Pizza Hut 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013Proxy Statement 33

Proxy Statement

EXECUTIVE COMPENSATION

Shareholder Outreach and Engagement

At our 2012 Annual Meeting of Shareholders, over 70% of votes

cast were in favor of our Named Executive Offi cers’ compensation

program as disclosed in our 2012 Proxy Statement. While these

results represented a substantial majority support, we initiated an

extensive shareholder outreach program to better understand our

investors’ opinions on our compensation practices. Members of

our board of directors and management were directly involved in

this effort, including engaging in a dialogue with two proxy advisory

fi rms, to explain why we believe our pay for performance philosophy

has benefi ted shareholders over the long term. We appreciate the

feedback from our shareholders and the proxy advisory fi rms.

Changes Made After Committee Consideration of Feedback

After review and consideration of the shareholder vote and feedback,

the Committee unanimously approved and we made the following

changes to our compensation program for 2013:

•Updated the Company’s Executive P eer G roup to better align

the size of the peer group companies with YUM

•

Eliminated use of similar metrics in short-term incentive (“STI”) and

long-term incentive (“LTI”) programs by re-designing 2013-2015

performance share plan to measure relative total shareholder

return vs. the S&P 500

•

Increased use of performance criteria in LTI by changing the

CEO’s mix from 90% Stock Appreciation Rights and 10%

Performance Shares to 75% Stock Appreciation Rights and

25% Performance Shares

•

Discontinued Mr. Novak’s accruing nonqualifi ed pension benefi ts

under the Pension Equalization Plan (PEP) effective January 1,

2012 and, effective January 1, 2013, replaced his PEP benefi t with

a pension account determined under the Leadership Retirement

Plan. The Committee made this change to provide Mr. Novak a

long term benefi t that is similar to what he would have received

under PEP assuming historically normal interest rates, and to

provide him an annual benefi t amount that will not fl uctuate from

year-to-year due to interest rate volatility. Beginning in 2013, Mr.

Novak will receive an allocation to his pension account equal to

9.5% of his salary and target bonus and will receive an annual

interest allocation on his account balance equal to 120% of

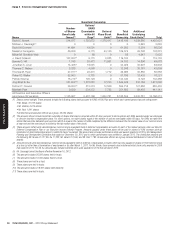

the applicable federal rate. (See footnote (5) to the Summary

Compensation Table at page 45 for further details)

•

Consistent with the dominant governance model, eliminated

excise tax gross-ups upon a change in control for current and

future agreements and implemented double trigger vesting upon

a change in control of the Company for equity awards made

in 2013 and beyond

The changes described above reinforce our longstanding

commitment to an executive compensation philosophy that

emphasizes performance while at the same time is a direct response

to the feedback we received.

YUM’s Compensation Philosophy

YUM’s compensation philosophy for the Named Executive Offi cers

is reviewed annually by the Committee, and has the following key

principles:

•Reward performance

•Pay our executives like owners

•

Design pay programs that align team and individual performance,

customer satisfaction and shareholder return

•Emphasize long-term incentive compensation

•

Require Named Executive Offi cers and other executives to

personally invest in Company stock

Key Elements of Our Executive Compensation Program

•

Pay for Performance – The majority of Named Executive

Offi cer pay is performance based. We establish annual division,

corporate and individual performance targets designed to achieve

our annual EPS growth target of at least 10%.

•

Retain and Reward the Best Talent to Achieve Superior

Shareholder Results – To be consistently better than our

competitors, we need to recruit and retain superior talent

who are able to drive superior results. We have structured our

compensation programs to motivate and reward these results.

•

Long-Term Incentives are L inked to Our Shareholder Value

– Our belief is simple, if we create value for shareholders then

we share a portion of that value with those responsible for the

results. If no value is created then there is little or no reward from

our long-term incentive structure. Stock Appreciation Rights

and Performance Shares are designed to align the interests

of the Company’s executives with those of shareholders by

encouraging executives to grow the value of the Company.

•

Strong Stock Ownership Guidelines – We have always required

our Named Executive Offi cers (and top 600 employees) to

meet stock ownership guidelines. All Named Executive Offi cers

exceed their guidelines.

In addition, we have established the following policies for our programs: