Pizza Hut 2014 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13MAR201517272138

PART II

ITEM 8 Financial Statements and Supplementary Data

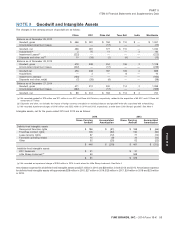

refranchised during 2014 with future plans calling for further focus on net assets of the Little Sheep business of approximately $100 million

franchise-ownership for the Concept. as of December 27, 2014 include primarily the remaining $58 million

trademark and PP&E of approximately $30 million related to a wholly-

We tested the Little Sheep trademark and goodwill for impairment in owned business that sells seasoning to retail customers.

the fourth quarter of 2014 pursuant to our accounting policy. The

inputs used in determining the 2014 fair values of the Little Sheep The primary drivers of remaining fair value in our Little Sheep

trademark and reporting unit no longer include a three-year recovery business include franchise revenue growth and cash flows associated

of sales and profits to pre-acquisition levels and reflect further with the aforementioned seasoning business. Franchise revenue

reductions in Company ownership to a level of 50 restaurants (from 92 growth reflects annual same-store sales growth of 4% and

restaurants at December 27, 2014). As a result of comparing the approximately 35 new franchise units per year, partially offset by

trademark’s 2014 fair value estimate of $58 million to its carrying value approximately 25 franchise closures per year. The seasoning

of $342 million, we recorded a $284 million impairment charge. business is forecasted to generate sales growth rates and margins

Additionally, after determining the 2014 fair value estimate of the Little consistent with historical results.

Sheep reporting unit was less than its carrying value we wrote off Little The losses related to Little Sheep that have occurred concurrent with

Sheep’s remaining goodwill balance of $160 million. The Company our trademark and goodwill impairments in 2014 and 2013 and our

also evaluated other Little Sheep long-lived assets for impairment and gain on acquisition in 2012, none of which have been allocated to any

recorded $14 million of restaurant-level PP&E impairment and a segment for performance reporting purposes, are summarized below:

$5 million impairment of our equity method investment in a meat

processing business that supplies lamb to Little Sheep. The remaining

2014 2013 2012 Income Statement Classification

Gain on Acquisition $ — $ — $ (74) Other (income) expense

Impairment of Goodwill 160 222 — Closures and Impairment (income) expense

Impairment of Trademark 284 69 — Closures and Impairment (income) expense

Impairment of PP&E 14 4 — Closures and Impairment (income) expense

Impairment of Investment in Little Sheep Meat 5 — — Closures and Impairment (income) expense

Tax Benefit (76) (18) — Income tax provision

Loss Attributable to Non-Controlling Interest (26) (19) — Net Income (loss) noncontrolling interests

Net (gain) loss $ 361 $ 258 $ (74) Net Income – YUM! Brands, Inc.

Both the 2014 and 2013 Little Sheep trademark and reporting unit fair values were based on the estimated prices a willing buyer would pay. The

fair values of the trademark were determined using a relief from royalty valuation approach that included future estimated sales as a significant

input. The reporting unit fair values were determined using an income approach with future cash flow estimates generated by the business as a

significant input. All fair values incorporated a discount rate of 13% as our estimate of the required rate of return that a third-party buyer would

expect to receive when purchasing the Little Sheep trademark or reporting unit.

performance reporting purposes. See Note 13 for further discussion of

Losses Related to the Extinguishment of our pension plans.

Debt

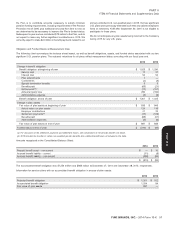

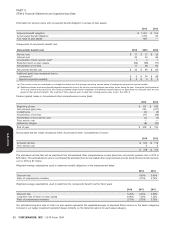

During the fourth quarter of 2013, we completed a cash tender offer to Refranchising (Gain) Loss

repurchase $550 million of our Senior Unsecured Notes due either

The Refranchising (gain) loss by reportable segment is presented

March 2018 or November 2037. This transaction resulted in

below. We do not allocate such gains and losses to our segments for

$120 million of losses as a result of premiums paid and other costs,

performance reporting purposes.

$118 million of which was classified as Interest expense, net in our

Consolidated Statement of Income. The repurchase of the Senior

Refranchising (gain) loss

Unsecured Notes was funded primarily by proceeds of $599 million

received from the issuance of new Senior Unsecured Notes. 2014 2013 2012

China $ (17) $ (5) $ (17)

KFC Division (18) (8) (3)

Pension Settlement Charges Pizza Hut Division(a) 4(3)53

During the fourth quarter of 2012 and continuing through 2013, the Taco Bell Division (4) (84) (111)

Company allowed certain former employees with deferred vested India 2 — —

balances in our U.S. pension plans an opportunity to voluntarily elect Worldwide $ (33) $ (100) $ (78)

an early payout of their pension benefits. The majority of these

payouts were funded from existing pension plan assets. (a) During the fourth quarter of 2012, we refranchised our remaining 331

Company-owned Pizza Hut dine-in restaurants in the United Kingdom

As a result of settlement payments exceeding the sum of service and (‘‘UK’’). The franchise agreement for these stores allowed the franchisee to

interest costs within these U.S. pension plans in 2013 and 2012, pay continuing franchise fees in the initial years of the agreement at a

pursuant to our accounting policy we recorded pre-tax settlement reduced rate. We agreed to allow the franchisee to pay these reduced fees

in part as consideration for their assumption of lease liabilities related to

charges of $30 million and $89 million for the years ended underperforming stores that we anticipated they would close that were part

December 28, 2013 and December 29, 2012, respectively, in General of the refranchising. We recognize the estimated value of terms in franchise

and administrative expenses. These amounts included settlement agreements entered into concurrently with a refranchising transaction that

charges of $10 million and $84 million in the years ended are not consistent with market terms as part of the upfront refranchising

(gain) loss. Accordingly, upon the closing of this refranchising we

December 28, 2013 and December 29, 2012, respectively, related to recognized a loss of $53 million representing the estimated value of these

the programs discussed above that were not allocated for reduced continuing fees. The associated deferred credit is being amortized

into Pizza Hut Division’s Franchise and license fees and income through

50 YUM! BRANDS, INC. - 2014 Form 10-K

Form 10-K