Pizza Hut 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

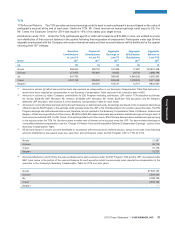

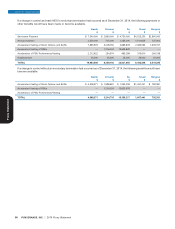

Pension Benefits

The table below shows the present value of accumulated benefits payable to each of the NEOs, including the number of years of

service credited to each NEO, under the YUM! Brands Retirement Plan (‘‘Retirement Plan’’), the YUM! Brands, Inc. Pension

Equalization Plan (‘‘PEP’’), and the YUM! Brands International Retirement Plan (‘‘YIRP’’) determined using interest rate and

mortality rate assumptions consistent with those used in the Company’s financial statements.

2014 FISCAL YEAR PENSION BENEFITS TABLE

Novak(i) Retirement Plan(1) 28 1,598,356 —

Pension Equalization Plan(2) ——

Grismer(ii) —— ——

Su International Retirement Plan(3) 25 20,459,770 —

Creed(iii) Retirement Plan(1) 2 154,835 —

Bergren(iv) Retirement Plan(1) 6 351,896 —

Pension Equalization Plan(2) 6 168,202 —

(i) Mr. Novak no longer receives benefits under the PEP. The Management Planning and Development Committee discontinued Mr. Novak’s

accruing pension benefits under the PEP effective January 1, 2012 and replaced this benefit, effective January 1, 2013, with a benefit

determined under the Leadership Retirement Plan (‘‘LRP’’), an unfunded, unsecured, deferred account-based retirement plan. See

footnote (5) to the Summary Compensation Table at page 46 for more detail.

(ii) Mr. Grismer is not accruing a benefit under these plans because he was hired after September 30, 2001 and is therefore ineligible for these

benefits. Mr. Grismer participates in the LRP.

(iii) Mr. Creed is not an active participant in the Retirement Plan but maintains a balance in the Retirement Plan for the two years (2002 and

2003) during which he was a participant in the plan. As discussed at page 42, Mr. Creed participates in the Third Country National plan, an

unfunded, unsecured deferred account-based retirement plan.

(iv) Mr. Bergren is not an active participant in the Retirement Plan but maintains a balance in the Retirement Plan for six years of accrued benefit

(1992 – 1998) during which he was a participant in the plan. As of February 14, 1998, Mr. Bergren no longer accrues a benefit under the

Retirement Plan or the PEP. Mr. Bergren participates in the LRP.

(1) YUM! Brands Retirement Plan C. .43% of Final Average Earnings up to Social

Security covered compensation multiplied by

The Retirement Plan provides an integrated program of Projected Service up to 35 years of service

retirement benefits for salaried employees who were hired

by the Company prior to October 1, 2001. The Retirement the result of which is multiplied by a fraction, the numerator

Plan replaces the same level of pre-retirement pensionable of which is actual service as of date of termination, and the

earnings for all similarly situated participants. The denominator of which is the participant’s Projected Service.

Retirement Plan is a tax qualified plan, and it is designed to Projected Service is the service that the participant would

provide the maximum possible portion of this integrated have earned if he had remained employed with the

benefit on a tax qualified and funded basis. Company until his normal retirement age (generally age 65).

Benefit Formula If a participant leaves employment after becoming eligible

for early or normal retirement, benefits are calculated using

Benefits under the Retirement Plan are based on a the formula above except that actual service attained at the

participant’s final average earnings (subject to the limits participant’s retirement date is used in place of Projected

under Internal Revenue Code Section 401(a)(17)) and Service.

service under the plan. Upon termination of employment, a

participant’s normal retirement benefit from the plan is equal Final Average Earnings

to

A participant’s final average earnings is determined based

A. 3% of Final Average Earnings times Projected on his highest five consecutive years of pensionable

Service up to 10 years of service, plus earnings. Pensionable earnings is the sum of the

B. 1% of Final Average Earnings times Projected participant’s base pay and annual incentive compensation

Service in excess of 10 years of service, minus from the Company, including amounts under the Yum

2015 Proxy Statement YUM! BRANDS, INC. 53

Number of Years of Present Value of Payments During

Credited Service Accumulated Benefit(4) Last Fiscal Year

Name Plan Name (#) ($) ($)

(a) (b) (c) (d) (e)

EXECUTIVE COMPENSATION

Proxy Statement