Pizza Hut 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

PART II

ITEM 8 Financial Statements and Supplementary Data

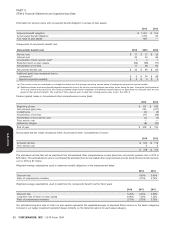

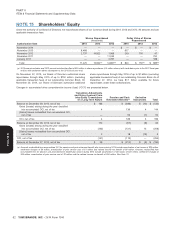

Shareholders’ Equity

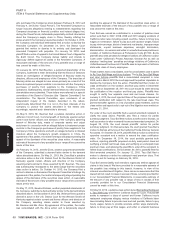

Under the authority of our Board of Directors, we repurchased shares of our Common Stock during 2014, 2013 and 2012. All amounts exclude

applicable transaction fees.

Shares Repurchased Dollar Value of Shares

(thousands) Repurchased

Authorization Date 2014 2013 2012 2014 2013 2012

November 2014 — — — $ — $ — $ —

November 2013 8,488 — — 617 — —

November 2012 2,737 10,922 1,069 203 750 47

November 2011 — — 11,035 — — 750

January 2011 — — 2,787 — — 188

Total 11,225 10,922(a) 14,891(a) $ 820 $ 750(a) $ 985(a)

(a) 2013 amount excludes and 2012 amount includes the effect of $20 million in share repurchases (0.3 million shares) with trade dates prior to the 2012 fiscal year

end but with settlement dates subsequent to the 2012 fiscal year end.

On November 22, 2013, our Board of Directors authorized share share repurchases through May 2016 of up to $1 billion (excluding

repurchases through May 2015 of up to $750 million (excluding applicable transaction fees) of our outstanding Common Stock. As of

applicable transaction fees) of our outstanding Common Stock. On December 27, 2014, we have $1.1 billion available for future

November 20, 2014, our Board of Directors authorized additional repurchases under these authorizations.

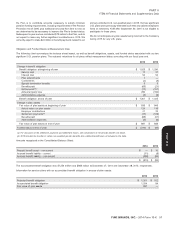

Changes in accumulated other comprehensive income (loss) (‘‘OCI’’) are presented below.

Translation Adjustments

and Gains (Losses) From

Intra-Entity Transactions Pension and Post- Derivative

of a Long-Term Nature Retirement Benefits(a) Instruments Total

Balance at December 29, 2012, net of tax $ 166 $ (286) $ (12) $ (132)

Gains (losses) arising during the year classified

into accumulated OCI, net of tax 4 136 4 144

(Gains) losses reclassified from accumulated OCI,

net of tax — 53 (1) 52

OCI, net of tax 4 189 3 196

Balance at December 28, 2013, net of tax 170 (97) (9) 64

Gains (losses) arising during the year classified

into accumulated OCI, net of tax (143) (131) 15 (259)

(Gains) losses reclassified from accumulated OCI,

net of tax 2 18 (15) 5

OCI, net of tax (141) (113) — (254)

Balance at December 27, 2014, net of tax $ 29 $ (210) $ (9) $ (190)

(a) Amounts reclassified from accumulated OCI for pension and post-retirement benefit plan losses during 2014 include amortization of net losses of $20 million,

settlement charges of $6 million, amortization of prior service cost of $1 million and related income tax benefit of $9 million. Amounts reclassified from

accumulated OCI for pension and post-retirement benefit plan losses during 2013 include amortization of net losses of $51 million, settlement charges of

$30 million, amortization of prior service cost of $2 million and the related income tax benefit of $30 million. See Note 13.

62 YUM! BRANDS, INC. - 2014 Form 10-K

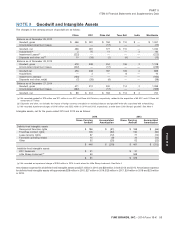

NOTE 15

Form 10-K