Pizza Hut 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

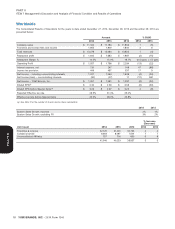

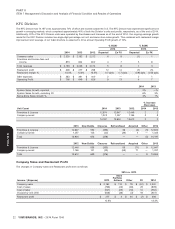

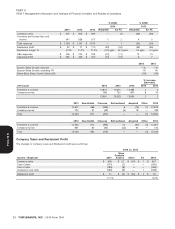

KFC Division

The KFC Division has 14,197 units, approximately 70% of which are located outside the U.S. The KFC Division has experienced significant unit

growth in emerging markets, which comprised approximately 40% of both the Division’s units and profits, respectively, as of the end of 2014.

Additionally, 91% of the KFC Division units were operated by franchisees and licensees as of the end of 2014. Our ongoing earnings growth

model for the KFC Division includes low-single-digit percentage net unit and same store sales growth. This combined with restaurant margin

improvement and leverage of our G&A structure is expected to drive annual Operating Profit growth of 10%.

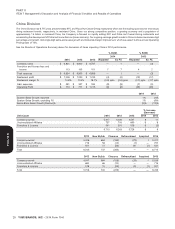

% B/(W) % B/(W)

2014 2013

2014 2013 2012 Reported Ex FX Reported Ex FX

Company sales $ 2,320 $ 2,192 $ 2,212 6 9 (1) 1

Franchise and license fees and

income 873 844 802 4 7 5 8

Total revenues $ 3,193 $ 3,036 $ 3,014 5 8 1 3

Restaurant profit $ 308 $ 277 $ 298 12 14 (7) (5)

Restaurant margin % 13.3% 12.6% 13.5% 0.7 ppts. 0.7 ppts. (0.9) ppts. (0.9) ppts.

G&A expenses $ 383 $ 391 $ 400 2 — 2 1

Operating Profit $ 708 $ 649 $ 626 9 13 4 7

2014 2013

System Sales Growth, reported 2% —%

System Sales Growth, excluding FX 6% 3%

Same-Store Sales Growth % 3% 1%

% Increase

(Decrease)

Unit Count 2014 2013 2012 2014 2013

Franchise & License 12,874 12,647 12,446 2 2

Company-owned 1,323 1,257 1,166 5 8

14,197 13,904 13,612 2 2

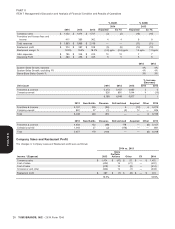

2013 New Builds Closures Refranchised Acquired Other 2014

Franchise & License 12,647 553 (356) 39 (4) (5) 12,874

Company-owned 1,257 123 (22) (39) 4 — 1,323

Total 13,904 676 (378) — — (5) 14,197

2012 New Builds Closures Refranchised Acquired Other 2013

Franchise & License 12,446 558 (353) 58 (71) 9 12,647

Company-owned 1,166 101 (23) (58) 71 — 1,257

Total 13,612 659 (376) — — 9 13,904

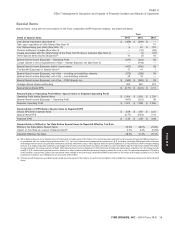

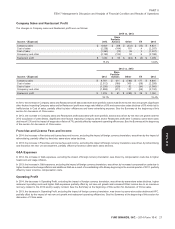

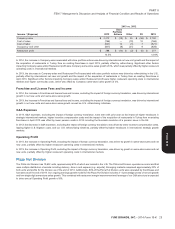

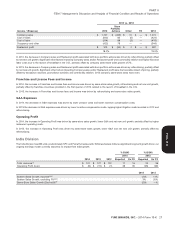

Company Sales and Restaurant Profit

The changes in Company sales and Restaurant profit were as follows:

2014 vs. 2013

Store

Portfolio

Income / (Expense) 2013 Actions Other FX 2014

Company sales $ 2,192 $ 110 $ 79 $ (61) $ 2,320

Cost of sales (766) (43) (26) 26 (809)

Cost of labor (521) (25) (16) 10 (552)

Occupancy and other (628) (38) (3) 18 (651)

Restaurant profit $ 277 $ 4 $ 34 $ (7) $ 308

12.6% 13.3%

22 YUM! BRANDS, INC. - 2014 Form 10-K

Form 10-K