Pizza Hut 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

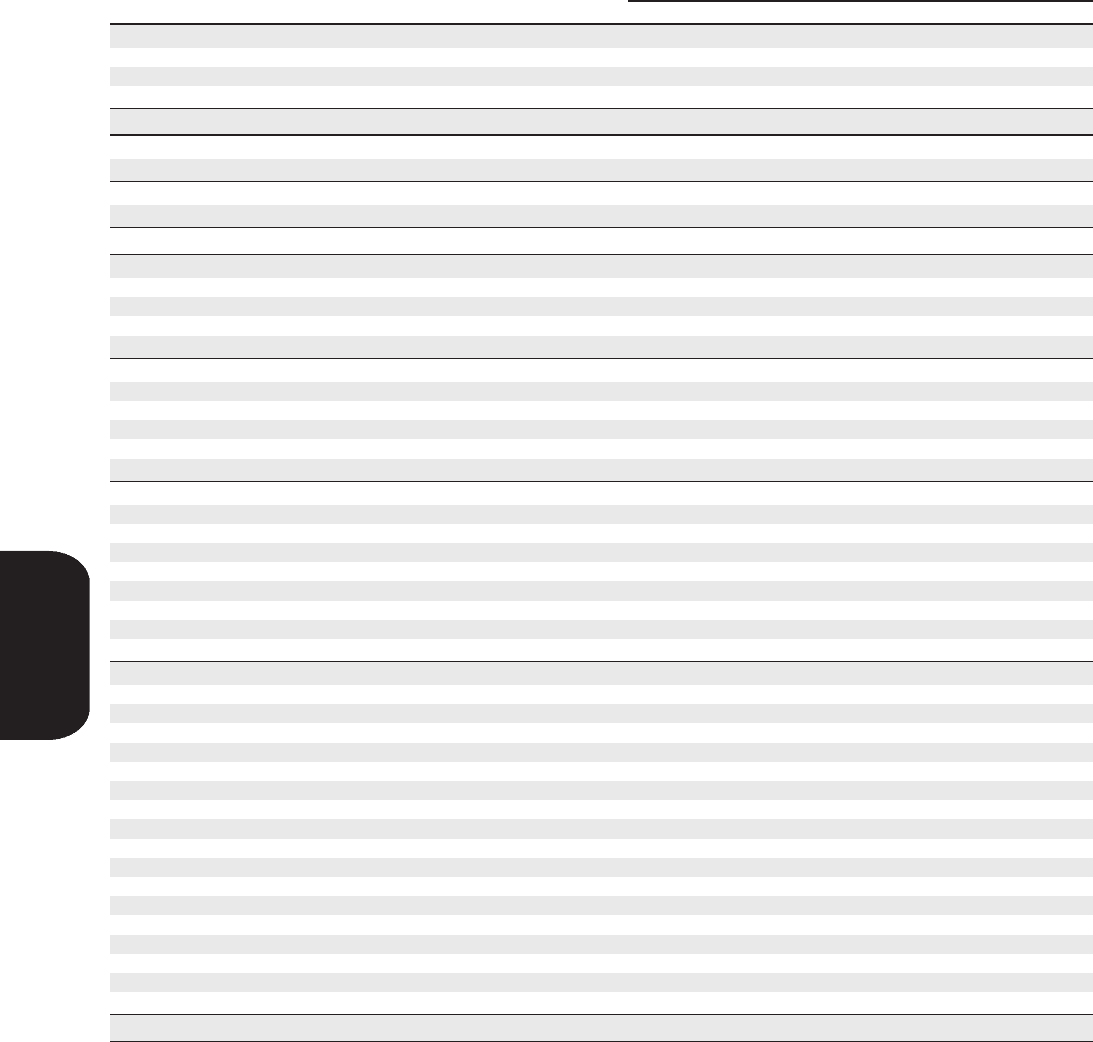

PART II

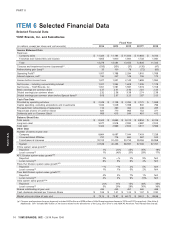

Selected Financial Data

Selected Financial Data

YUM! Brands, Inc. and Subsidiaries

Fiscal Year

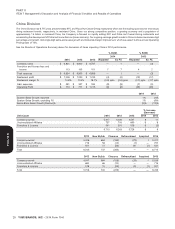

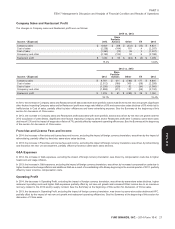

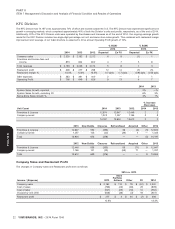

(in millions, except per share and unit amounts) 2014 2013 2012 2011(h) 2010

Income Statement Data

Revenues

Company sales $ 11,324 $ 11,184 $ 11,833 $ 10,893 $ 9,783

Franchise and license fees and income 1,955 1,900 1,800 1,733 1,560

Total 13,279 13,084 13,633 12,626 11,343

Closures and impairment income (expenses)(a) (535) (331) (37) (135) (47)

Refranchising gain (loss)(b) 33 100 78 (72) (63)

Operating Profit(c) 1,557 1,798 2,294 1,815 1,769

Interest expense, net(c) 130 247 149 156 175

Income before income taxes 1,427 1,551 2,145 1,659 1,594

Net Income – including noncontrolling interest 1,021 1,064 1,608 1,335 1,178

Net Income – YUM! Brands, Inc. 1,051 1,091 1,597 1,319 1,158

Basic earnings per common share 2.37 2.41 3.46 2.81 2.44

Diluted earnings per common share 2.32 2.36 3.38 2.74 2.38

Diluted earnings per common share before Special Items(c) 3.09 2.97 3.25 2.87 2.53

Cash Flow Data

Provided by operating activities $ 2,049 $ 2,139 $ 2,294 $ 2,170 $ 1,968

Capital spending, excluding acquisitions and investments 1,033 1,049 1,099 940 796

Proceeds from refranchising of restaurants 114 260 364 246 265

Repurchase shares of Common Stock 820 770 965 752 371

