Pizza Hut 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

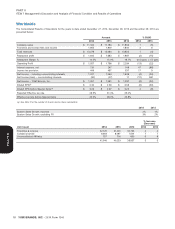

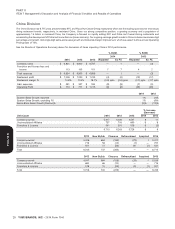

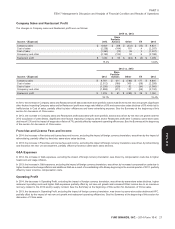

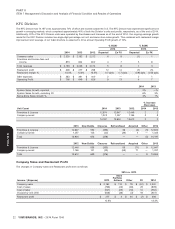

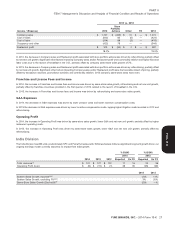

% Increase

(Decrease)

Unit Count 2014 2013 2012 2014 2013

Franchise & License 623 514 442 21 16

Company-owned 210 191 120 10 59

833 705 562 18 25

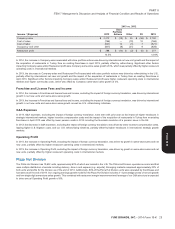

2013 New Builds Closures Refranchised Acquired 2014

Franchise & License 514 110 (21) 20 — 623

Company-owned 191 46 (7) (20) — 210

Total 705 156 (28) — — 833

2012 New Builds Closures Refranchised Acquired 2013

Franchise & License 442 89 (11) — (6) 514

Company-owned 120 68 (3) — 6 191

Total 562 157 (14) — — 705

(a) Effective the beginning of 2014, results from our 28 Mauritius stores are included in KFC and Pizza Hut Divisions as applicable. Prior year units have been

adjusted for comparability while division System Sales Growth, Total Revenues and Operating Profit (loss) have not been restated due to the immaterial dollar

impact of this change. While there was no impact to our consolidated results, this change negatively impacted India’s 2014 System Sales Growth, reported and

excluding FX, by 10% and 11%, respectively. This change negatively impacted India’s 2014 Total revenues by 2% and Operating Profit (loss) by $1 million.

(b) At the beginning of fiscal 2013, we eliminated the period lag that was previously used to facilitate the reporting of our India Division’s results. Accordingly, the India

Division’s 2013 results include the months of January through December 2013. Due to the immateriality of the India Division’s results we did not restate the prior

year’s operating results for the elimination of this period lag. Therefore, the 2012 results continue to include the months of December 2011 through November

2012. Additionally, the table above compares these months. If we had compared like months in 2013 to 2012, India Division system sales, excluding the impact of

foreign currency translation, would have been 2% higher and same-store sales would have been 1% lower versus what is shown above, respectively, for the year

ended December 28, 2013.

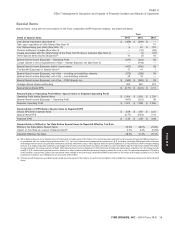

Corporate & Unallocated

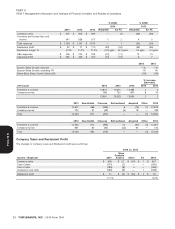

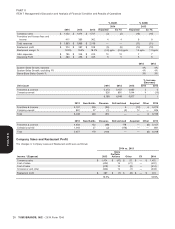

% B/(W)

Income / (Expense) 2014 2013 2012 2014 2013

Corporate G&A $ (189) $ (207) $ (271) 9 24

Unallocated closures and impairments (463) (295) $ — (57) NM

Unallocated Refranchising gain (loss) 33 100 78 (67) 29

Other unallocated (22) (6) 92 (78) NM

Interest expense, net (130) (247) (149) 47 (66)

Income tax provision (406) (487) (537) 17 9

Effective tax rate 28.5% 31.4% 25.0% 2.9 ppts. (6.4) ppts.

Corporate G&A

In 2014, the decrease in Corporate G&A was driven by lower pension costs, including lapping higher pension settlement charges, partially offset

by higher legal and professional fees.

In 2013, the decrease in Corporate G&A was driven by lower pension costs, including lapping higher pension settlement charges, and lower

incentive compensation costs, partially offset by higher legal and professional fees.

Unallocated Closures and Impairments

In 2014 and 2013, Unallocated closures and impairments represent Little Sheep impairment charges. See Note 4.

Unallocated Refranchising Gain (Loss)

Unallocated Refranchising gain (loss) in 2014, 2013 and 2012 is discussed in Note 4.

Other Unallocated

In 2014, Other unallocated includes higher foreign exchange losses.

In 2012, Other unallocated includes a non-cash gain of $74 million related to our acquisition of Little Sheep in 2012.

28 YUM! BRANDS, INC. - 2014 Form 10-K

Form 10-K