Pizza Hut 2014 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

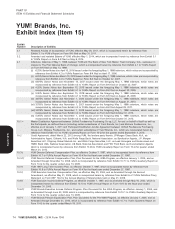

PART IV

ITEM 15 Exhibits and Financial Statement Schedules

Exhibit

Number Description of Exhibits

10.7.1† YUM! Brands, Inc. Pension Equalization Plan, Plan Document for the 409A Program, as effective January 1, 2005, and as

Amended through December 30, 2008, which is incorporated by reference from Exhibit 10.13.1 to YUM’s Quarterly Report

on Form 10-Q for the quarter ended June 13, 2009.

10.7.2† YUM! Brands Pension Equalization Plan Amendment, as effective January 1, 2012, which is incorporated by reference from

Exhibit 10.7.2 to Yum’s Quarterly Report on Form 10-Q for the quarter ended March 23, 2013.

10.7.3† YUM! Brands Pension Equalization Plan Amendment, as effective January 1, 2013, which is incorporated by reference from

Exhibit 10.7.3 to Yum’s Quarterly Report on Form 10-Q for the quarter ended March 23, 2013.

10.8† Form of Directors’ Indemnification Agreement, which is incorporated herein by reference from Exhibit 10.17 to YUM’s

Annual Report on Form 10-K for the fiscal year ended December 27, 1997.

10.9† Form of YUM! Brands, Inc. Change in Control Severance Agreement, which is incorporated herein by reference from

Exhibit 10.1 to Yum’s Report on Form 8-K filed on March 21, 2013.

10.10† YUM Long Term Incentive Plan, as Amended through the Fourth Amendment, as effective November 21, 2008, which is

incorporated by reference from Exhibit 10.18 to YUM’s Quarterly Report on Form 10-Q for the quarter ended June 13, 2009.

10.11 Second Amended and Restated YUM Purchasing Co-op Agreement, dated as of January 1, 2012, between YUM and the

Unified Foodservice Purchasing Co-op, LLC, which is incorporated herein by reference from Exhibit 10.11 to YUM’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2011.

10.12† YUM Restaurant General Manager Stock Option Plan, as effective April 1, 1999, and as amended through June 23, 2003,

which is incorporated herein by reference from Exhibit 10.22 to YUM’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2005.

10.13† YUM SharePower Plan, as effective October 7, 1997, and as amended through June 23, 2003, which is incorporated herein

by reference from Exhibit 10.23 to YUM’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

10.14† Form of YUM Director Stock Option Award Agreement, which is incorporated herein by reference from Exhibit 10.25 to

YUM’s Quarterly Report on Form 10-Q for the quarter ended September 4, 2004.

10.15† Form of YUM 1999 Long Term Incentive Plan Award Agreement, which is incorporated herein by reference from

Exhibit 10.26 to YUM’s Quarterly Report on Form 10-Q for the quarter ended September 4, 2004.

10.15.1† Form of YUM 1999 Long Term Incentive Plan Award Agreement (2013) (Stock Options), as incorporated by reference from

Exhibit 10.15.1 to YUM’s Quarterly Report on Form 10-Q for the quarter ended March 23, 2013.

10.15.2† Form of YUM 1999 Long Term Incentive Plan Award Agreement (2015) (Stock Options), as filed herewith.

10.16† YUM! Brands, Inc. International Retirement Plan, as in effect January 1, 2005, which is incorporated herein by reference

from Exhibit 10.27 to YUM’s Annual Report on Form 10-K for the fiscal year ended December 25, 2004.

10.17† Letter of Understanding, dated July 13, 2004, and as amended on May 18, 2011, by and between the Company and

Samuel Su, which is incorporated herein by reference from Exhibit 10.28 to YUM’s Annual Report on Form 10-K for the

fiscal year ended December 25, 2004, and from Item 5.02 of Form 8-K on May 24, 2011.

10.18† Form of 1999 Long Term Incentive Plan Award Agreement (Stock Appreciation Rights) which is incorporated by reference

from Exhibit 99.1 to YUM’s Report on Form 8-K as filed on January 30, 2006.

10.18.1† Form of YUM 1999 Long Term Incentive Plan Award Agreement (2013) (Stock Appreciation Rights), which is incorporated

by reference from Exhibit 10.18.1 to YUM’s Quarterly Report on Form 10-Q for the quarter ended March 23, 2013.

10.18.2† Form of YUM 1999 Long Term Incentive Plan Award Agreement (2015) (Stock Appreciation Rights), as filed herewith.

10.20† YUM! Brands Leadership Retirement Plan, as in effect January 1, 2005, which is incorporated herein by reference from

Exhibit 10.32 to YUM’s Quarterly Report on Form 10-Q for the quarter ended March 24, 2007.

10.20.1† YUM! Brands Leadership Retirement Plan, Plan Document for the 409A Program, as effective January 1, 2005, and as

Amended through December, 2009, which is incorporated by reference from Exhibit 10.21.1 to YUM’s Annual Report on

Form 10-K for the fiscal year ended December 26, 2009.

10.21† 1999 Long Term Incentive Plan Award (Restricted Stock Unit Agreement) by and between the Company and David C.

Novak, dated as of January 24, 2008, which is incorporated herein by reference from Exhibit 10.33 to YUM’s Annual Report

on Form 10-K for the fiscal year ended December 29, 2007.

10.22† YUM! Performance Share Plan, as effective January 1, 2009, which is incorporated by reference from Exhibit 10.24 to

YUM’s Annual Report on Form 10-K for the fiscal year ended December 26, 2009.

10.23† YUM! Brands Third Country National Retirement Plan, as effective January 1, 2009, which is incorporated by reference from

Exhibit 10.25 to YUM’s Annual Report on Form 10-K for the fiscal year ended December 26, 2009.

10.24† 2010 YUM! Brands Supplemental Long Term Disability Coverage Summary, as effective January 1, 2010, which is

incorporated by reference from Exhibit 10.26 to YUM’s Annual Report on Form 10-K for the fiscal year ended December 26,

2009.

10.25† 1999 Long Term Incentive Plan Award (Restricted Stock Unit Agreement) by and between the Company and Jing-Shyh S.

Su, dated as of May 20, 2010, which is incorporated by reference from Exhibit 10.27 to YUM’s Annual Report on Form 10-K

for the fiscal year ended December 25, 2010.

10.27† 1999 Long Term Incentive Plan Award (Stock Appreciation Rights) by and between the Company and David C. Novak,

dated as of February 6, 2015, as filed herewith.

10.28† YUM! Brands, Inc. Compensation Recovery Policy, Amended and Restated January 1, 2015, as filed herewith.

12.1 Computation of ratio of earnings to fixed charges.

21.1 Active Subsidiaries of YUM.

23.1 Consent of KPMG LLP.

31.1 Certification of the Chief Executive Officer pursuant to Rule 13a-14(a) of Securities Exchange Act of 1934, as adopted

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

YUM! BRANDS, INC. - 2014 Form 10-K 75

13MAR201516053226

Form 10-K