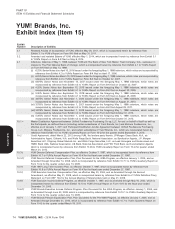

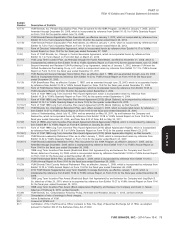

Pizza Hut 2014 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 8 Financial Statements and Supplementary Data

Contingencies

our guarantee exposure under this program is approximately

Lease Guarantees $6 million based on total loans outstanding of $29 million.

As a result of having (a) assigned our interest in obligations under real In addition to the guarantees described above, YUM has agreed to

estate leases as a condition to the refranchising of certain Company provide guarantees of up to approximately $100 million on behalf of

restaurants; (b) contributed certain Company restaurants to franchisees for several financing programs related to specific

unconsolidated affiliates; and (c) guaranteed certain other leases, we initiatives. At December 27, 2014 our guarantee exposure under

are frequently contingently liable on lease agreements. These leases these financing programs is approximately $25 million based on total

have varying terms, the latest of which expires in 2065. As of loans outstanding of $42 million.

December 27, 2014, the potential amount of undiscounted payments

we could be required to make in the event of non-payment by the

primary lessee was approximately $650 million. The present value of Unconsolidated Affiliates Guarantees

these potential payments discounted at our pre-tax cost of debt at

From time to time we have guaranteed certain lines of credit and loans

December 27, 2014 was approximately $575 million. Our franchisees

of unconsolidated affiliates. At December 27, 2014 there are no

are the primary lessees under the vast majority of these leases. We

guarantees outstanding for unconsolidated affiliates. Our

generally have cross-default provisions with these franchisees that

unconsolidated affiliates had total revenues of approximately

would put them in default of their franchise agreement in the event of

$1.1 billion for the year ended December 27, 2014 and assets and

non-payment under the lease. We believe these cross-default

debt of approximately $344 million and $82 million, respectively, at

provisions significantly reduce the risk that we will be required to make

December 27, 2014.

payments under these leases. Accordingly, the liability recorded for

our probable exposure under such leases at December 27, 2014 and

December 28, 2013 was not material. Insurance Programs

We are self-insured for a substantial portion of our current and prior

Franchise Loan Pool and Equipment years’ coverage including property and casualty losses. To mitigate

Guarantees the cost of our exposures for certain property and casualty losses, we

self-insure the risks of loss up to defined maximum per occurrence

We have agreed to provide financial support, if required, to a variable retentions on a line-by-line basis. The Company then purchases

interest entity that operates a franchisee lending program used insurance coverage, up to a certain limit, for losses that exceed the

primarily to assist franchisees in the development of new restaurants self-insurance per occurrence retention. The insurers’ maximum

or the upgrade of existing restaurants and, to a lesser extent, in aggregate loss limits are significantly above our actuarially

connection with the Company’s refranchising programs in the U.S. We determined probable losses; therefore, we believe the likelihood of

have determined that we are not required to consolidate this entity as losses exceeding the insurers’ maximum aggregate loss limits is

we share the power to direct this entity’s lending activity with other remote.

parties. We have provided guarantees of 20% of the outstanding

loans of the franchisee loan program. As such, at December 27, 2014

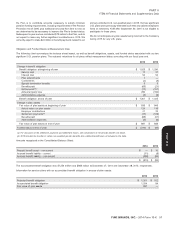

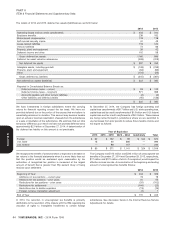

The following table summarizes the 2014 and 2013 activity related to our net self-insured property and casualty reserves as of December 27,

2014.

Beginning Balance Expense Payments Ending Balance

2014 Activity $ 128 42 (54) $ 116

2013 Activity $ 142 47 (61) $ 128

In the U.S. and in certain other countries, we are also self-insured for Legal Proceedings

healthcare claims and long-term disability for eligible participating

employees subject to certain deductibles and limitations. We have We are subject to various claims and contingencies related to

accounted for our retained liabilities for property and casualty losses, lawsuits, real estate, environmental and other matters arising in the

healthcare and long-term disability claims, including reported and normal course of business. An accrual is recorded with respect to

incurred but not reported claims, based on information provided by claims or contingencies for which a loss is determined to be probable

independent actuaries. and reasonably estimable.

Due to the inherent volatility of actuarially determined property and In early 2013, four putative class action complaints were filed in the

casualty loss estimates, it is reasonably possible that we could U.S. District Court for the Central District of California against the

experience changes in estimated losses which could be material to Company and certain executive officers alleging claims under

our growth in quarterly and annual Net income. We believe that we sections 10(b) and 20(a) of the Securities Exchange Act of 1934.

have recorded reserves for property and casualty losses at a level Plaintiffs alleged that defendants made false and misleading

which has substantially mitigated the potential negative impact of statements concerning the Company’s current and future business

adverse developments and/or volatility. and financial condition. The four complaints were subsequently

consolidated and transferred to the U.S. District Court for the Western

District of Kentucky. On August 5, 2013, lead plaintiff, Frankfurt Trust

Investment GmbH, filed a Consolidated Class Action Complaint

(‘‘Amended Complaint’’) on behalf of a putative class of all persons

YUM! BRANDS, INC. - 2014 Form 10-K 67

NOTE 18

13MAR201516053226

Form 10-K