Pizza Hut 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

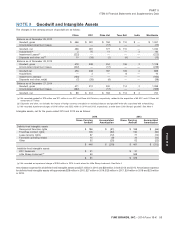

2016. This upfront loss largely contributed to a $70 million Refranchising not to be impaired as the fair value of the Pizza Hut UK reporting unit

loss we recognized during 2012 as a result of this refranchising. Also exceeded its carrying amount. For the year ended December 28, 2013, the

included in that loss was the write-off of $14 million in goodwill allocated to refranchising of the Pizza Hut UK dine-in restaurants decreased Company

the Pizza Hut UK reporting unit. The remaining carrying value of goodwill sales by 39% and increased Franchise and license fees and income and

allocated at that time to our Pizza Hut UK business of $87 million, Operating Profit by 3% and 6%, respectively, for the Pizza Hut Division

immediately subsequent to the aforementioned write-off, was determined versus 2012.

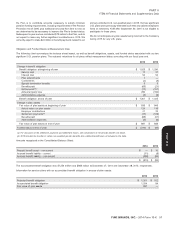

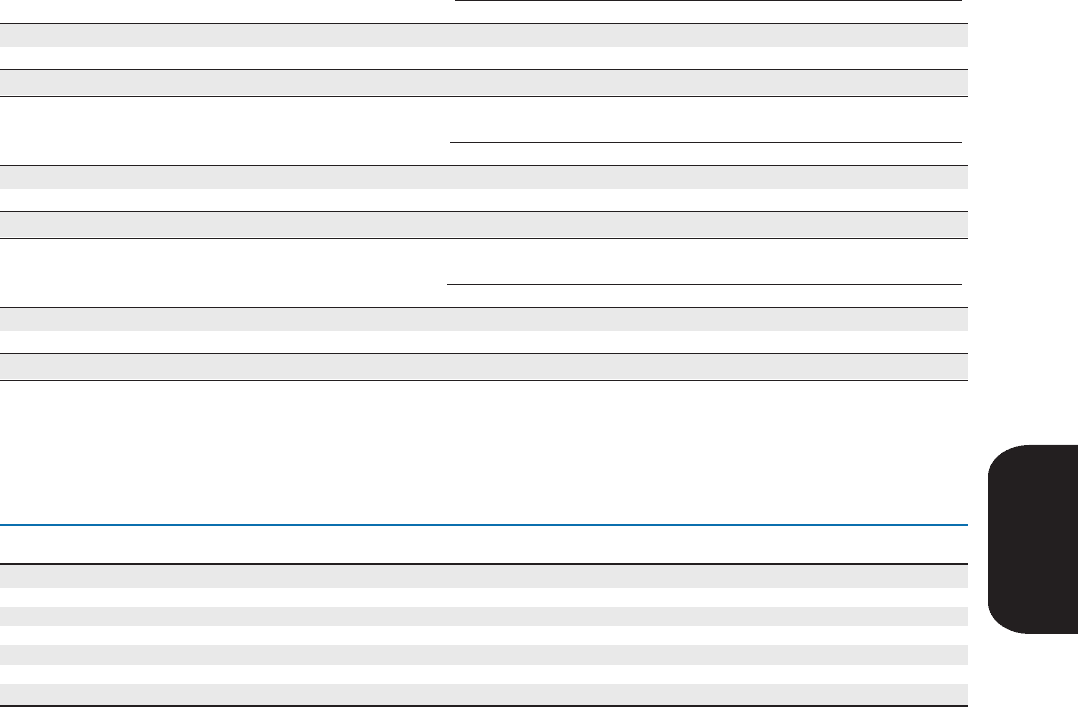

Store Closure and Impairment Activity

Store closure (income) costs and Store impairment charges by reportable segment are presented below. These tables exclude $463 million and

$295 million of Little Sheep impairment losses in 2014 and 2013, respectively which were not allocated to any segment for performance reporting

purposes.

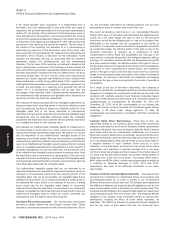

2014

China KFC Pizza Hut Taco Bell India Worldwide

Store closure (income) costs(a) $— $2 $1 $— $— $ 3

Store impairment charges 54 7 4 3 1 69

Closure and impairment (income) expenses $ 54 $ 9 $ 5 $ 3 $ 1 $ 72

2013

China KFC Pizza Hut Taco Bell India Worldwide

Store closure (income) costs(a) $ (1) $ (1) $ (3) $ — $ — $ (5)

Store impairment charges 31 4 3 1 2 41

Closure and impairment (income) expenses $ 30 $ 3 $ — $ 1 $ 2 $ 36

2012

China KFC Pizza Hut Taco Bell India Worldwide

Store closure (income) costs(a) $(4) $ 1 $10 $1 $— $ 8

Store impairment charges 13 11 2 3 — 29

Closure and impairment (income) expenses $ 9 $ 12 $ 12 $ 4 $ — $ 37

(a) Store closure (income) costs include the net gain or loss on sales of real estate on which we formerly operated a Company-owned restaurant that was closed,

lease reserves established when we cease using a property under an operating lease and subsequent adjustments to those reserves and other facility-related

expenses from previously closed stores. Remaining lease obligations for closed stores were not material at December 27, 2014 or December 28, 2013.

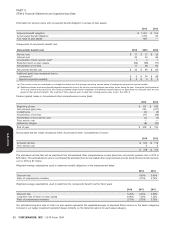

Supplemental Cash Flow Data

2014 2013 2012

Cash Paid For:

Interest(a) $ 149 $ 269 $ 166

Income taxes(b) 684 489 417

Significant Non-Cash Investing and Financing Activities:

Capital lease obligations incurred $ 24 $ 15 $ 17

Capital lease obligations relieved, primarily through divestitures and refranchisings 1 2 112

Increase in accrued capital expenditures 15 N/A 35

(a) 2013 includes $109 million of cash premiums and fees paid related to the extinguishment of debt, which is the primary component of the $120 million loss on debt

extinguishment. See Note 4.

(b) 2014 includes $200 million of cash paid related to the resolution of a valuation issue with the Internal Revenue Service related to years 2004-2008. See the

Internal Revenue Service Adjustments section of Note 16.

YUM! BRANDS, INC. - 2014 Form 10-K 51

NOTE 5

13MAR201516053226

Form 10-K