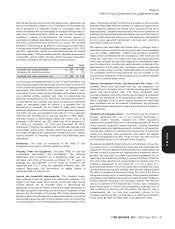

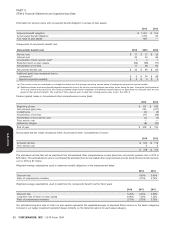

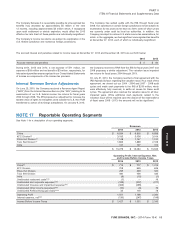

The annual maturities of short-term borrowings and long-term debt as of December 27, 2014, excluding capital lease obligations of $175 million

and fair value hedge accounting adjustments of $7 million, are as follows:

Year ended:

2015 $ 250

2016 300

2017 416

2018 325

2019 250

Thereafter 1,625

Total $ 3,166

Interest expense on short-term borrowings and long-term debt was $152 million, $270 million and $169 million in 2014, 2013 and 2012,

respectively. 2013 included $118 million in losses recorded in Interest expense, net as a result of premiums paid and other costs related to the

extinguishment of debt. See Losses Related to the Extinguishment of Debt section of Note 4 for further discussion.

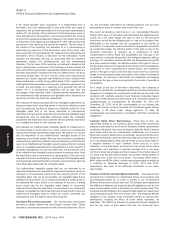

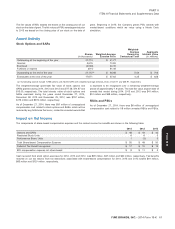

Leases

At December 27, 2014 we operated nearly 8,700 restaurants, leasing We also lease office space for headquarters and support functions, as

the underlying land and/or building in approximately 7,775 of those well as certain office and restaurant equipment. We do not consider

restaurants with the vast majority of our commitments expiring within any of these individual leases material to our operations. Most leases

20 years from the inception of the lease. In addition, the Company require us to pay related executory costs, which include property

leases or subleases approximately 875 units to franchisees, taxes, maintenance and insurance.

principally in the U.S., UK, China and Mexico.

Future minimum commitments and amounts to be received as lessor or sublessor under non-cancelable leases are set forth below:

Commitments Lease Receivables

Capital Operating Direct Financing Operating

2015 $20 $ 709 $2 $56

2016 21 661 2 52

2017 20 609 2 47

2018 20 555 2 44

2019 20 501 1 38

Thereafter 181 2,444 4 116

$ 282 $ 5,479 $ 13 $ 353

At December 27, 2014 and December 28, 2013, the present value of minimum payments under capital leases was $175 million and $172 million,

respectively. At December 27, 2014, unearned income associated with direct financing lease receivables was $3 million.

The details of rental expense and income are set forth below:

2014 2013 2012

Rental expense

Minimum $ 766 $ 759 $ 721

Contingent 302 293 290

$ 1,068 $ 1,052 $ 1,011

Rental income $ 103 $ 94 $ 77

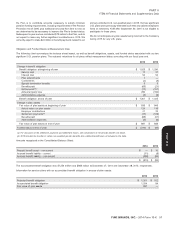

Fair Value Disclosures

As of December 27, 2014 the carrying values of cash and cash receivable net of allowances and lease guarantees less subsequent

equivalents, short-term investments, accounts receivable and amortization approximates their carrying value. The Company’s debt

accounts payable approximated their fair values because of the obligations, excluding capital leases, were estimated to have a fair

short-term nature of these instruments. The fair value of notes value of $3.4 billion (Level 2), compared to their carrying value of

YUM! BRANDS, INC. - 2014 Form 10-K 55

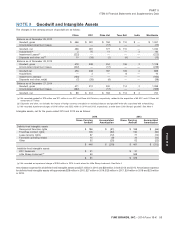

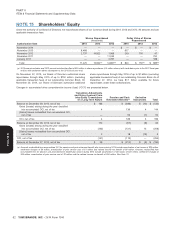

NOTE 11

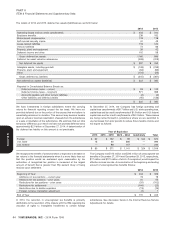

NOTE 12

13MAR201516053226

Form 10-K