Pizza Hut 2014 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

practices in violation of California Business & Professions Code federal FLSA claims, asserted state-law class action claims under the

§17200. This case appears to be duplicative of the In Re Taco Bell laws of sixteen different states. Pizza Hut filed a motion to dismiss the

Wage and Hour Actions case described above. Taco Bell removed the amended complaint, and plaintiffs sought leave to amend their

case to federal court and, on June 25, 2013, plaintiff filed a first complaint a second time. In August 2010, the court granted plaintiffs’

amended complaint to include a claim seeking penalties for alleged motion to amend. Pizza Hut filed another motion to dismiss the

violations of California’s Labor Code under California’s Private Second Amended Complaint. In July 2011, the court granted Pizza

Attorneys General Act. Taco Bell’s motion to dismiss or stay the action Hut’s motion with respect to plaintiffs’ state law claims but allowed the

in light of the In Re Taco Bell Wage and Hour Actions case was denied FLSA claims to go forward. Plaintiffs filed their Motion for Conditional

on October 30, 2013. In April 2014 the parties stipulated to address Certification in August 2011, and the court granted plaintiffs’ motion in

the sufficiency of plaintiff’s legal theory as to her discount meal break April 2012. The opt-in period closed on August 23, 2012, and 6,049

claim before conducting full discovery. A hearing on the parties’ cross- individuals opted in. On February 28, 2014, Pizza Hut filed a motion to

summary judgment motions was held on October 22, 2014, and on decertify the collective action, along with a motion for partial summary

October 23, 2014, the court granted Taco Bell’s motion for summary judgment seeking an order from the court that the FLSA does not

judgment on the discount meal break claim and denied plaintiff’s require Pizza Hut to reimburse certain fixed costs that delivery drivers

motion. Discovery will continue as to plaintiff’s remaining claims. would have incurred regardless of their employment with Pizza Hut.

Taco Bell denies liability and intends to vigorously defend against all On September 24, 2014, the parties entered into a Term Sheet setting

claims in this lawsuit. A reasonable estimate of the amount of any forth the terms upon which the parties had agreed to settle this matter.

possible loss or range of loss cannot be made at this time. Pursuant to the parties’ original agreement, one issue, the mileage of

an average round trip, remained outstanding and was to be submitted

In July 2009, a putative class action styled Mark Smith v. Pizza

for arbitration. The parties have instead negotiated a final settlement,

Hut, Inc. was filed in the U.S. District Court for the District of Colorado.

inclusive of that issue and without any contingencies. The proposed

The complaint alleged that Pizza Hut did not properly reimburse its

settlement amount has been accrued in our Consolidated Financial

delivery drivers for various automobile costs, uniforms costs, and

Statements, and the associated cash payments will not be material.

other job-related expenses and seeks to represent a class of delivery

drivers nationwide under the Fair Labor Standards Act (FLSA) and We are engaged in various other legal proceedings and have certain

Colorado state law. In January 2010, plaintiffs filed a motion for unresolved claims pending, the ultimate liability for which, if any,

conditional certification of a nationwide class of current and former cannot be determined at this time. However, based upon consultation

Pizza Hut, Inc. delivery drivers. However, in March 2010, the court with legal counsel, we are of the opinion that such proceedings and

granted Pizza Hut’s pending motion to dismiss for failure to state a claims are not expected to have a material adverse effect, individually

claim, with leave to amend. Plaintiffs subsequently filed an amended or in the aggregate, on our Consolidated Financial Statements.

complaint, which dropped the uniform claims but, in addition to the

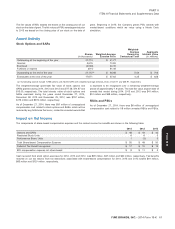

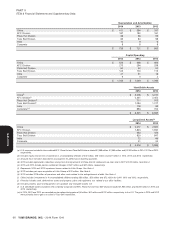

Selected Quarterly Financial Data (Unaudited)

2014

First Quarter Second Quarter Third Quarter Fourth Quarter Total

Revenues:

Company sales $ 2,292 $ 2,758 $ 2,891 $ 3,383 $ 11,324

Franchise and license fees and income 432 446 463 614 1,955

Total revenues 2,724 3,204 3,354 3,997 13,279

Restaurant profit 441 428 429 344 1,642

Operating Profit(a) 571 479 550 (43) 1,557

Net Income – YUM! Brands, Inc. 399 334 404 (86) 1,051

Basic earnings per common share 0.89 0.75 0.91 (0.20) 2.37

Diluted earnings per common share 0.87 0.73 0.89 (0.20) 2.32

Dividends declared per common share 0.37 0.37 — 0.82 1.56

2013

First Quarter Second Quarter Third Quarter Fourth Quarter Total

Revenues:

Company sales $ 2,099 $ 2,474 $ 3,021 $ 3,590 $ 11,184

Franchise and license fees and income 436 430 445 589 1,900

Total revenues 2,535 2,904 3,466 4,179 13,084

Restaurant profit 333 310 531 509 1,683

Operating Profit(b) 487 390 350 571 1,798

Net Income – YUM! Brands, Inc.(c) 337 281 152 321 1,091

Basic earnings per common share 0.74 0.62 0.34 0.72 2.41

Diluted earnings per common share 0.72 0.61 0.33 0.70 2.36

Dividends declared per common share 0.335 0.335 — 0.74 1.41

(a) Includes a non-cash charge of $463 million in the fourth quarter related primarily to the impairment of Little Sheep intangible assets. See Note 4.

(b) Includes a non-cash charge of $295 million in the third quarter related primarily to the impairment of Little Sheep intangible assets and net U.S. refranchising gains

of $17 million, $28 million, $37 million and $9 million in the first, second, third and fourth quarters, respectively. See Note 4.

(c) Includes an after-tax charge of $75 million in the fourth quarter related to the repurchase of Senior Unsecured Notes. See Note 4.

YUM! BRANDS, INC. - 2014 Form 10-K 69

NOTE 19

13MAR201516053226

Form 10-K