Pizza Hut 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013Proxy Statement28

Proxy Statement

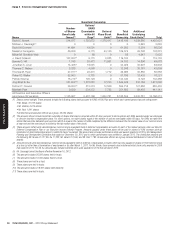

ITEM5STOCK OWNERSHIP INFORMATION

Name

Benefi cial Ownership

Additional

Underlying

Stock Units(4) Total

Number

of Shares

Benefi cially

Owned(1)

Options/

SARS

Exercisable

within 60

Days(2)

Deferral

Plans Stock

Units(3)

Total

Benefi cial

Ownership

DavidC. Novak 314,077 1,725,672 1,375,417 3,415,166 1,039,865 4,455,031

Michael J. Cavanagh(5) 0 0 0 0 2,645 2,645

DavidW. Dorman 41,691 19,591 0 61,282 5,254 66,536

Massimo Ferragamo 56,829 9,115 43,130 109,074 29,798 138,872

MirianM. Graddick-Weir 0 88 0 88 4,947 5,035

J.David Grissom 107,933(6) 9,115 2,055 119,103 0 119,103

BonnieG. Hill 1,748 20,473 11,961 34,182 14,896 49,078

Jonathan S. Linen 14,438(7) 19,591 0 34,029 30,907 64,936

ThomasC. Nelson 8,288 4,560 0 12,848 30,761 43,609

ThomasM. Ryan 27,811(8) 20,473 1,712 49,996 30,862 80,858

RobertD. Walter 52,003 5,783 0 57,786 18,435 76,221

Patrick Grismer 18,214(9) 105,126 0 123,340 9,126 132,466

Jing-ShyhS. Su 351,632(10 ) 1,275,561 17,233 1,644,426 233,166 1,877,592

Richard T. Carucci 26,833(11 ) 515,374 12,509 554,716 127,686 682,402

Muktesh Pant 9,529 334,372 7,782 351,683 89,458 441,141

All Directors and Executive Offi cers

asaGroup (22persons) 1,135,607 5,407,166 1,622,761 8,165,534 2,030,781 10,196,315

(1) Shares owned outright. These amounts include the following shares held pursuant to YUM’s 401(k) Plan as to which each named person has sole voting power:

• Mr.Novak, 31,913 shares

• Mr.Grismer, 6,614 shares

• Mr.Pant, 1,941 shares

• all directors and executive officers as a group, 43,050 shares

(2) The amounts shown include beneficial ownership of shares that may be acquired within 60days pursuant to stock options and SARs awarded under our employee

or director incentive compensation plans. For stock options, we report shares equal to the number of options exercisable within 60days. For SARs we report the

shares that would be delivered upon exercise (which is equal to the number of SARs multiplied by the difference between the fair market value of our common stock

at year-end and the exercise price divided by the fair market value of the stock).

(3) These amounts reflect units denominated as common stock equivalents held in deferred compensation accounts for each of the named persons under our Director

Deferred Compensation Plan or our Executive Income Deferral Program. Amounts payable under these plans will be paid in shares of YUM common stock at

termination of directorship/employment or within 60days if so elected. This amount also includes performance share unit awards granted in 2010 by the Management

Planning and Development Committee that vested on December29 ,2012 and to which performance was certified in January2013. The distribution amounts are

the following: Mr.Novak 41,137; Mr.Su 17,233; Mr.Carucci 12,509; and Mr.Pant 7,782. All executive officers as a group received distributions in total of 108,406

awards .

(4) Amounts include units denominated as common stock equivalents held in deferred compensation accounts which become payable in shares of YUM common stock

at a time (a)other than at termination of employment or (b)after March1,2013. For Mr.Novak, those amounts also include restricted stock units awarded in 2008

that vested in 2012. For Mr.Su, amounts also include restricted stock units awarded in 2010 that will vest in 2015.

(5) Mr.Cavanagh joined the Board effective November16,2012.

(6) This amount includes 26,000 shares held in trusts.

(7) This amount includes 10,000 shares held in a trust.

(8) These shares are held in a trust.

(9 ) Th ese shares are held in trusts.

(10 ) This amount includes 278,361 shares held indirectly.

(11 ) These shares are held in trusts.