Pizza Hut 2014 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

PART II

ITEM 8 Financial Statements and Supplementary Data

compensation on a pre-tax basis. Participants may allocate their compensation. We recognized as compensation expense our total

contributions to one or any combination of multiple investment options matching contribution of $12 million in both 2014 and 2013 and

or a self-managed account within the 401(k) Plan. We match 100% of $13 million in 2012.

the participant’s contribution to the 401(k) Plan up to 6% of eligible

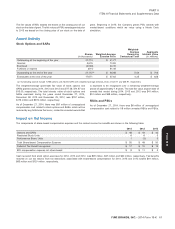

Share-based and Deferred Compensation Plans

Our Executive Income Deferral (‘‘EID’’) Plan allows participants to

Overview defer receipt of a portion of their annual salary and all or a portion of

At year end 2014, we had four stock award plans in effect: the YUM! their incentive compensation. As defined by the EID Plan, we credit

Brands, Inc. Long-Term Incentive Plan and the 1997 Long-Term the amounts deferred with earnings based on the investment options

Incentive Plan (collectively the ‘‘LTIPs’’), the YUM! Brands, Inc. selected by the participants. These investment options are limited to

Restaurant General Manager Stock Option Plan (‘‘RGM Plan’’) and cash, phantom shares of our Common Stock, phantom shares of a

the YUM! Brands, Inc. SharePower Plan (‘‘SharePower’’). Under all Stock Index Fund and phantom shares of a Bond Index Fund.

our plans, the exercise price of stock options and SARs granted must Investments in cash and phantom shares of both index funds will be

be equal to or greater than the average market price or the ending distributed in cash at a date as elected by the employee and therefore

market price of the Company’s stock on the date of grant. are classified as a liability on our Consolidated Balance Sheets. We

recognize compensation expense for the appreciation or the

Potential awards to employees and non-employee directors under the depreciation, if any, of investments in cash and both of the index

LTIPs include stock options, incentive stock options, SARs, restricted funds. Deferrals into the phantom shares of our Common Stock will be

stock, stock units, restricted stock units (‘‘RSUs’’), performance distributed in shares of our Common Stock, under the LTIPs, at a date

restricted stock units, performance share units (‘‘PSUs’’) and as elected by the employee and therefore are classified in Common

performance units. We have issued only stock options, SARs, RSUs Stock on our Consolidated Balance Sheets. We do not recognize

and PSUs under the LTIPs. While awards under the LTIPs can have compensation expense for the appreciation or the depreciation, if any,

varying vesting provisions and exercise periods, outstanding awards of investments in phantom shares of our Common Stock. Our EID plan

under the LTIPs vest in periods ranging from immediate to five years. also allows participants to defer incentive compensation to purchase

Stock options and SARs expire ten years after grant. phantom shares of our Common Stock and receive a 33% Company

match on the amount deferred. Deferrals receiving a match are similar

Potential awards to employees under the RGM Plan include stock

to a RSU award in that participants will generally forfeit both the match

options, SARs, restricted stock and RSUs. We have issued only stock

and incentive compensation amounts deferred if they voluntarily

options and SARs under this plan. RGM Plan awards granted have a

separate from employment during a vesting period that is two years

four-year cliff vesting period and expire ten years after grant. Certain

from the date of deferral. We expense the intrinsic value of the match

RGM Plan awards are granted upon attainment of performance

and the incentive compensation over the requisite service period

conditions in the previous year. Expense for such awards is

which includes the vesting period.

recognized over a period that includes the performance condition

period. Historically, the Company has repurchased shares on the open

market in excess of the amount necessary to satisfy award exercises

Potential awards to employees under SharePower include stock

and expects to continue to do so in 2015.

options, SARs, restricted stock and RSUs. We have issued only stock

options and SARs under this plan. These awards generally vest over a

period of four years and expire ten years after grant.

At year end 2014, approximately 14 million shares were available for

future share-based compensation grants under the above plans.

Award Valuation

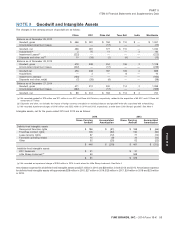

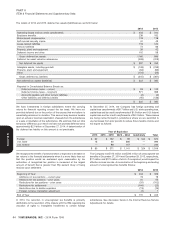

We estimated the fair value of each stock option and SAR award as of the date of grant using the Black-Scholes option-pricing model with the

following weighted-average assumptions:

2014 2013 2012

Risk-free interest rate 1.6% 0.8% 0.8%

Expected term (years) 6.2 6.2 6.0

Expected volatility 29.7% 29.9% 29.0%

Expected dividend yield 2.1% 2.1% 1.8%

We believe it is appropriate to group our stock option and SAR awards post-vesting termination behavior, we have determined that our

into two homogeneous groups when estimating expected term. These restaurant-level employees and our executives exercised the awards

groups consist of grants made primarily to restaurant-level employees on average after 4.75 years and 6.25 years, respectively.

under the RGM Plan, which cliff-vest after four years and expire ten When determining expected volatility, we consider both historical

years after grant, and grants made to executives under our other stock volatility of our stock as well as implied volatility associated with our

award plans, which typically have a graded vesting schedule of 25% publicly traded options. The expected dividend yield is based on the

per year over four years and expire ten years after grant. We use a annual dividend yield at the time of grant.

single weighted-average term for our awards that have a graded

vesting schedule. Based on analysis of our historical exercise and

60 YUM! BRANDS, INC. - 2014 Form 10-K

NOTE 14

Form 10-K