Pizza Hut 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

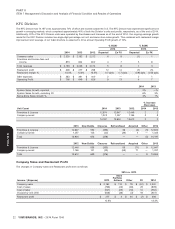

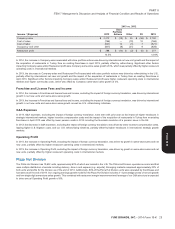

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

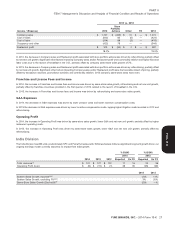

China Division

The China Division has 6,715 units, predominately KFC and Pizza Hut Casual Dining restaurants which are the leading quick service and casual

dining restaurant brands, respectively, in mainland China. Given our strong competitive position, a growing economy and a population of

approximately 1.4 billion in mainland China, the Company is focused on rapidly adding KFC and Pizza Hut Casual Dining restaurants and

accelerating the development of Pizza Hut Home Service (home delivery). Our ongoing earnings growth model in China includes low double-digit

percentage unit growth, mid-single digit same-store sales growth and moderate margin improvement, which we expect to drive annual Operating

Profit growth of 15%.

See the Results of Operations Summary above for discussion of items impacting China’s 2014 performance.

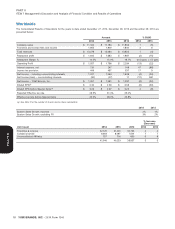

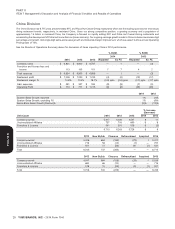

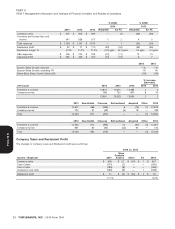

% B/(W) % B/(W)

2014 2013

2014 2013 2012 Reported Ex FX Reported Ex FX

Company sales $ 6,821 $ 6,800 $ 6,797 — 1 — (3)

Franchise and license fees and

income 113 105 101 7 7 4 2

Total revenues $ 6,934 $ 6,905 $ 6,898 — 1 — (3)

Restaurant profit $ 1,009 $ 1,050 $ 1,233 (4) (4) (15) (17)

Restaurant margin % 14.8% 15.4% 18.1% (0.6) ppts. (0.6) ppts. (2.7) ppts. (2.7) ppts.

G&A expenses $ 391 $ 357 $ 334 (9) (9) (7) (5)

Operating Profit $ 713 $ 777 $ 1,015 (8) (8) (23) (26)

2014 2013

System Sales Growth, reported 1% (1)%

System Sales Growth, excluding FX 1% (4)%

Same-Store Sales Growth (Decline)% (5)% (13)%

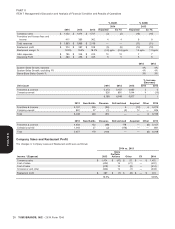

% Increase

(Decrease)

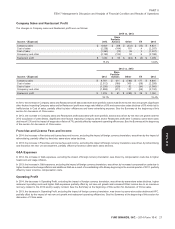

Unit Count 2014 2013 2012 2014 2013

Company-owned 5,417 5,026 4,547 8 11

Unconsolidated Affiliates 757 716 660 6 8

Franchise & License 541 501 519 8 (3)

6,715 6,243 5,726 8 9

2013 New Builds Closures Refranchised Acquired 2014

Company-owned 5,026 664 (195) (79) 1 5,417

Unconsolidated Affiliates 716 56 (14) (1) — 757

Franchise & License 501 17 (56) 80 (1) 541

Total 6,243 737 (265) — — 6,715

2012 New Builds Closures Refranchised Acquired 2013

Company-owned 4,547 664 (158) (28) 1 5,026

Unconsolidated Affiliates 660 66 (10) — — 716

Franchise & License 519 10 (55) 28 (1) 501

Total 5,726 740 (223) — — 6,243

20 YUM! BRANDS, INC. - 2014 Form 10-K

Form 10-K