Pizza Hut 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

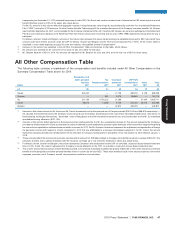

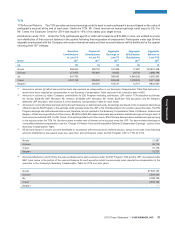

TCN

TCN Account Returns. The TCN provides an annual earnings credit to each to each participant’s account based on the value of

participant’s account at the end of each year. Under the TCN, Mr. Creed receives an annual earnings credit equal to 5%. For

Mr. Creed, the Employer Credit for 2014 was equal to 15% of his salary plus target bonus.

Distributions under TCN. Under the TCN, participants age 55 or older with a balance of $15,000 or more, are entitled to a lump

sum distribution of their account balance in the quarter following their separation of employment. Participants under age 55 who

separate employment with the Company will receive interest annually and their account balance will be distributed in the quarter

following their 55th birthday.

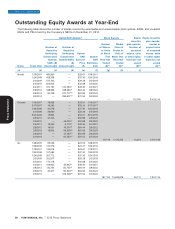

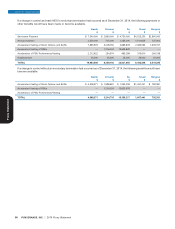

Novak 939,600 358,150 100,369 12,387 232,612,208

Grismer 277,875 135,850 26,630 29,719 2,888,799

Su 614,790 — 168,463 4,949,209 4,350,845

Creed 2,074,125 225,000 308,443 1,478,019 9,271,429

Bergren — 406,000 103,137 12,721 9,822,950

(1) Amounts in column (b) reflect amounts that were also reported as compensation in our Summary Compensation Table filed last year or,

would have been reported as compensation in our Summary Compensation Table last year if the executive were a NEO.

(2) Amounts in column (c) reflect Company contributions for EID Program matching contribution, LRP and/or TCN allocation as follows:

Mr. Novak, $358,150 LRP allocation; Mr. Grismer, $135,850 LRP allocation; Mr. Creed, $225,000 TCN allocation; and Mr. Bergren,

$406,000 LRP allocation. See footnote 5 of the Summary Compensation Table for more detail.

(3) Amounts in column (d) reflect earnings during the last fiscal year on deferred amounts. All earnings are based on the investment alternatives

offered under the EID Program or the earnings credit provided under the LRP or the TCN described in the narrative above this table. The EID

Program earnings are market based returns and, therefore, are not reported in the Summary Compensation Table. For Messrs. Grismer and

Bergren, of their earnings reflected in this column, $9,087 and $55,905 respectively were deemed above market earnings accruing to each of

their accounts under the LRP. For Mr. Creed, of his earnings reflected in this column, $16,726 were deemed above market earnings accruing

to his account under the TCN. Mr. Novak receives a market rate of interest on his account under the LRP. For above market earnings on

nonqualified deferred compensation, see the ‘‘Change in Pension Value and Nonqualified Deferred Compensation Earnings’’ column of the

Summary Compensation Table.

(4) All amounts shown in column (e) were distributed in accordance with the executive’s deferral election, except in the case of the following

amounts distributed to pay payroll taxes due upon their account balance under the EID Program, LRP or TCN for 2014.

Novak 12,387

Grismer 29,718

Creed 70,778

Bergren 12,721

(5) Amounts reflected in column (f) are the year-end balances for each executive under the EID Program, TCN and the LRP. As required under

SEC rules, below is the portion of the year-end balance for each executive which has previously been reported as compensation to the

executive in the Company’s Summary Compensation Table for 2014 and prior years.

Novak 87,578,135

Grismer 2,500,045

Su 3,798,759

Creed 4,519,162

Bergren —

2015 Proxy Statement YUM! BRANDS, INC. 57

Executive Registrant Aggregate Aggregate Aggregate

Contributions Contributions Earnings in Withdrawals/ Balance at

in Last FY in Last FY Last FY Distributions Last FYE

Name ($)(1) ($)(2) ($)(3) ($)(4) ($)(5)

(a) (b) (c) (d) (e) (f)

EXECUTIVE COMPENSATION

Proxy Statement