Pizza Hut 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations

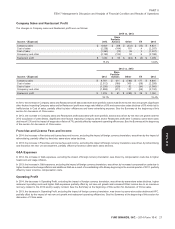

Subsequent to December 27, 2014, we contributed $75 million to the liability, automobile liability, product liability and property losses

Plan. We do not anticipate making any additional significant (collectively ‘‘property and casualty losses’’) and employee healthcare

contributions to the Plan in 2015. Investment performance and and long-term disability claims. The majority of our recorded liability

corporate bond rates have a significant effect on our net funding for self-insured property and casualty losses and employee

position as they drive our asset balances and discount rate healthcare and long-term disability claims represents estimated

assumptions. Future changes in investment performance and reserves for incurred claims that have yet to be filed or settled.

corporate bond rates could impact our funded status and the timing We have not included in the contractual obligations table

and amounts of required contributions in 2015 and beyond. approximately $25 million of long-term liabilities for unrecognized tax

Our post-retirement plan in the U.S. is not required to be funded in benefits relating to various tax positions we have taken. These

advance, but is pay as you go. We made post-retirement benefit liabilities may increase or decrease over time as a result of tax

payments of $6 million in 2014 and no future funding amounts are examinations, and given the status of the examinations, we cannot

included in the contractual obligations table. See Note 13. reliably estimate the period of any cash settlement with the respective

taxing authorities. These liabilities exclude amounts that are

We have excluded from the contractual obligations table payments we temporary in nature and for which we anticipate that over time there

may make for exposures for which we are self-insured, including will be no net cash outflow.

workers’ compensation, employment practices liability, general

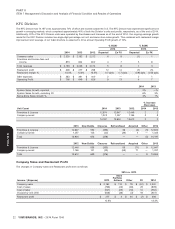

Off-Balance Sheet Arrangements

See the Franchise Loan Pool and Equipment Guarantees and Unconsolidated Affiliates Guarantees sections of Note 18 for discussion of our

off-balance sheet arrangements.

New Accounting Pronouncements Not Yet Adopted

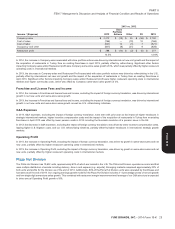

In April 2014, the Financial Accounting Standards Board (‘‘FASB’’) In May 2014, the FASB issued ASU No. 2014-09, Revenue from

issued ASU No. 2014-08, Presentation of Financial Statements (Topic Contracts with Customers (Topic 606) (ASU 2014-09), to provide

205) and Property, Plant, and Equipment (Topic 360): Reporting principles within a single framework for revenue recognition of

Discontinued Operations and Disclosures of Disposals of transactions involving contracts with customers across all industries.

Components of an Entity (ASU 2014-08), which limits dispositions that ASU 2014-09 is effective for the Company in our first quarter of fiscal

qualify for discontinued operations presentation to those that 2017 with no early adoption permitted. The standard allows for either

represent strategic shifts that have or will have a major effect on an a full retrospective or modified retrospective transition method. The

entity’s operations and financial results. Strategic shifts could include Standard will not impact our recognition of revenue from company-

a disposal of a major geographical area, a major line of business, a owned restaurants or our recognition of continuing fees from

major equity method investment or other major parts of the business. franchisees or licensees, which are based on a percentage of

ASU 2014-08 is effective prospectively for the Company in our first franchise and license sales. We are continuing to evaluate the impact

quarter of fiscal 2015. We do not believe the adoption of this standard the adoption of this standard will have on the recognition of other less

will have a significant impact on our consolidated financial statements. significant revenue transactions such as initial fees from franchisees

and refranchising of company-owned restaurants.

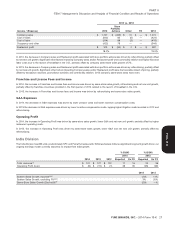

Critical Accounting Policies and Estimates

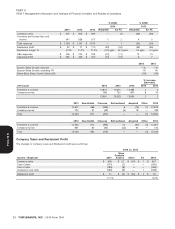

Our reported results are impacted by the application of certain actual results at comparable restaurants. For restaurant assets that

accounting policies that require us to make subjective or complex are deemed to not be recoverable, we write down the impaired

judgments. These judgments involve estimations of the effect of restaurant to its estimated fair value. Key assumptions in the

matters that are inherently uncertain and may significantly impact our determination of fair value are the future after-tax cash flows of the

quarterly or annual results of operations or financial condition. restaurant, which are reduced by future royalties a franchisee would

Changes in the estimates and judgments could significantly affect our pay, and a discount rate. The after-tax cash flows incorporate

results of operations, financial condition and cash flows in future reasonable sales growth and margin improvement assumptions that

years. A description of what we consider to be our most significant would be used by a franchisee in the determination of a purchase

critical accounting policies follows. price for the restaurant. Estimates of future cash flows are highly

subjective judgments and can be significantly impacted by changes in

the business or economic conditions.

Impairment or Disposal of Long-Lived We perform an impairment evaluation at a restaurant group level if it is

Assets more likely than not that we will refranchise restaurants as a group.

Expected net sales proceeds are generally based on actual bids from

We review long-lived assets of restaurants (primarily PP&E and

the buyer, if available, or anticipated bids given the discounted

allocated intangible assets subject to amortization) semi-annually for

projected after-tax cash flows for the group of restaurants. Historically,

impairment, or whenever events or changes in circumstances indicate

these anticipated bids have been reasonably accurate estimations of

that the carrying amount of a restaurant may not be recoverable. We

the proceeds ultimately received. The after-tax cash flows used in

evaluate recoverability based on the restaurant’s forecasted

determining the anticipated bids incorporate reasonable assumptions

undiscounted cash flows, which incorporate our best estimate of sales

we believe a franchisee would make such as sales growth and margin

growth and margin improvement based upon our plans for the unit and

YUM! BRANDS, INC. - 2014 Form 10-K 31

13MAR201516053226

Form 10-K