Pizza Hut 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2012 Form10-K 25

Form 10-K

PART II

ITEM7Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations

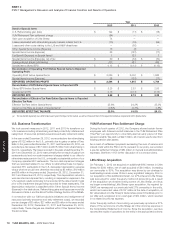

In 2012, theincrease in China Company sales associated with store portfolio

actions was primarily driven by new unit development and the acquisition

of Little Sheep, partially offset by restaurant closures. The increase in China

Restaurant profi t associated with store portfolio actions was primarily

driven by new unit development, partially offset by restaurant closures.

Signifi cant other factors impacting Company sales and/or Restaurant profi t

were Company same-store sales growth of 4%, which was partially offset

by wage rate infl ation of 10% and higher rent and utilities.

In 2011, theincrease in China Company sales and Restaurant profi t

associated with store portfolio actions was primarily driven by the

development of new units partially offset by lapping the benefi t of our

participation in the World Expo in 2010.Signifi cant other factors impacting

Company sales and/or Restaurant profi t were Company same-store sales

growth of 18% which was driven by transaction growth partially offset by

a negative impact from sales mix shift and a new business tax that took

effect December2010, wage rate infl ation of 20% as well as commodity

infl ation of $90million, or 8%.

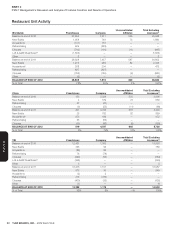

YRI

Income/(Expense)

2012 vs. 2011

2011

Store Portfolio

Actions Other FX

53rd Week

in 2011 2012

Company sales $ 2,341 $ 100 $ 72 $ (82) $ (29) $ 2,402

Cost of sales (743) (65) (18) 30 9 (787)

Cost of labor (608) (3) (15) 19 8 (599)

Occupancy and other (700) (16) (18) 23 6 (705)

RESTAURANT PROFIT $ 290 $ 16 $ 21 $ (10) $ (6) $ 311

Restaurant margin 12.4% 12.9%

Income/(Expense)

2011 vs. 2010

2010

Store Portfolio

Actions Other FX

53rd Week

in 2011 2011

Company sales $ 2,310 $ (171) $ 57 $ 116 $ 29 $ 2,341

Cost of sales (738) 77 (35) (38) (9) (743)

Cost of labor (587) 38 (21) (30) (8) (608)

Occupancy and other (711) 60 (10) (33) (6) (700)

RESTAURANT PROFIT $ 274 $ 4 $ (9) $ 15 $ 6 $ 290

Restaurant margin 11.8% 12.4%

In 2012, the increase in YRI Company sales and Restaurant profi t associated

with store portfolio actions was driven by the acquisition of restaurants

in South Africa in the fourth quarter of 2011 and new unit development,

partially offset by refranchising. Signifi cant other factors impacting Company

sales and/or Restaurant profi t were Company same-store sales growth

of 3%, which was offset by the combination of higher labor costs and

commodity infl ation.

In 2011, the decrease in YRI Company sales associated with store portfolio

actions was driven by refranchising, primarily Mexico, partially offset by

new unit development. Signifi cant other factors impacting Company sales

and/or Restaurant profi t were Company same-store sales growth of 3%

offset by commodity infl ation and higher labor costs.

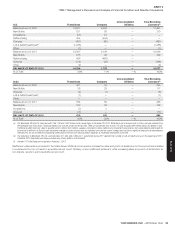

U.S.

Income/(Expense)

2012 vs. 2011

2011

Store Portfolio

Actions Other

53rd Week in

2011 2012

Company sales $ 3,000 $ (535) $ 128 $ (43) $ 2,550

Cost of sales (917) 177 (13) 13 (740)

Cost of labor (912) 165 (16) 12 (751)

Occupancy and other (809) 164 (7) 9 (643)

RESTAURANT PROFIT $ 362 $ (29) $ 92 $ (9) $ 416

Restaurant margin 12.1% 16.3%