Pizza Hut 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013Proxy Statement 59

Proxy Statement

EQUITY COMPENSATION PLAN INFORMATION

Planning and Development Committee (Mr.Walter in 2012) receives

an additional $15,000 stock retainer annually.

Initial Stock Grant upon Joining Board. Non-employee directors

also receive a one-time stock grant with a fair market value of

$25,000 on the date of grant upon joining the Board, distribution

of which is deferred until termination from the Board.

Stock Ownership Requirements. Similar to executive offi cers,

directors are subject to share ownership requirements. The

directors’ requirements provide that directors will not sell any of

the Company’s common stock received as compensation for

service on the Board until the director has ceased being a member

of the Board for one year (sales are permitted to cover income

taxes attributable to any stock retainer payment or exercise of a

stock option or SAR).

Matching Gifts. To further YUM’s support for charities, non-employee

directors are able to participate in the YUM!Brands,Inc. Matching

Gifts Program on the same terms as YUM’s employees. Under this

program, the YUM!Brands Foundation will match up to $10,000

a year in contributions by the director to a charitable institution

approved by the YUM!Brands Foundation. At its discretion, the

Foundation may match director contributions exceeding $10,000.

For Mr.Holland, in recognition of his long term service on the

Board, the Company made an additional matching contribution

that exceeded $10,000.

Insurance. We also pay the premiums on directors’ and offi cers’

liability and business travel accident insurance policies. The annual

cost of this coverage was approximately $2 million. This is not

included in the tables above as it is not considered compensation

to the directors.

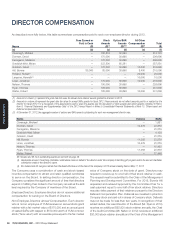

EQUITY COMPENSATION PLAN INFORMATION

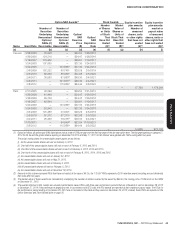

The following table summarizes, as of December31,2012, the equity compensation plans under which we may issue shares of stock

to our directors, offi cers and employees under the 1999 Long Term Incentive Plan (“1999 Plan”), the 1997 Long Term Incentive Plan

(the “1997 Plan”), SharePower Plan and Restaurant General Manager Stock Option Plan (“RGM Plan”).

Plan Category

Number of

Securities To

be Issued Upon

Exercise of

Outstanding

Options, Warrants

and Rights

Weighted-

Average

Exercise Price

of Outstanding

Options, Warrants

and Rights

Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding

Securities Refl ected in

Column(a))

(a) (b) (c)

Equity compensation plans approved by security holders 19,484,207(1) 37.03(2) 10,417,997(3)

Equity compensation plans not approved by securityholders(4) 628,915 37.94(2) 7,609,509

TOTAL 20,113,122(1) 37.07(2) 18,027,506(3)

(1) Includes 5,516,637shares issuable in respect of RSUs, performance units and deferred units.

(2) Weighted average exercise price of outstanding options and SARs only.

(3) Includes 5,208,998 shares available for issuance of awards of stock units, restricted stock, restricted stock units and performance share unit awards under the 1999 Plan.

(4) Awards are made under the RGM Plan.

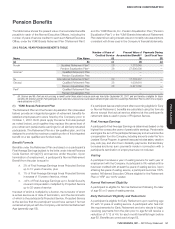

What are the key features of the 1999 Plan?

The 1999 Plan provides for the issuance of up to 70,600,000shares

of stock as non-qualifi ed stock options, incentive stock options,

SARs, restricted stock, restricted stock units, performance shares

or performance units. Only our employees and directors are

eligible to receive awards under the 1999 Plan. The purpose of

the 1999 Plan is to motivate participants to achieve long range

goals, attract and retain eligible employees, provide incentives

competitive with other similar companies and align the interest

of employees and directors with those of our shareholders. The

1999 Plan is administered by the Management Planning and

Development Committee of the Board of Directors. The exercise

price of a stock option grant or SAR under the 1999 Plan may not

be less than the average market price of our stock on the date

of grant for years prior to 2008 or the closing price of our stock

on the date of the grant beginning in 2008, and no options or

SARs may have a term of more than ten years. The options and

SARs that are currently outstanding under the 1999 Plan generally

vest over a one to four year period and expire ten years from the

date of the grant. Our shareholders approved the 1999 Plan in

May1999, and the plan as amended in 2003 and again in 2008.