Dividends paid on Common Stock 669 615 544 481 412

Balance Sheet Data

Total assets $ 8,345 $ 8,695 $ 9,013 $ 8,834 $ 8,316

Long-term debt 3,077 2,918 2,932 2,997 2,915

Total debt 3,344 2,989 2,942 3,317 3,588

Other Data

Number of stores at year end

Company 8,664 8,097 7,544 7,403 7,238

Unconsolidated Affiliates 757 716 660 587 525

Franchisees & licensees 32,125 31,420 30,733 29,056 29,998

System 41,546 40,233 38,937 37,046 37,761

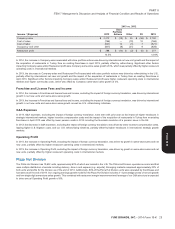

China system sales growth(d)

Reported 1% (1)% 23% 35% 18%

Local currency(e) 1% (4)% 20% 29% 17%

KFC Division system sales growth(d)(f)

Reported 2% —% 2% 9% N/A

Local currency(e) 6% 3% 6% 4% N/A

Pizza Hut Division system sales growth(d)(f)

Reported —% —% 2% 5% N/A

Local currency(e) 1% 1% 5% 2% N/A

Taco Bell Division system sales growth(d)(f)

Reported 4% 4% 7% 1% N/A

Local currency(e) 4% 4% 9% (1)% N/A

India system sales growth(d)(g)

Reported (1)% 11% 13% 36% 43%

Local currency(e) 3% 20% 29% 35% 36%

Shares outstanding at year end 434 443 451 460 469

Cash dividends declared per Common Share $ 1.56 $ 1.41 $ 1.24 $ 1.07 $ 0.92

Market price per share at year end $ 73.14 $ 73.87 $ 64.72 $ 59.01 $ 49.66

(a) Closures and impairment income (expense) includes $463 million and $295 million of Little Sheep impairment losses in 2014 and 2013 respectively, (See Note 4).

Additionally, 2011 included $80 million of net losses related to the divestitures of the Long John Silver’s and A&W All American Food Restaurants brands.

14 YUM! BRANDS, INC. - 2014 Form 10-K

ITEM 6

Form 10-K